BlackRock’s iShares Bitcoin Belief exchange-traded fund has handed the $70 billion mark quicker than every other ETF in historical past by a protracted shot, in accordance with analysts.

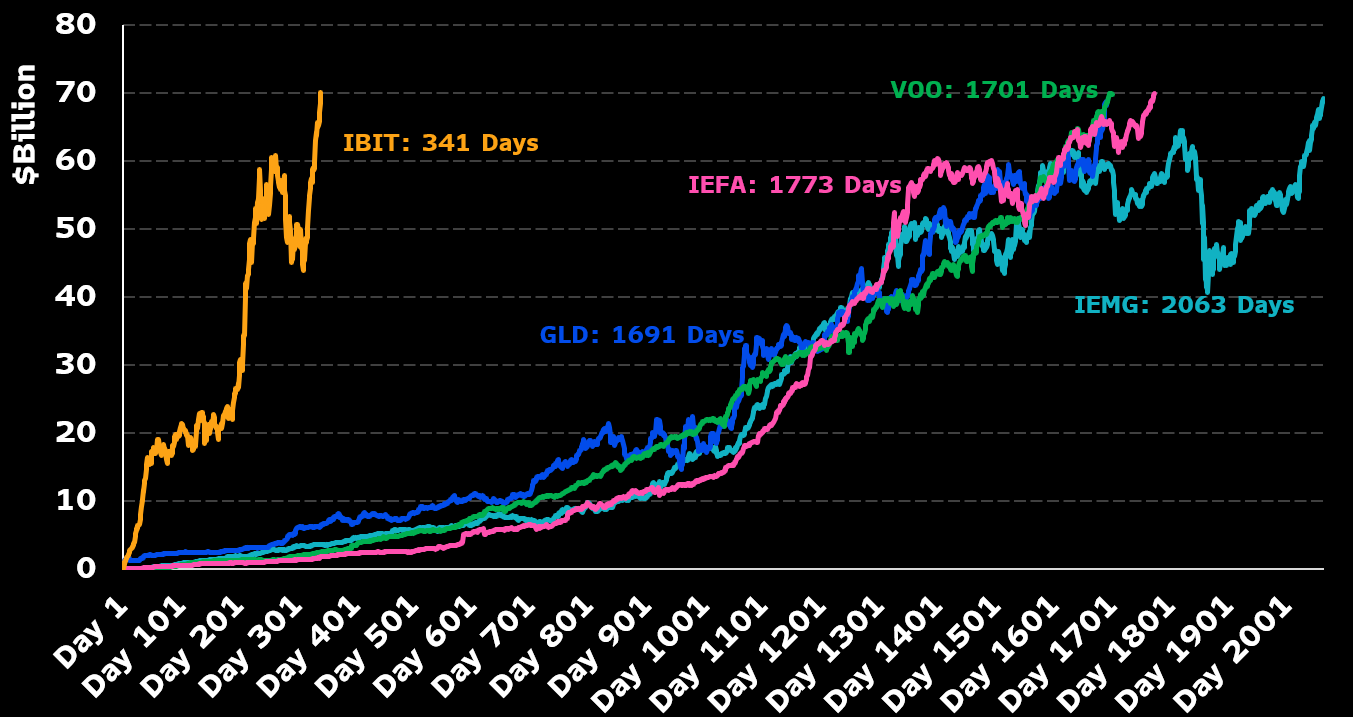

Bloomberg ETF specialist Eric Balchunas says in a publish on the social media platform X that IBIT has surpassed the $70 billion mark 5 instances quicker than the gold-based GLD product.

“IBIT simply blew by $70b and is now the quickest ETF to ever hit that mark in solely 341 days, which is 5x quicker than the outdated document held by GLD of 1,691 days…

When BlackRock filed for IBIT, the value was $30k and the stench of FTX was nonetheless in air. It’s now $110k (a return that’s 7x that of the mighty S&P 500) and is now seen as reliable for different huge traders.”

In line with information from blockchain analytics platform Arkham, BlackRock at the moment holds $76.19 billion value of digital belongings in its crypto wallets.

In his annual letter to traders, BlackRock CEO Larry Fink mentioned that US greenback supremacy can’t final perpetually and is already being weakened, not solely resulting from skyrocketing debt but in addition the rise of digital belongings and decentralized finance (DeFi).

Says Fink,

“The US has benefited from the greenback serving because the world’s reserve foreign money for many years.

However that’s not assured to final perpetually. The nationwide debt has grown at thrice the tempo of GDP since Instances Sq.’s debt clock began ticking in 1989.57 This yr, curiosity funds will surpass $952 billion— exceeding protection spending. By 2030, obligatory authorities spending and debt service will devour all federal income, making a everlasting deficit. If the US doesn’t get its debt beneath management, if deficits hold ballooning, America dangers shedding that place to digital belongings like Bitcoin.

To be clear, I’m clearly not anti-digital belongings (removed from it; see the following part). However two issues may be true on the similar time: Decentralized finance is a rare innovation. It makes markets quicker, cheaper, and extra clear. But that very same innovation may undermine America’s financial benefit if traders start seeing Bitcoin as a safer wager than the greenback.”

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any losses you could incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney