Welcome to Commerce Secrets and techniques. This month, we’re speaking to prime crypto analysts about the place Bitcoin and different main cryptocurrencies are going within the 12 months forward and checking the choices knowledge and prediction markets.

The Bulls

Bag verify: Dogecoin, Solana

Dogecoin could pump now that Elon Musk has extra time on his fingers: Santiment

Santiment analyst Maksim Balashhevich says now that Elon Musk is now not working for the White Home, he has time for extra pro-Dogecoin antics, that means one other value rally might be on the horizon.

The truth that Musk and Trump are actually combating opens up the potential for Musk to return to his “previous crypto playbook,” says Balashhevich.

“Musk may flip again to Dogecoin to attain a public ‘win’ and restore some credibility.”

His “actionable perception” is for merchants to observe Dogecoin’s social quantity. “If discussions across the coin stay low for a number of extra days, it might create the right setup for a pump ought to Musk resolve to submit about it,” he says.

Dogecoin has been carefully tied to Musk’s antics through the years, with many tweets from the erratic Tesla boss resulting in sudden pumps — a lot in order that he had a lawsuit in opposition to him.

Dogecoin surged 196% final November, following Trump’s presidential election victory and a broader upswing within the crypto market. Many attribute that rally to the joy round Musk being appointed to steer the very conveniently named Division of Authorities Effectivity (DOGE).

Dogecoin has since misplaced most of Trump’s post-election good points as public opinion turned in opposition to the DOGE company, buying and selling at $0.1935 on the time of publication, in keeping with CoinMarketCap knowledge.

Solana might see $300 price ticket earlier than year-end: 21Shares

Solana has dropped almost 13% over the previous month and is holding onto the $160 mark tightly. With memecoin season nowhere in sight, what near-term catalysts, if any, can it depend on?

21Shares crypto analysis strategist Matt Mena brushes off the short-term value ache and forecasts a small rally quickly forward of Solana’s value doubling by 12 months’s finish.

“Within the close to time period, a clear break above the $180 resistance stage might open the door for my near-to-medium time period $200 goal,” Mena tells Journal.

“I see Solana getting into value discovery and pushing above $300 by year-end,” he provides, citing the extremely anticipated however much-delayed Firedancer improve, which is predicted someday in 2025, and the worldwide rollout of the Solana Seeker telephone beginning in August.

“I’m bullish on Solana as a result of it’s constructed for scale and retail,” he provides.

Mena cites the community’s low charges and the upcoming upgrades as key causes for the agency’s conviction. He says these upgrades are anticipated to extend transaction speeds by 10 to 100 instances, considerably bettering the community scalability. He added:

“Solana is changing into the default chain for consumer-facing crypto apps.”

“It’s very best for retail-driven use circumstances like funds, gaming, DePIN, and onchain social – areas the place pace and price matter most,” he says.

The Bears

Bag verify: Bitcoin, Ethereum

Bitcoin could head again to $88K earlier than ‘subsequent leg up’

Bitcoin reached the present all-time excessive of $111,970 again on Could 22, leaving many merchants on the sting of their seats, hoping for a value reclaim and even increased good points. Nevertheless one crypto analyst warns the ache won’t be over but.

Regardless of Bitcoin approaching its all-time excessive once more, hovering round $109,000, Ledn’s chief funding officer, John Glover, tells Journal he believes it might nonetheless drop under $100,000 within the close to future.

“I don’t consider that this corrective transfer decrease has accomplished but,” Glover says.

Glover speculates that the Bitcoin pullback “will full” within the $88,000 to $93,000 vary earlier than the following upswing.

He foresees the “corrective transfer” ending someday within the mid-to-late summer time, adopted by an “impulsive wave” increased.

He doesn’t rule out a potential retest of Bitcoin’s earlier all-time excessive close to $74,500 in a particularly bearish state of affairs. Nevertheless, his longer-term outlook is extra optimistic, with expectations for the value to succeed in round $136,000 by year-end.

