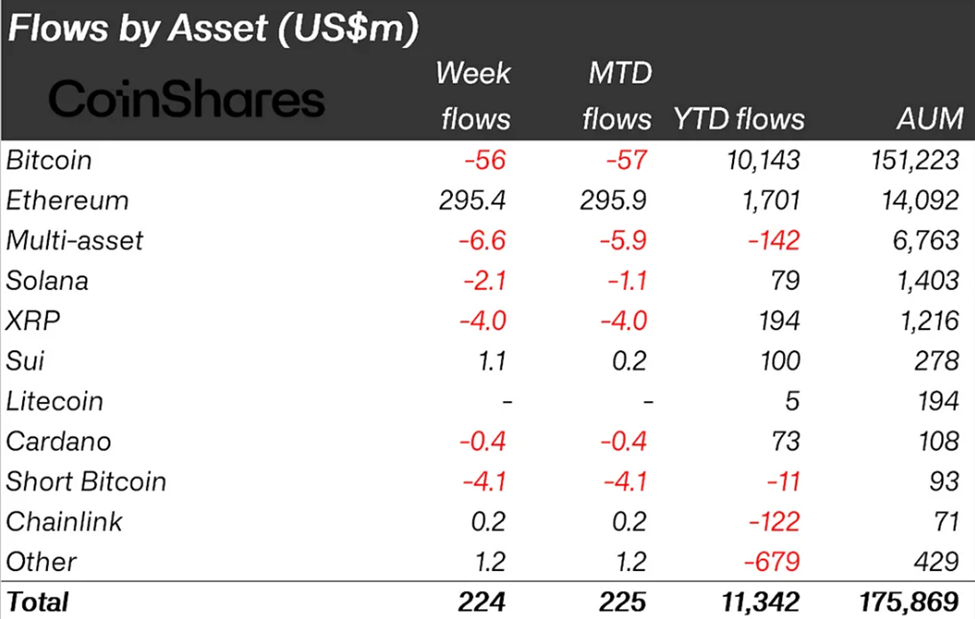

The newest CoinShares report reveals that crypto inflows soared to $224 million final week. In the meantime, Ethereum (ETH) continues solidifying its place as a frontrunner in institutional sentiment.

The second-largest crypto by market cap continues to document constructive returns, with fortunes turning for the reason that Pectra Improve hit the mainnet on Could 7.

Ethereum Data Strongest Influx Streak Since US Elections

CoinShares’ newest report signifies that Ethereum posted $296.4 million in inflows final week, marking its strongest run for the reason that November US elections.

The inflows helped push complete weekly crypto inflows to $224 million, extending the continued seven-week streak to $11 billion regardless of macroeconomic headwinds.

“Ethereum leads with US$296.4 million in inflows, its strongest run for the reason that US election, now representing 10.5% of complete AuM,” learn an excerpt within the report.

CoinShares’s James Butterfill famous that the surge in demand for Ethereum comes regardless of a broader slowdown as a result of uncertainty across the US Federal Reserve (Fed) coverage.

In the meantime, Ethereum’s rise coincides with the community’s Pectra improve on Could 7, which enhanced consumer expertise and good contract effectivity.

Ethereum has repeatedly led crypto inflows within the weeks since, attracting $1.5 billion over seven consecutive weeks. BeInCrypto reported that Ethereum notched inflows of $785 million in the course of the week after the improve and $286 million the next week, contributing majorly to its momentum.

Institutional demand can be evident in Ethereum ETF (exchange-traded funds) flows. As BeInCrypto highlighted, Ethereum ETFs recorded a 15-day streak of inflows as of the final buying and selling session on June 6.

This displays rising confidence in ETH’s long-term potential following the Pectra improve and renewed ETF optimism within the US.

“Ethereum 2025 is 2016 on steroids. Identical consolidation, similar shakeout, similar reversal sample. Again then, ETH rewrote the charts. Now? We’ve received stronger base, extra capital, and ETF momentum,” wrote analyst Merlijn the Dealer.

Bitcoin Slips Once more as Altcoins Stay Subdued Amid Macro Uncertainty

Whereas Ethereum soared, Bitcoin recorded its second week of outflows, shedding $56.5 million as traders stay cautious.

“Bitcoin noticed its second straight week of modest outflows totaling $56.5 million, as coverage uncertainty stored traders on the sidelines…short-Bitcoin merchandise additionally skilled a second week of outflows,” the CoinShares report added.

Altcoin exercise was largely subdued. Sui (SUI) noticed modest inflows of $1.1 million, whereas XRP recorded its third straight week of outflows totaling $6.6 million. This means sentiment stays blended outdoors Ethereum.

Regardless of the broader slowdown, Ethereum’s efficiency highlights a rising divergence between main digital belongings. Its ETF and institutional curiosity surge indicators that traders could also be positioning for Ethereum to outperform in a post-rate-hike setting.

With Ethereum now representing 10.5% of complete digital asset AuM, the asset seems to be regaining its management standing within the eyes of establishments. Whether or not the development continues could depend upon indicators from the Fed afterward Wednesday.

BeInCrypto information exhibits Ethereum was buying and selling for $2,528, up 1.28% within the final 24 hours.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.