Bitcoin exchange-traded funds (ETFs) noticed sturdy demand yesterday, with whole internet inflows exceeding $350 million. This adopted BTC’s breakout previous the $105,000 resistance stage to shut above the $110,000 value.

With strengthening bullish stress, the main coin is poised to proceed its rally, additional fueling the demand for ETF merchandise.

BTC ETFs See $386 Million Inflows as Investor Confidence Returns

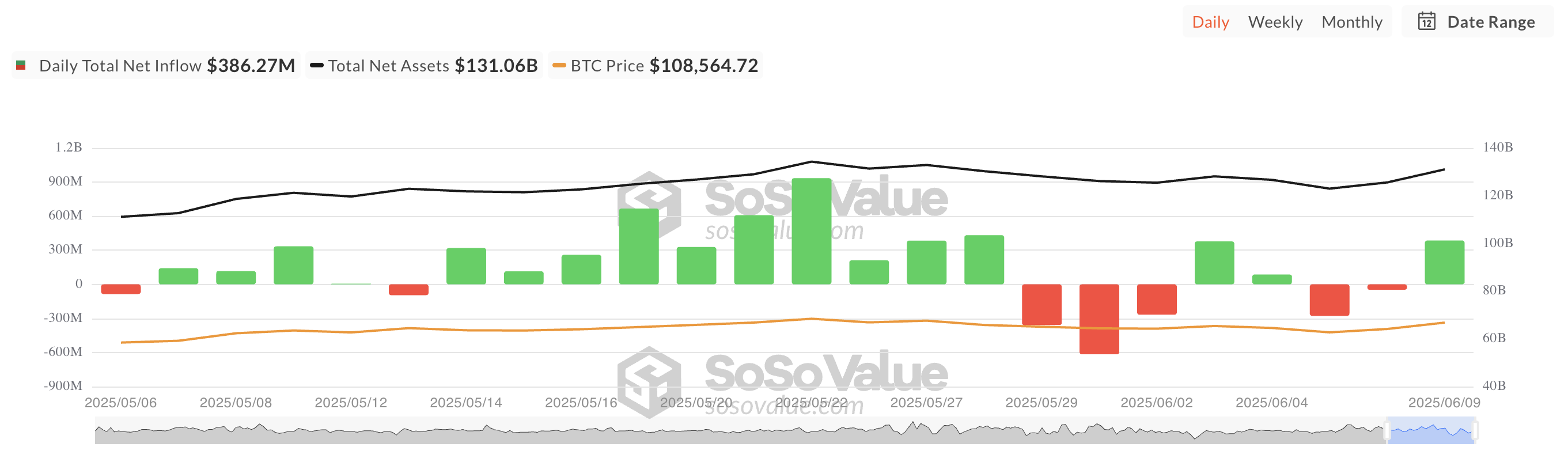

On Monday, BTC spot ETFs recorded internet inflows of $386.27 million. This capital influx marked a major shift in market sentiment following final week’s decline.

These inflows reversed the earlier week’s pattern of internet outflows, as BTC’s lackluster efficiency and waning investor confidence had dragged down demand. The surge adopted BTC’s breakout above the $105,000 resistance stage, with the asset closing at $110,263 throughout yesterday’s buying and selling session.

In consequence, renewed optimism unfold throughout the market, driving heightened exercise in ETF buying and selling as nicely. On Monday, Constancy’s CBOE-listed FBTC fund led the cost, posting the biggest single-day internet influx amongst all US BTC ETF issuers.

BTC Futures and Choices Flash Bullish as Worth Holds Above $109,000

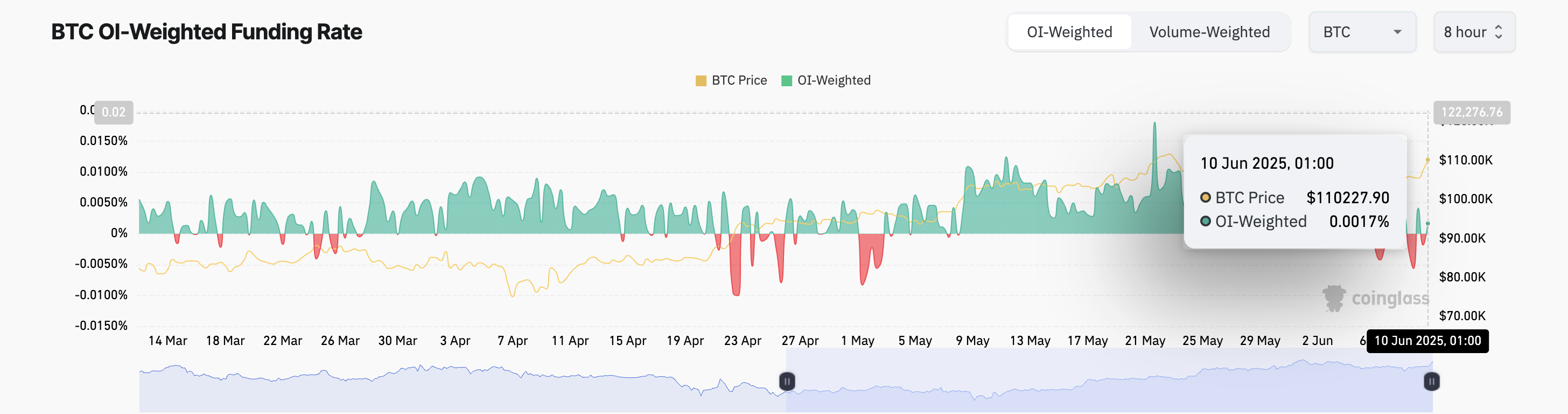

BTC trades at $110,227 at press time, up 4% over the previous day. The coin’s funding price has flipped again into optimistic territory on the derivatives entrance, signaling a shift towards bullish market positioning. It at present stands at 0.0017%.

The funding price is a periodic fee exchanged between merchants in perpetual futures contracts to maintain costs aligned with the spot market.

When its worth is optimistic, it signifies bullish sentiment and a better demand for longs. It implies that merchants holding lengthy BTC positions pay these holding brief positions, a pattern that might drive the coin’s worth upward within the close to time period.

Moreover, merchants are shopping for BTC name choices right this moment, signaling rising bullish sentiment on the asset’s future value.

Subsequently, the mixture of institutional inflows, rising value momentum, and a return to optimistic sentiment in derivatives means that the market could also be coming into a renewed accumulation part.

Disclaimer

In step with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.