Investor consideration is returning to Ethereum as staked ETH climbs to new highs and Spot Ethereum ETFs proceed drawing regular inflows. With institutional curiosity on the rise and market confidence gaining momentum, these developments underscore Ethereum’s evolving function far past that of a easy good contract platform.

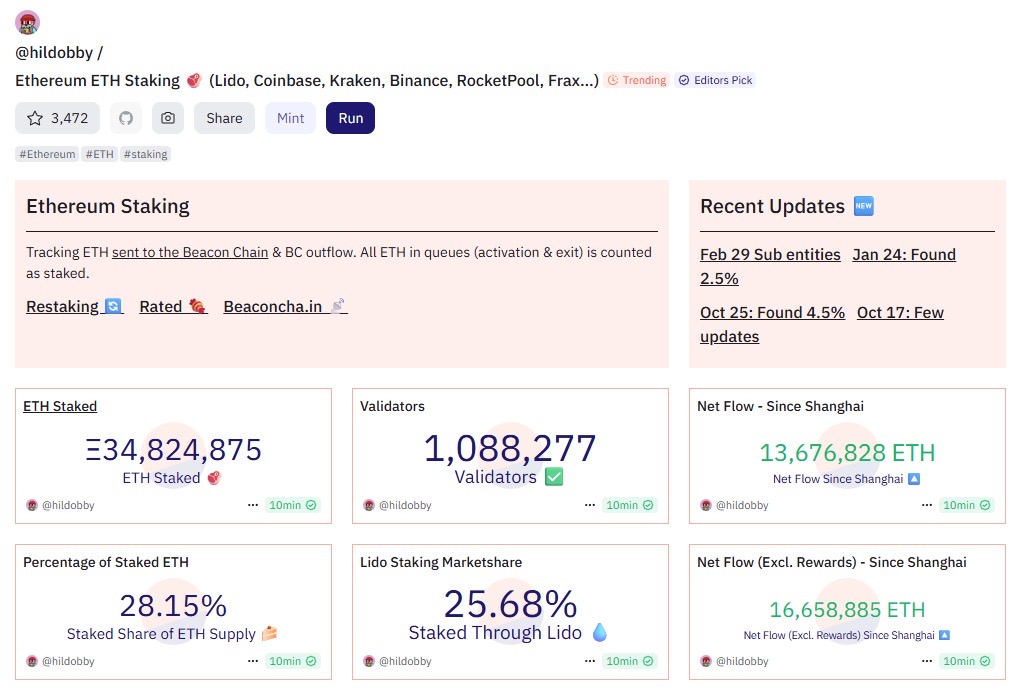

Ethereum staking has simply hit an all time excessive with 34.6M ETH staked, practically ~$90B which is 28% of whole provide.

With a powerful month-to-month motion, 7 weeks straight of web inflows and $815M into ETFs in simply 20 days, ETH is trying scorching! 🔥

Ultimately, Ethereum will all the time win. pic.twitter.com/iEGiRy76er

— Ali (@AleyProbably) June 10, 2025

As extra holders lock up ETH for passive yield and recent ETF approvals encourage portfolio reallocations, Ethereum stands out as a key participant amid shifting market dynamics. This rising enthusiasm round ETH factors traders towards figuring out one of the best crypto to purchase now.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t chargeable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

Ethereum Surge: Report Inflows, Rising Staking Ranges, and Bullish Momentum Drive Market Confidence

Ethereum is at the moment using a wave of optimism, with traders shifting capital from Bitcoin ETFs to the newly authorized Spot Ethereum ETFs. This has pushed whole inflows to a file $837.5 million, marking 15 consecutive days of positive factors since Might 16. Ought to the bullish momentum persist, traders consider that web inflows may exceed the $1 billion mark by subsequent week.

A number of elements are driving this surge: institutional curiosity in Ethereum merchandise is resurging, rising anticipation round Ethereum’s upcoming upgrades, and the latest launch of the Pectra improve.

