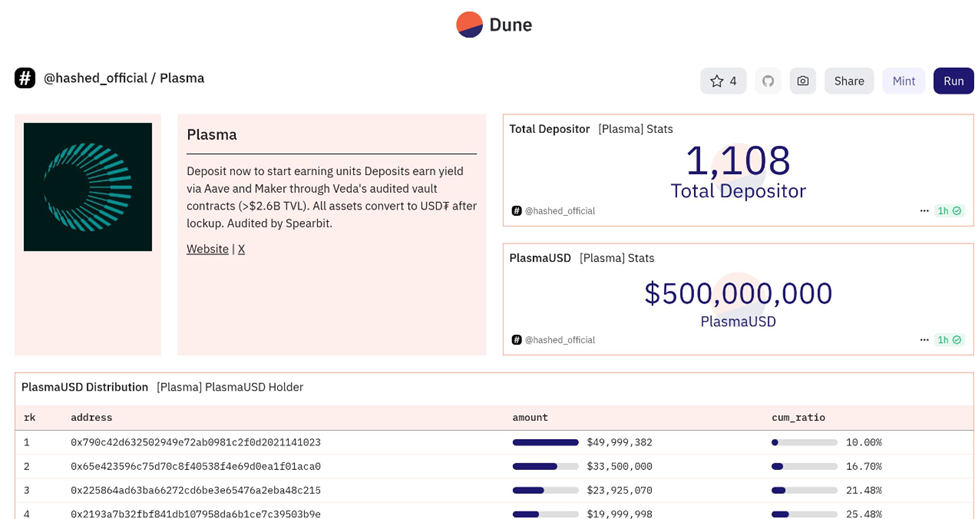

Plasma’s extremely anticipated ICO (Preliminary Coin Providing) for its XPL token closed its vaults after elevating $500 million from over 1,100 depositors.

The occasion, which marked a dizzying show of capital deployment and gasoline wars, has raised considerations amongst group members.

Plasma ICO Raises $500 Million Amid Whale Frenzy, Anticipating $1–2 Billion Unlock?

Whereas the token has not but been launched, expectations are already swelling that the ultimate unlock may usher in $1 billion to $2 billion, if no more.

“We’ve got reached our deposit cap of $500 million. We’re thrilled that 1,100+ wallets participated, with a median deposit quantity of ~$35,000. Trillions,” Plasma introduced.

Amid the headlines and hype, nonetheless, a deeper story is rising. Considerations lengthen from whale domination and insider entry to a rising sense that token launches are more and more turning into gated occasions for the crypto elite.

The numbers present that solely a handful of wallets accounted for outsized allocations. Extra particularly, the highest three contributors alone deployed over $100 million collectively.

Maybe extra surprising, one person reportedly paid 39 ETH (roughly $104,871 at present charges of $2,689) in gasoline charges, which secured them a $10 million USDC allocation.

“This man spent 100k in gasoline (230,000 Gwei) to get his deposit in for Plasma,” wrote MonaMoon, the founding father of the Duck Frens NFT undertaking.

This illustrates the depth of FOMO and the lengths members have been prepared to go to for early entry. However, the frenzy has come at a reputational price. With whales taking the lion’s share, many are calling this launch something however honest.

“…it’s an apparent skip for the group…Solely 100 wallets with $50 million every… these wallets alone will create an oversubscription of 100x… sadly, it’s not a good launch, despite the fact that the worth may be very engaging,” warned an X person earlier than the increase closed.

Regardless of providing simply 10% of the entire XPL token provide within the public sale at a $500 million FDV (absolutely diluted valuation), retail customers have been successfully pushed to the sidelines. They’ll doubtless solely get in later, at 10x to 16x the worth.

Critics Slam Plasma’s Tech and Tokenomics- ICO Was a Lockout, Not a Launch

This sharp disparity has some dubbing it a “whale sale,” moderately than a launch accessible to the broader group. Additional, there could also be extra than simply dangerous optics at play. Crypto dealer Hanzo raised severe purple flags, suggesting doable coordinated insider conduct.

