- Bitcoin surged 11.1% in Could whereas housing and auto markets confirmed critical indicators of weakening.

- BTC ETFs drew $5.5 billion in inflows, over triple the quantity seen by gold ETFs.

- ARK Make investments sees the transfer as a strategic shift, not speculative mania, as buyers search safer floor.

Bitcoin’s climb to contemporary all-time highs isn’t taking place in a vacuum. In response to a brand new report from ARK Make investments, led by Cathie Wooden, the rally is unfolding simply as cracks start to widen throughout key sectors of the U.S. financial system.

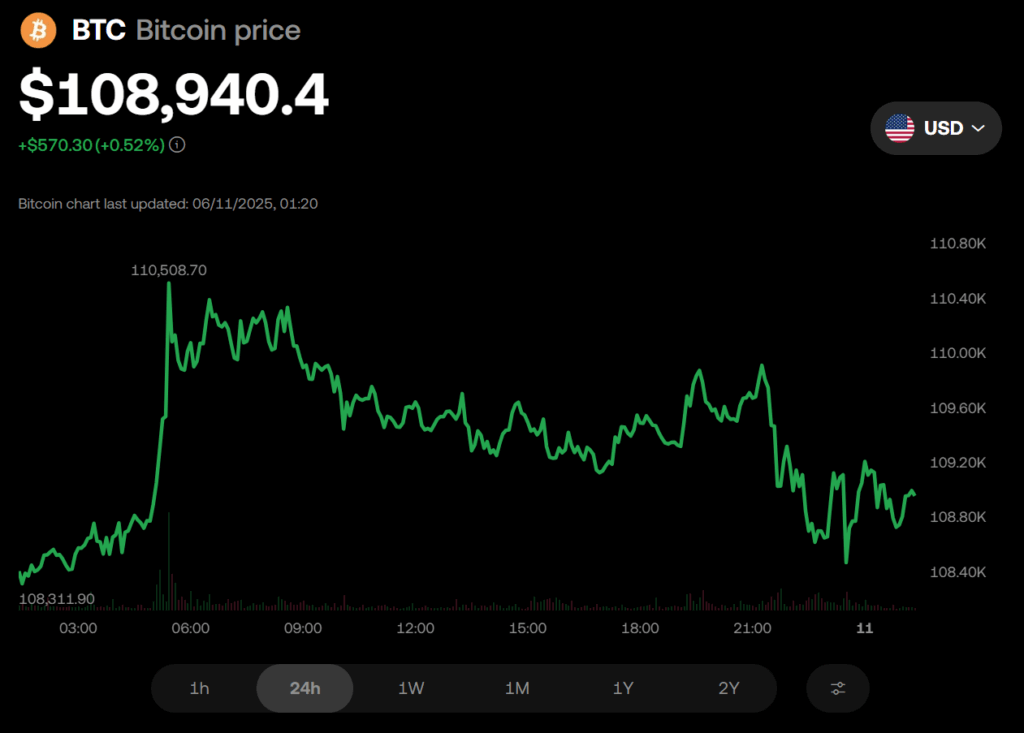

In Could alone, BTC rose 11.1%, outpacing gold and smashing by means of essential resistance zones. However what makes the transfer much more hanging is when it’s taking place — proper as housing and auto markets, each bedrocks of client energy, begin to wobble.

Financial Pressure Meets Digital Ascent

ARK’s information exhibits dwelling sellers now far outnumber patrons, a development amplified by the Fed’s aggressive charge hikes since 2022. Housing affordability has plunged, and that’s starting to tug costs decrease in what’s nonetheless the largest driver of family wealth. In the meantime, U.S. auto gross sales — after booming earlier this 12 months in a rush to beat tariffs — dropped onerous in Could, sliding from over 17 million items to only 15.6 million.

As conventional property falter, bitcoin is quietly pulling in sidelined capital. Spot BTC ETFs noticed inflows of $5.5 billion in Could — that’s greater than triple what gold ETFs introduced in, which truly noticed outflows. Clearly, one thing is shifting.

No Mania, Simply Motion

Regardless of the fast value motion, ARK says we’re not in speculative bubble territory. On-chain information exhibits profit-taking stays modest, and unrealized features are far under the euphoric highs seen in previous cycles.

For a lot of buyers, this doesn’t seem like wild hypothesis. It seems to be extra like a quiet however calculated pivot — out of confused sectors, into an asset they see as resilient in unsure occasions.