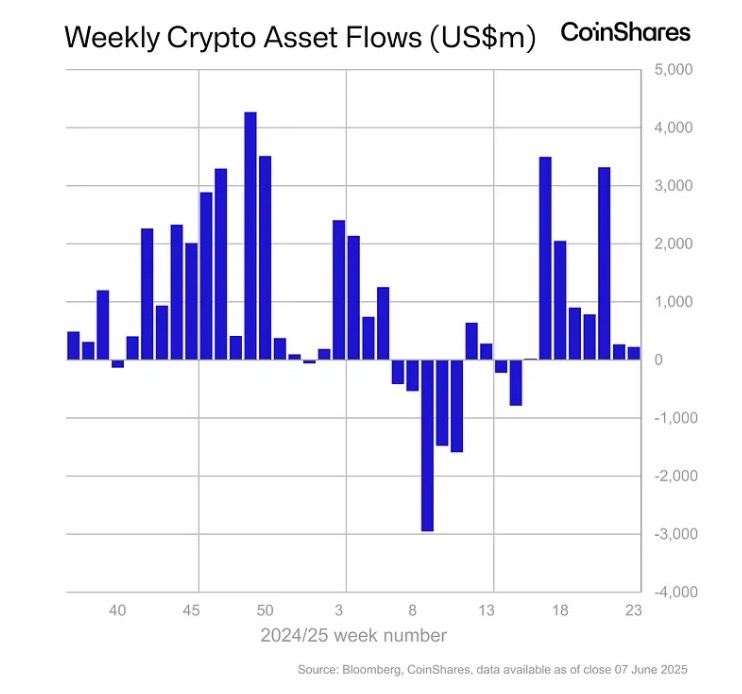

Moreover, the rising ETH/BTC ratio is hinting at the potential of an ‘altcoin season,’ which is fueling additional investor confidence. In consequence, Ethereum funding merchandise have led digital asset inflows for the second consecutive week, pulling in $296.4 million and bringing the 7-week whole to $1.5 billion, in response to the report of digital asset supervisor CoinShares.

James Butterfill, Head of Analysis at CoinShares, commented: “This represents the strongest run of inflows because the U.S. election,” including that Ethereum merchandise now account for 10.5% of all ETH belongings beneath administration.

This progress can be mirrored within the Ethereum staking ecosystem. On Sunday, the quantity of ETH staked on the Beacon Chain hit a file 34.65 million, surpassing the earlier excessive set in November 2024.

Whereas staking ranges have remained above 33 million for the previous 12 months, they started to climb once more in June, in response to Beaconcha. Whereas Dune Analytics and Ultrasound.Cash report barely various figures, with the previous displaying 34.8 million ETH stake and the latter displaying 34.7 million.

Supply: Dune Analytics

These rising staking ranges sign that extra holders are opting to earn passive yield somewhat than promoting at present costs, additional signaling rising confidence in Ethereum as a long-term asset.

Ethereum Worth Evaluation

Whereas the Ethereum worth motion was insulated from the BTC worth momentum for many of 2024 and the higher a part of this 12 months, issues have shifted. Because of Ethereum ETF inflows in addition to enhancing market situations, the Ethereum worth has gone up by greater than 11% within the final two weeks.

Accompanied by the information concerning the ETF, the ETH worth has been consolidating inside the $2.3K – $2.8K mark. Related consolidation intervals up to now have led to the ETH worth making a parabolic transfer upwards. Due to this fact, there’s a risk that ETH’s sustained momentum may result in one other huge pump. Sustaining assist above the present degree may enable the ETH worth to retest the $3.4K mark.

On the time of writing, Ethereum is buying and selling slightly below the $2.8K mark and has a market capitalization of greater than $333 billion.

Greatest Crypto to Purchase Now

These sturdy inflows, rising staking ranges, and institutional curiosity sign a renewed confidence in Ethereum’s ecosystem. For traders, this implies alternatives to diversify portfolios and capitalize on the momentum spreading throughout the crypto market. Understanding these tendencies is essential when selecting one of the best crypto to purchase now.

SUBBD

As Ethereum continues to make waves, so does AI. For these trying to diversify their investments, the SUBBD Token is gaining consideration for its AI-powered instruments that streamline post-production. These instruments assist creators produce extra content material and construct stronger relationships with their followers.

The platform lets customers token-gate unique content material and even craft digital personas utilizing built-in AI brokers tailor-made to every creator’s model.

$SUBBD takes a recent method to monetization. As an alternative of adverts or platform charges, creators challenge their very own tokens to reward followers and develop direct communities.

Holding $SUBBD unlocks perks like personal content material, early entry, unique drops, and voting rights on creator selections.

In contrast to passive tokens, $SUBBD is designed to be used. Followers stake, commerce, and earn based mostly on a creator’s ongoing exercise and engagement ranges.