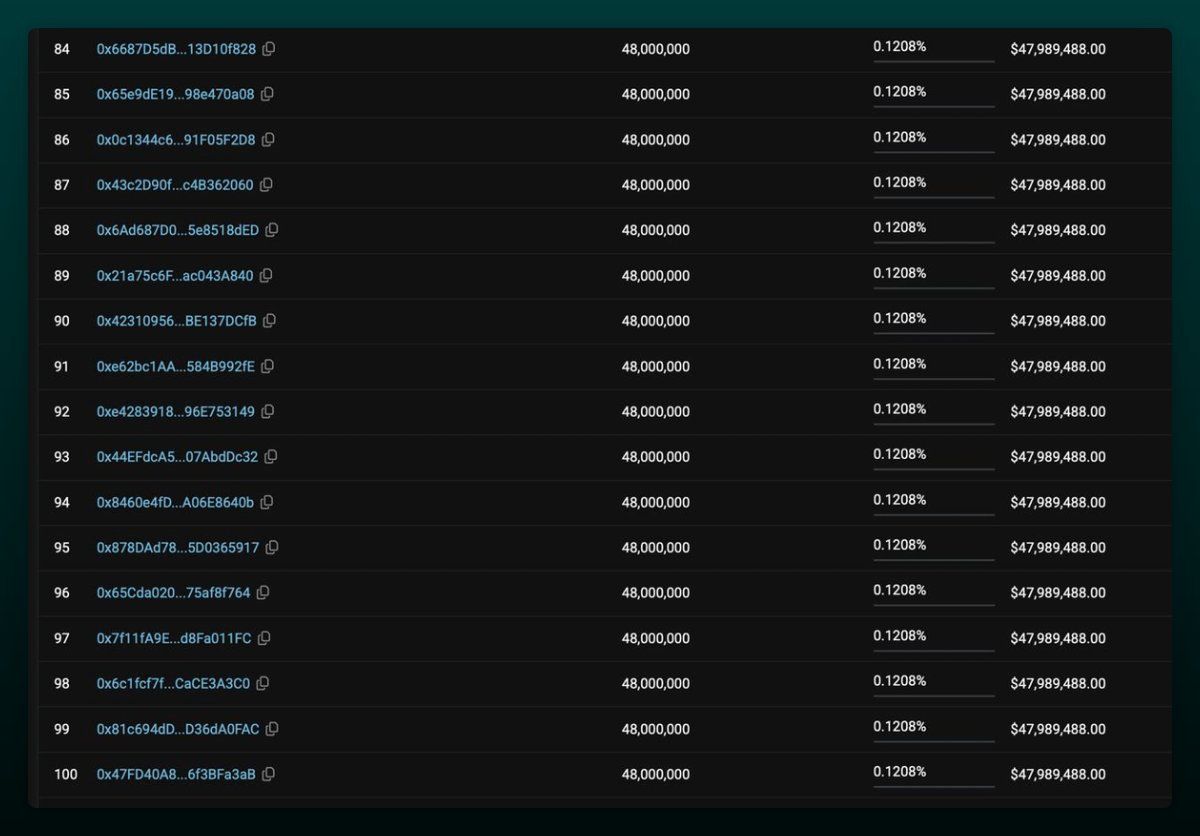

Hanzo calls out over 100 wallets, every receiving 48 million USDC, earlier than the token even launched, highlighting that a few of these wallets authorised token interactions earlier than the token contract went public.

“Which means insiders had early entry to mint and commerce. This wasn’t a shock launch — it was a personal celebration. Retail wasn’t invited,” he claimed.

The mechanics of the increase additionally increase questions. Hosted on Sonar/Echo, dubbed by some as “the CoinList of this cycle,” a time-weighted share of vault deposits decided plasma’s deposit interval.

Contributors needed to lock stablecoins on Ethereum, with a minimal 40-day lockup. Nonetheless, with the deposit cap abruptly raised to $500 million and stuffed virtually immediately, many customers have been left questioning whether or not this was ever meant to be an open alternative.

Even the expertise underpinning Plasma has not escaped scrutiny. A person broke down the chain’s structure and located it missing.

“Plasma is one other L1 chain… It makes use of a ‘traditional’ pBFT consensus layer, with Proof-of-Stake… and Bitcoin as ‘settlement’ by merely publishing state variations… It appears quite a bit like many alt-L1 EVM forks… It surfs on the Bitcoin “side-chain” advertising marketing campaign and is pushed by influencors.. however I’m not satisfied in any respect,” the person famous.

In his view, Plasma’s use of influencers and Bitcoin branding is extra advertising veneer than technical substance.

Nonetheless, not everybody agrees. Zaheer from SplitCapital praised the distribution, noting a broad holder distribution with over 1,100 wallets and just one pockets holding $50 million.

“All issues thought-about insanely good distribution of holders for Plasma at $500m whole measurement of deposit. Seeing a ton of parents with smaller quantities on right here and just one entity with $50m in a pockets. Properly completed,” he said in a submit.

In keeping with Zaheer, this contrasts with the standard whale-dominated ICOs and suggests a extra inclusive allocation technique.

Plasma’s ICO serves as a mirror to right now’s market mechanics, the place velocity, measurement, and for some, connections, usually matter greater than innovation or accessibility.

Whether or not Plasma turns into a foundational chain or one other cautionary story will depend upon the unlock numbers and the way its ecosystem gala’s past the ICO hype.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.