- Bitcoin touched $108,500 however cautious dealer sentiment and macro headwinds are holding it again from a clear breakout.

- BTC’s 82% correlation with the S&P 500 retains it tethered to broader market dangers, dampening its function as a hedge.

- If U.S. debt considerations worsen, Bitcoin might see capital inflows that push it past $150,000—even in a shaky economic system.

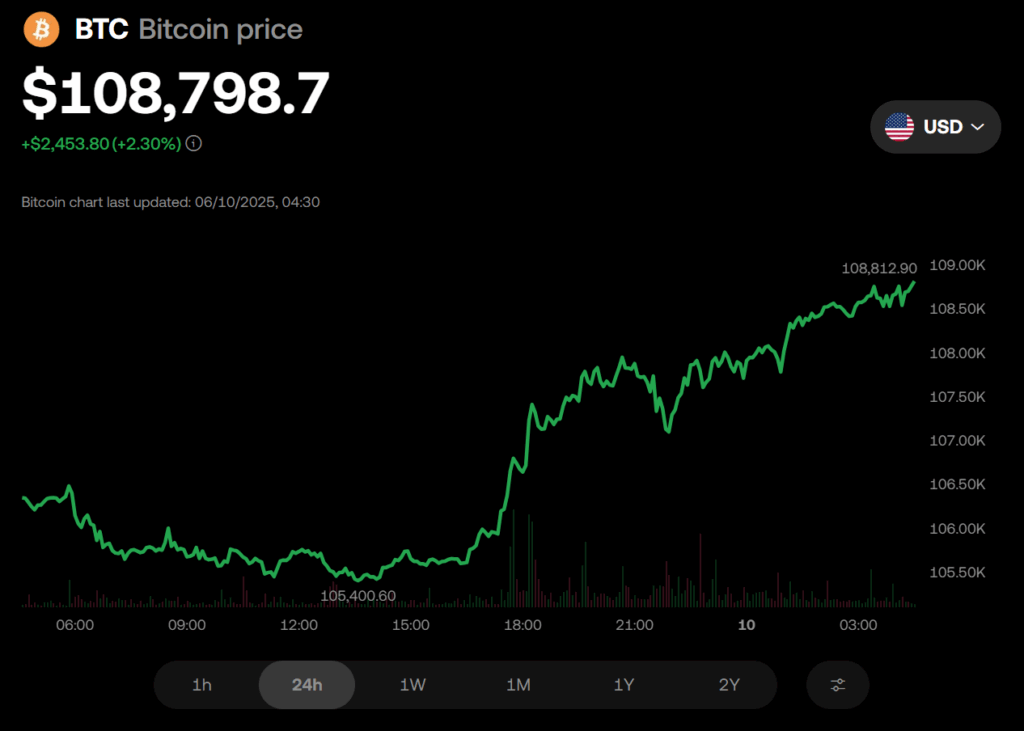

Bitcoin surged 3.5% between June 7 and 9, hitting near $108,500. Even with this acquire, professional merchants aren’t absolutely satisfied. Derivatives markets present a lukewarm sentiment, with BTC futures premiums hanging close to a impartial 5%. Regardless of being simply 3% shy of its all-time excessive, broader market anxieties are conserving expectations in verify.

Some speculate that the U.S. debt ceiling enhance might push BTC as excessive as $150K. However with muted enthusiasm in futures and no indicators of a leverage-fueled rally, the rally feels cautious—presumably ready for stronger macro indicators earlier than making an actual transfer.

Inventory Market Correlation Weighs on Bitcoin

BTC’s value stays tightly linked with equities, particularly the S&P 500. Proper now, the 50-day correlation between BTC and the S&P 500 sits at a stable 82%, displaying they’ve been transferring nearly in lockstep. This sample makes Bitcoin extra of a “risk-on” asset than a hedge, leaving it weak if shares flip south.

If recession fears preserve brewing, Bitcoin might wrestle to carry above $110,000. Merchants are hesitant, not due to weak fundamentals, however as a result of the normal finance system nonetheless casts a protracted shadow over crypto sentiment.

Potential Catalysts and Market Confidence

Margin knowledge at OKX reveals a long-to-short ratio of 4:1 in favor of bulls. Whereas that’s not overly aggressive, it’s not sufficient to counsel an impending breakout both. Nevertheless, no main indicators at the moment trace at a dramatic sell-off.

Long run, if belief in U.S. fiscal stability erodes and Treasury yields look much less interesting, some capital might shift towards Bitcoin. Even a tiny share of outflows from the $50 trillion S&P 500 or $22.5 trillion gold market might catapult BTC to $150,000.