As conventional monetization fashions lose traction, SUBBD affords a extra sustainable path, particularly for unbiased creators.

The platform bridges social media and blockchain, turning on-line status into verified, tokenized worth with out third-party gatekeepers.

SUBBD rewards verified human interplay, letting creators and followers construct belief and earn collectively by way of actual engagement.

Further rewards can be found for presale traders as nicely – a flat 20% APY, which additional provides to the worth of this ecosystem.

Solaxy ($SOLX)

Solaxy stands to profit from Ethereum’s record-high staking ranges and surging optimism round newly authorized spot ETH ETFs, as elevated institutional curiosity and staking yields spotlight the rising attraction of scalable, reward-focused crypto tasks like Solaxy.

Solaxy runs on a customized Layer 2 community, boosting velocity and reducing charges throughout Ethereum and Solana for smoother transactions and higher developer assist.

As customers face rising charges and community delays elsewhere, Solaxy’s setup affords a extra environment friendly surroundings constructed to scale with demand.

$SOLX powers your entire ecosystem, masking governance, staking, community charges, and future cross-chain exercise because the platform evolves.

Solaxy’s roadmap contains dApp assist and future upgrades, positioning it alongside top-tier Layer 2 networks eyeing actual adoption.

In a market stuffed with short-term performs, Solaxy stands out by providing each purpose-driven funding and significant infrastructure influence.

Bitcoin Hyper

Bitcoin Hyper is a next-gen Layer 2 protocol for Bitcoin, leveraging Solana’s Digital Machine to allow quick, low-cost transactions, DeFi, and dApps. As Ethereum staking and ETF optimism surge, Bitcoin Hyper positions Bitcoin for related institutional and DeFi progress.

Bitcoin Hyper acts like an specific lane for Bitcoin, utilizing a system known as the Canonical Bridge to switch BTC onto a sooner Layer 2 community.

The method begins by sending BTC to a particular handle, the place a Relay Program checks block headers and proofs to substantiate the transaction is legitimate.

As soon as verified, customers obtain the identical quantity of BTC on Bitcoin Hyper’s community. Transactions full in seconds as an alternative of minutes, with charges dropping to pennies.

This velocity enhance comes from Solana’s Digital Machine, which might course of 1000’s of transactions in parallel with out slowing down.

To maintain Bitcoin safe, Bitcoin Hyper bundles transactions, makes use of zero-knowledge proofs, and posts verified summaries again to the principle chain.

In response to the favored crypto YouTuber 99Bitcoins, Bitcoin Hyper has the potential to ship parabolic returns.

By mixing Solana’s effectivity with Bitcoin’s reliability, Bitcoin Hyper is fixing actual issues with a sensible, well-structured method.

BTC Bull

BTC Bull rides renewed market optimism pushed by Ethereum’s ETF success and file staking, providing publicity to Bitcoin’s bullish potential. It attracts traders trying to capitalize on Bitcoin’s upward momentum and evolving ecosystem.

BTC Bull Token is popping heads as its presale nears its June 30 deadline, providing actual Bitcoin rewards and early staking incentives.

What units BTC Bull aside is its provide technique. The undertaking burns tokens at key worth ranges, making provide scarcer as demand grows.

Fewer tokens in circulation may push costs larger after launch, a mannequin that’s helped different early-stage tokens go parabolic up to now.

Presale consumers will be capable of declare their tokens as soon as the undertaking lists on exchanges. A devoted declare portal will go dwell after launch.

With fastened presale pricing and deflationary mechanics, the undertaking is gaining traction amongst traders looking for a extra structured meme coin play.

BTC Bull isn’t nearly hype. It’s pegging its ecosystem to Bitcoin’s efficiency, providing retail traders new methods to achieve BTC publicity.

Conclusion

Ethereum’s latest surge in staking and ETF inflows marks an necessary milestone in its maturation as a mainstream funding asset. These developments present that institutional traders are deepening their engagement whereas retail holders are more and more embracing staking rewards.

Collectively, these elements reveal a crypto ecosystem gaining sophistication and resilience. For traders, rigorously evaluating such alerts can information extra strategic asset selections. With Ethereum’s increasing footprint and supporting tendencies, it stays among the many greatest crypto to purchase now.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t chargeable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, instantly or not directly, for any harm or loss precipitated or alleged to be attributable to or in reference to use of or reliance on any content material, items or companies talked about.