Learn additionally

Options

Crypto-Sec: $11M Bittensor phish, UwU Lend and Curve faux information, $22M Lykke hack

Options

Off The Grid’s success reveals ‘invisible’ blockchain is the profitable play

Ethereum to fall in need of $3K mark for now?

Nansen principal analysis analyst Aurelie Barthere tells Journal that Ether will in all probability prime out quickly and should fall in need of reclaiming the long-awaited $3,000.

Ethereum is buying and selling at $2,691, up 2.65% over the previous seven days, in keeping with CoinMarketCap knowledge. Barthere forecasts it might solely rise a number of hundred {dollars} increased.

In her view, the best-case state of affairs is Ether at its Could excessive of $2,700, however warns the extent may additionally mark an area prime.

“It seems to be like this value cap will persist this summer time, until we get very bullish information on the tariff negotiation entrance. Subsequent assist for ETH is 2,300,” Barthere says.

“Some basic constructive drivers for ETH embody the newest SEC steering on staking, which stipulates the authorized framework for staking,” she provides.

Many trade consultants consider staking is the important thing lacking function that may make US-based spot Ether ETFs much more interesting to retail traders.

What the derivatives markets are saying…

Onchain choices protocol Derive founder Nick Forster tells Journal that futures merchants are pricing in a ten% probability of Bitcoin topping $120,000 by the tip of September. There’s additionally a ten% probability of Bitcoin ending up under $92,000 over the identical interval.

Forster says that Bitcoin value consolidation looks as if probably the most “probably state of affairs” within the close to time period. “Derivatives market makers are positioned in a manner that can require them to promote BTC because the spot value rises, which might restrict any potential rallies,” he says.

Forster says the narrative might quickly shift towards Ether and stablecoins within the brief time period, following Circle’s profitable June 5 IPO and a 15-day influx streak into spot Ether ETFs.

Nevertheless, the derivatives market knowledge on Ether’s spot value is barely extra bearish than Bitcoin’s.

There’s an 11% probability it is going to surpass $3,200 by the tip of September, and a 21% probability it is going to fall under $2,100 over the identical interval.

Sentiment: Santiment says retail merchants are coming again, however is {that a} good factor?

Crypto sentiment platform Santiment has noticed a transparent development of retail merchants shopping for again in since Bitcoin reclaimed the psychological $100,000 mark, after spending three months under six figures.

However the agency says that isn’t essentially bullish.

“Small wallets, holding as much as 1 BTC, have been accumulating aggressively,” Santiment mentioned on June 6.

“Since Could 22, these retail holders have added almost 33,000 BTC to their steadiness,” Santiment mentioned, including it views this “as a basic counter-indicator.”

“Traditionally, when the ‘small fish’ purchase with confidence, it usually alerts that whales are getting ready to promote into that liquidity,” the agency mentioned.

“This retail FOMO is a big warning signal {that a} native prime might be forming.”

Fineqia senior affiliate Matteo Greco tells Journal that the market seems “evenly balanced” and there’s no clear consensus on what lies forward.

“We’ll probably must see extra decisive value motion, together with readability on exterior elements, earlier than a definitive development emerges and expectations are firmly set.”

In the meantime, different sentiment indicators sign that market sentiment is wholesome, however very Bitcoin-dominated.

The Crypto Concern & Greed Index, which gauges general market sentiment, presently reveals a “Greed” rating of 62, bouncing again after lately dipping into “Impartial” territory amid Bitcoin retracing from its Could $111,970 all-time highs.

CoinMarketCap’s Altcoin Index, which compares the efficiency of the highest 100 altcoins relative to Bitcoin over the previous 90 days, means that the market is closely favoring Bitcoin, with a rating of 26/100. Bitcoin dominance is 64.59%, in keeping with TradingView knowledge.

