- GameStop is elevating $1.75B by way of convertible notes to additional its Bitcoin treasury technique, with an choice for $250M extra.

- The corporate beforehand raised $1.3B and purchased 4,710 BTC in Might utilizing these funds.

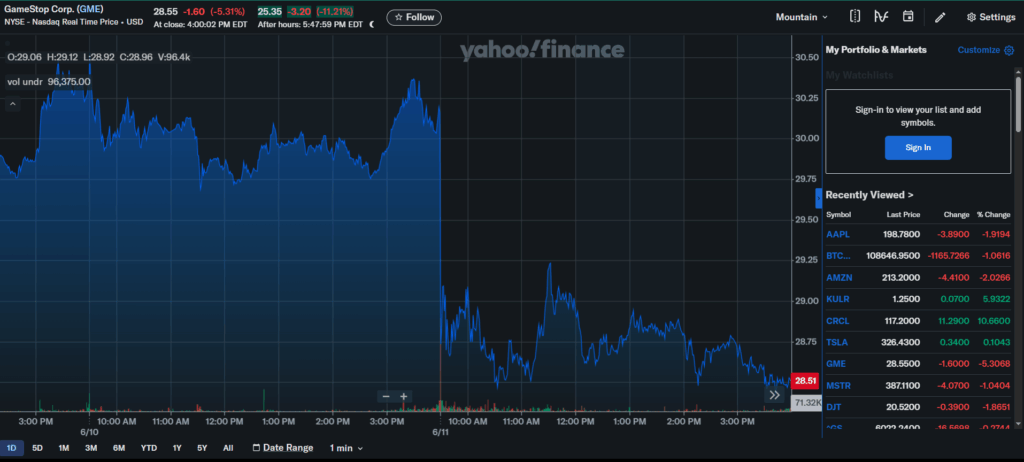

- GME inventory dropped 10% after hours as buyers react to the daring crypto-focused transfer.

GameStop (GME) is doubling down on its crypto pivot. The corporate introduced on Wednesday it is going to elevate $1.75 billion by means of a convertible senior observe providing, with the choice so as to add one other $250 million inside two weeks. Based on GameStop’s press launch, proceeds will go towards investments aligned with its official Funding Coverage—a coverage that features holding Bitcoin as a treasury reserve asset, first disclosed again in March.

This marks GameStop’s second main elevate for its crypto treasury technique. In Might, the meme inventory darling used funds from a $1.3 billion convertible observe providing to scoop up 4,710 BTC, value round $500 million on the time.

Right this moment’s notes received’t carry any common curiosity and are due in June 2032, except transformed or repurchased early. The providing is open completely to certified institutional consumers, reflecting a rising urge for food for long-term speculative publicity tied to each GameStop and Bitcoin.

Nonetheless, not everyone seems to be shopping for the hype. GME shares fell 10% in after-hours buying and selling, with some buyers possible unsettled by the continued pivot away from core retail operations.