- SUI sits at ~$3.40 with sturdy DeFi/NFT development, nonetheless ~40% below its ATH — room to run because the ecosystem scales.

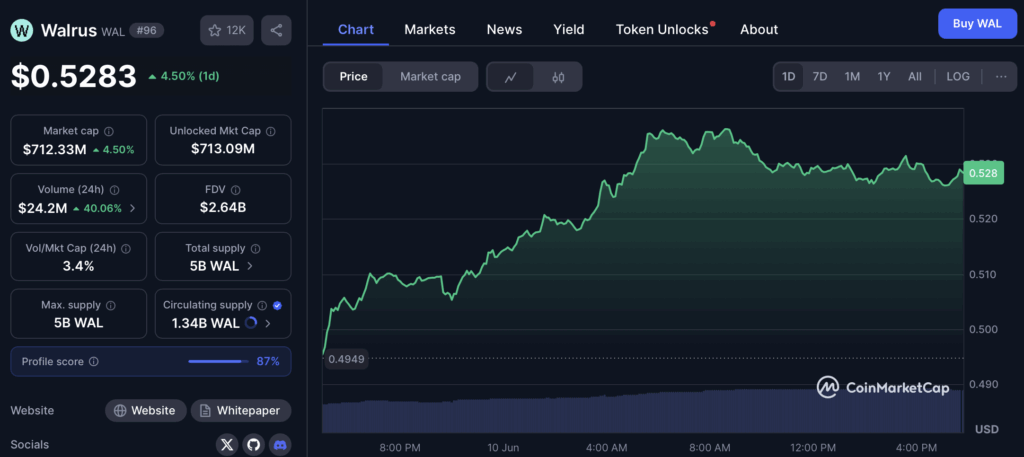

- WAL goals to rival Filecoin, already 26% utilized — hit $0.76 ATH, now $0.51 with contemporary partnerships.

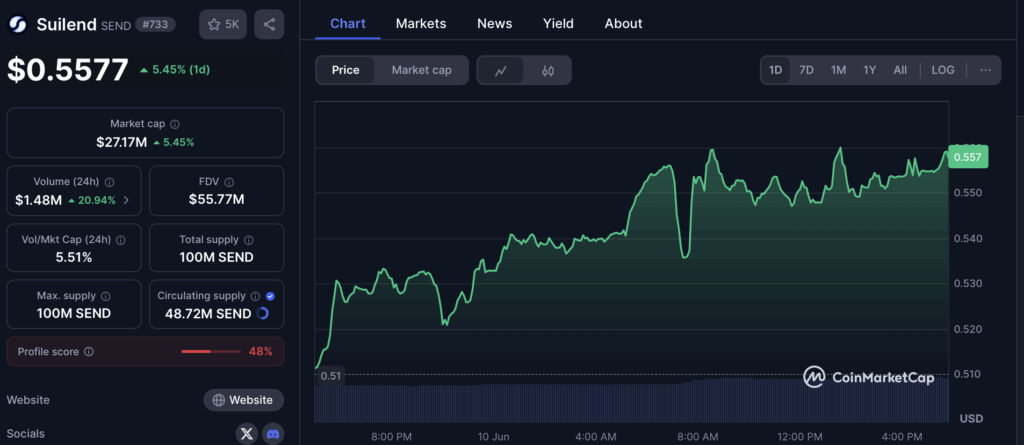

- SEND leads in SUI-based DeFi lending, zero borrowing charges, enormous BTC inflows — buying and selling far under highs.

The Sui blockchain’s been gaining traction currently, and among the initiatives constructed on prime of it? Nicely, they’re beginning to present indicators of actual breakout potential. With stable dev exercise and extra customers leaping in, a couple of of those SUI-linked altcoins may very well be organising for severe runs — possibly even 10x, if the market flips bullish once more. Let’s dive into three that stand out proper now.

SUI (SUI) — The Core of the Ecosystem

First up is the community’s personal token — SUI. It’s solely been round for a pair years, however it’s already made waves. The group retains stacking options, particularly round DeFi and NFTs. One of many newer additions, Nautilus, goals to deliver non-public and tamper-proof oracles into the combo — not unhealthy for a challenge nonetheless discovering its groove.

For the time being, SUI holds the eighth spot when it comes to TVL throughout all blockchains. Priced at round $3.40, it’s nonetheless sitting roughly 40% under its all-time excessive. Some of us see this as a stable entry level, particularly with the ecosystem increasing. May it climb from right here? Lots of people appear to assume so.

Walrus Protocol (WAL) — Storage Will get a Increase

Subsequent on the radar is Walrus Protocol — WAL. This one’s all about decentralized storage, aiming to do what Filecoin does however with fewer hiccups and higher pace. It raised a hefty $140 million and launched its mainnet in March. Adoption’s been stable, with over 26% of obtainable storage already in use. It additionally teamed up with Nautilus for added privateness and knowledge encryption — one other win.

Value-wise, WAL hit an all-time excessive at $0.76 not too long ago however has since cooled off to about $0.51. Nonetheless up on the day although. If the partnerships hold rolling and customers hold coming, the thought of a 10x isn’t too far-fetched.

Suilend (SEND) — DeFi’s Lending Chief

Final however not least, there’s SEND — the highest lending and borrowing protocol within the SUI ecosystem. It’s obtained the very best TVL in DeFi on the chain and not too long ago added zero borrowing charges, which… let’s be trustworthy, is type of a game-changer. APYs on some property are wild — we’re speaking 42% on DEEP and 64% on WPLUS.

With over $100 million in Bitcoin-backed property already deposited, it’s main the pack in that nook of DeFi. Proper now, the SEND token trades at $0.53 — effectively below earlier highs, and yeah, that is likely to be a window of alternative for early movers.