- Solana rose 5% after reviews that the SEC is advancing the method for spot SOL ETFs.

- Main asset managers like Constancy and Grayscale have filed to launch SOL-based funding autos.

- The SEC is predicted to evaluation up to date filings over the following 30 days, signaling potential progress towards approval.

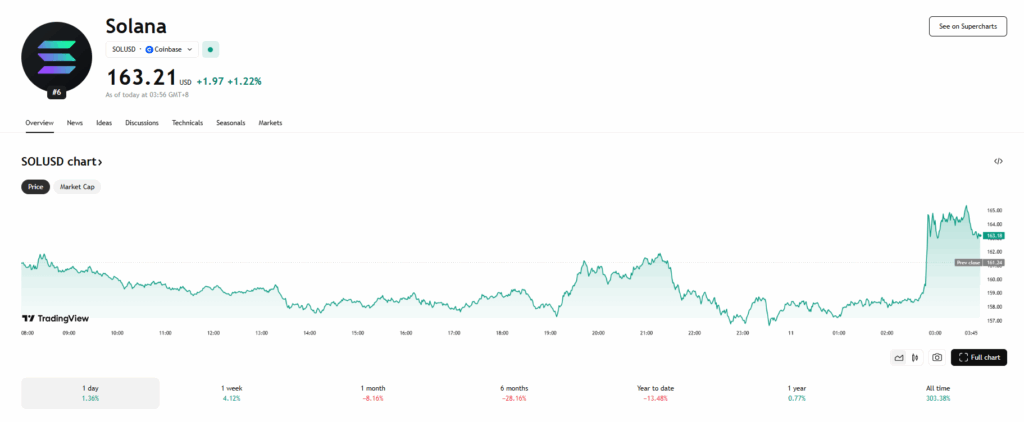

Solana (SOL) jumped 5% late Tuesday following a report from Blockworks that U.S. regulators are inching nearer to greenlighting spot SOL ETFs. The information despatched a jolt by the market, pushing SOL previous the $164 mark in after-hours buying and selling and lighting up bullish sentiment amongst buyers.

In accordance with the report, the U.S. Securities and Alternate Fee (SEC) has requested that potential ETF issuers revise and submit their S-1 filings throughout the subsequent week. As soon as obtained, the company will start a 30-day evaluation course of—an early however significant step in what might grow to be a serious milestone for Solana’s institutional adoption.

ETF Race Expands Past Bitcoin and Ethereum

With spot bitcoin and ether ETFs already buying and selling within the U.S., the push for Solana-based merchandise has accelerated. Main asset managers together with Constancy, Grayscale, Franklin Templeton, and VanEck have filed to launch SOL ETFs, hoping to faucet into rising demand from conventional buyers who need crypto publicity with out coping with wallets or non-public keys.

SOL has already been performing properly in 2025, and this new ETF improvement might function a key catalyst. If authorized, a Solana ETF wouldn’t solely enhance accessibility but in addition probably convey higher stability and long-term capital influx into the SOL ecosystem.

Market Response and Subsequent Steps

Shortly after the information broke, SOL spiked to $164.89, persevering with a gradual climb that has seen it outperform a lot of the market. The token is now up almost 5% previously 24 hours and will see additional upside if regulatory momentum holds.

Whereas the SEC hasn’t formally confirmed timelines or approvals, the request for up to date S-1 filings suggests the company is taking the proposals severely. CoinDesk reached out to the asset managers concerned for additional remark, however responses hadn’t come by at press time.