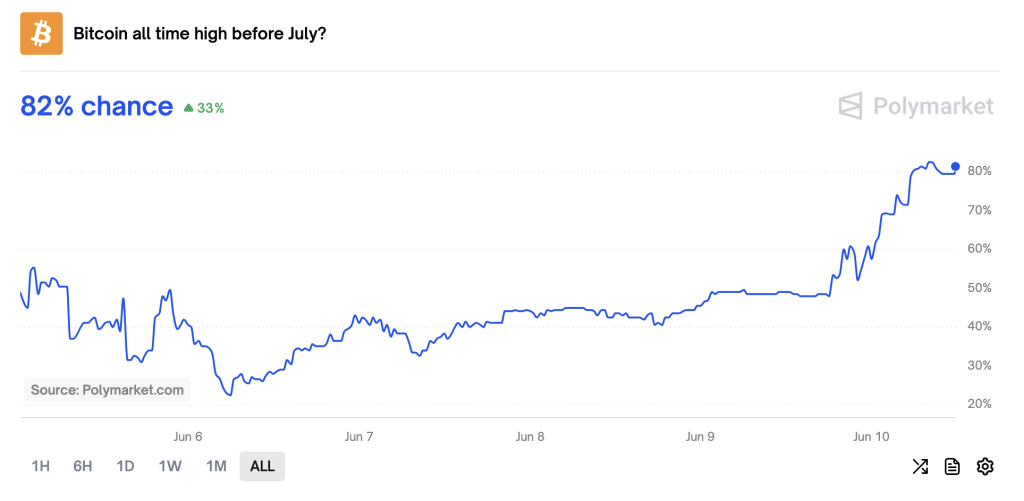

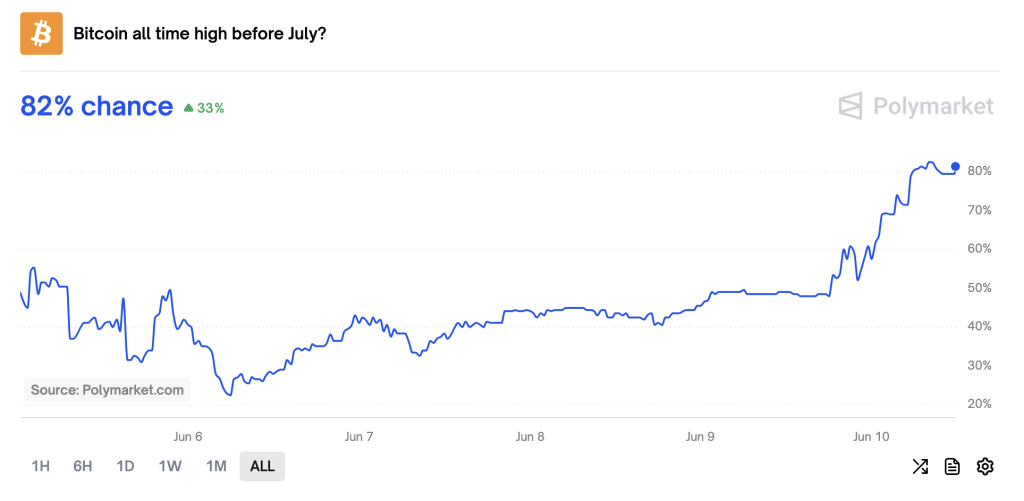

What the prediction markets are saying…

Prediction markets counsel punters are assured Bitcoin will attain new highs by year-end, however that very same conviction isn’t mirrored in bets on Solana or XRP.

Bitcoin has an 82% probability of breaking its present all-time excessive of $111,970 by July 1, in keeping with crypto prediction platform Polymarket.

The percentages of different main cryptocurrencies reaching new all-time highs by the tip of the 12 months have declined because the Could Commerce Secrets and techniques column.

Solana now has only a 27% probability of surpassing its earlier peak of $293 by the tip of 2025, down 16% from its odds final month, following an almost 13% drop in its value.

XRP’s odds of hitting a brand new all-time excessive by year-end have additionally slipped to 38%, down 11% from its odds final month. XRP, which has but to prime its 2018 excessive of $3.40, noticed a 2.46% value decline over the identical interval.

Ethereum has 24% odds of breaking its all-time excessive of $4,878, down 2% from its odds final month.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Ciaran Lyons

Ciaran Lyons is an Australian crypto journalist. He is additionally a standup comic and has been a radio and TV presenter on Triple J, SBS and The Venture.