- 2.8M SOL flowed into Binance final week, triggering a 7% worth drop; funding fee turned constructive on June 8.

- Whereas short-term momentum seems to be barely bullish, quantity and OBV tendencies nonetheless level to warning.

- A break above $162 might flip the 4H construction bullish and supply swing commerce potential.

Final week, Solana [SOL] obtained hit with a wave of tokens heading straight for Binance—2.8 million SOL, to be precise. That type of influx sometimes units off alarms, and this time was no completely different. The worth slid from $155 all the way down to $143, marking a 7% dip that lined up with that bearish stress. Humorous sufficient although, the funding fee really flipped constructive on June 8, hinting at a slight shift in dealer sentiment.

However let’s be actual—regardless of that sparkle of optimism, SOL’s been in a fairly clear downtrend for about three weeks now. Any short-term features? They’re extra like velocity bumps than indicators of a breakout. Nonetheless, for those who’re a nimble dealer, there could also be alternatives to experience this shift in momentum for some fast upside.

Each day Chart Exhibits Indicators of Life—However It’s Not a Pattern Reversal But

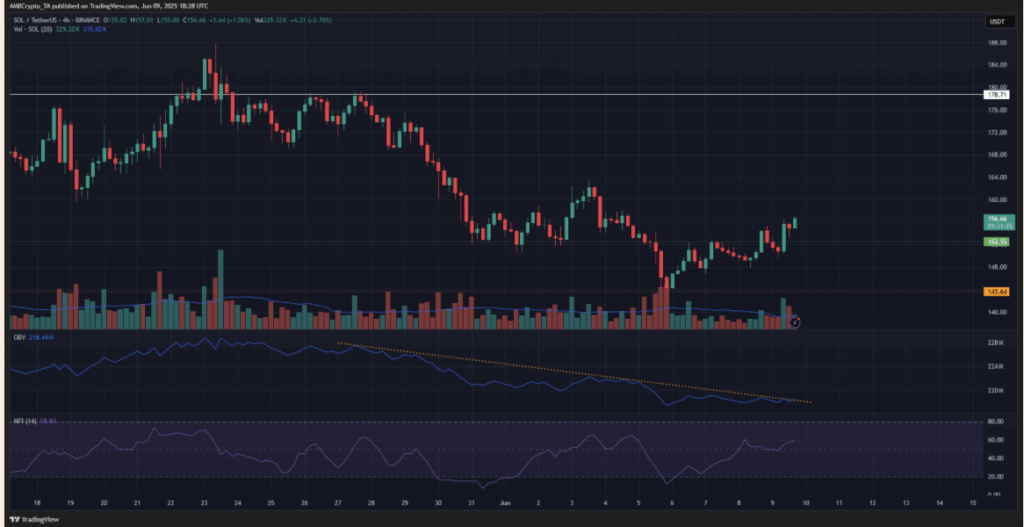

Trying on the 1-day chart, Solana’s construction has been bearish since mid-Could. It got here again all the way down to retest the $143 help degree, which was a key zone flipped earlier in April. After touching that line once more, SOL bounced again practically 8.5% over the next three days—a stable response from consumers. Doesn’t scream reversal, but it surely does present demand nonetheless exists.

Downside is, the Cash Circulate Index (MFI) suggests sellers nonetheless have the higher hand. Quantity’s additionally been sluggish—the 20-day common has been drifting decrease as SOL pulled again. The On-Stability Quantity (OBV) has been sliding south too, and until that flips, speak of $178 or greater is simply wishful pondering for now.

4H Chart Affords Clues for the Quick-Time period Gamers

Zooming into the 4-hour chart, the OBV continues to be below stress, caught below a descending trendline. It hasn’t been damaged but, but it surely’s getting shut. If consumers can push it previous the native excessive from early June, that’d be the primary actual signal of power from bulls. Till then? Warning is essential.

On a brighter notice, the MFI on this timeframe is climbing once more, transferring in sync with worth. This means some recent shopping for stress over the previous few days. Nonetheless, the market construction on the 4H stays bearish. That $162 mark—that’s the decrease excessive from earlier this month—is the road to observe. If SOL can clear it, swing merchants might lastly have one thing to get enthusiastic about.