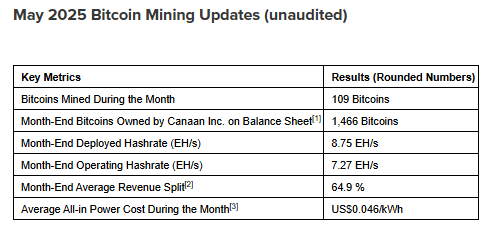

Canaan Inc. (NASDAQ: CAN), an innovator in Bitcoin mining, reported right this moment their bitcoin mining replace for the month ending Could 31, 2025, with 109 bitcoins mined. The corporate’s complete bitcoin holdings rose to 1,466 BTC.

“In Could 2025, regardless of the ten% enhance in tariffs on our Malaysia-made Bitcoin mining machines resulting from ongoing U.S. commerce uncertainties, we remained centered on executing our strategic priorities with self-discipline and agility,” stated the Chairman and CEO of Canaan Nangeng Zhang. “By capitalizing on the favorable momentum in bitcoin costs, we achieved a 25% month-over-month enhance in our bitcoin manufacturing, reaching a report 109 bitcoins. This efficiency marks a brand new month-to-month excessive for our mining manufacturing and brings our complete cryptocurrency holdings to an all-time excessive of 1,466 bitcoins at month-end.”

As of Could 31, 2025, Canaan’s present mining tasks add to 7.27 EH/s of working and eight.75 EH/s deployed hashrate. In America, 3.09 EH/s is energized, together with a 0.02 EH/s in Canada. Ethiopia’s contribute 4.13 EH/s energized and the Center East facility delivers 0.03 EH/s energized. Complete estimated world capability stands at 8.75 EH/s.

“Our put in and operational hashrates reached 8.75 EH/s and seven.27 EH/s, respectively, underscoring the continued buildout of our world mining operations,” said Zhang. “We additionally achieved a brand new historic excessive in put in computing energy, whereas sustaining a aggressive all-in energy price. This efficiency demonstrates our skill to execute on our technique of environment friendly and sustainable development.”

“With Bitcoin costs climbing to historic ranges, we’re seeing elevated world demand for our mining machines,” commented Zhang. “Mixed with the power of our mining operations and our disciplined method to capital allocation, we stay assured in our enterprise fundamentals and our skill to ship long-term worth to our shareholders.”

On June 9, 2025, the corporate introduced that its CEO and its CFO acquired 817,268 of American Depositary Shares at a median worth of US$0.76 per ADS, displaying their perception within the firm’s future.

“My share buy underscores my perception in Canaan’s imaginative and prescient and the large alternatives forward,” said Zhang within the announcement. “Each James and I imagine there’s a important disconnect between our present ADS worth and the worth we imagine we are able to ship within the coming years.”