- Nasdaq has filed a 19b-4 with the SEC to listing the 21Shares SUI ETF, marking a significant step towards US altcoin ETF approval.

- Sui boasts practically $2B in DeFi TVL, $1.1B in stablecoins, and a swift restoration from a significant DEX exploit.

- Analysts see Sui ETF submitting as a part of a broader “Altcoin ETF Summer time,” although demand could fluctuate throughout belongings.

Sui may simply be getting its second within the highlight. Nasdaq not too long ago filed a 19b-4 kind with the SEC to listing the 21Shares SUI ETF, formally kicking off the assessment course of for what might change into one of many first spot ETFs tied to an altcoin—outdoors of Ethereum, that’s. It’s an enormous step, particularly contemplating how the SUI ecosystem has needed to bounce again from some bumpy highway patches recently.

Based on the Sui Basis, this marks the “formal” starting of the ETF analysis. It follows 21Shares’ earlier S-1 submitting from April, signaling clear momentum towards institutional adoption. Globally, there’s already $300 million+ wrapped up in SUI-based ETPs through exchanges in Paris and Amsterdam. A US product? That would take issues to an entire totally different stage.

Sturdy Metrics Again the Bid

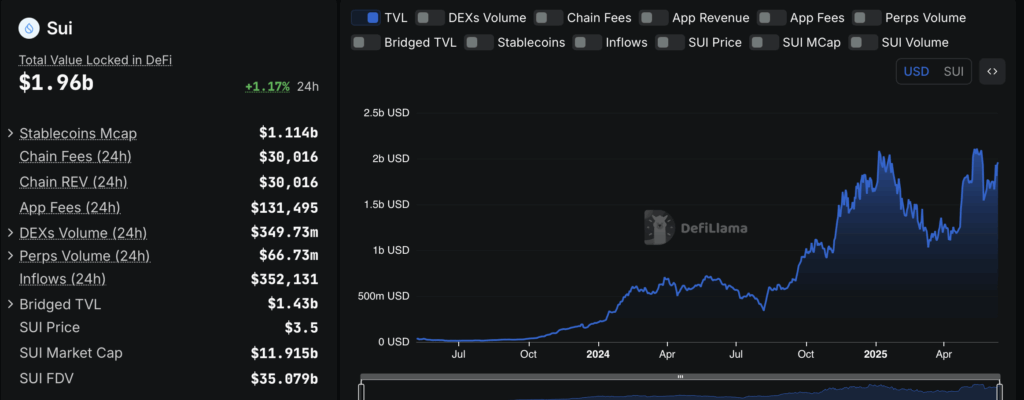

Sui’s not simply using hype—there’s some actual knowledge behind the excitement. Whole worth locked (TVL) throughout its DeFi protocols has reached practically $1.94 billion, inserting it eighth throughout all chains based on DeFiLlama. Stablecoins? These are booming too. Market cap for SUI-based stablecoins has jumped 190% this yr and not too long ago crossed $1.1 billion. Switch quantity? Over $110 billion… simply in Could.

Tech-wise, Sui’s no slouch. Its horizontal scaling, object-based programming, and real-world tokenization capabilities make it enticing to builders constructing all the pieces from video games to DeFi platforms. It’s rapidly cementing itself as a severe Layer-1 contender.

Cetus Hack Rocked the Ecosystem—However Restoration Was Quick

Issues haven’t been all easy crusing, although. Again in Could, Sui took successful when the Cetus DEX was exploited for $260 million. That shook investor confidence for a second—particularly because the response included a controversial $162 million restoration fund. Nonetheless, the community stabilized. TVL rebounded, and a $10 million safety initiative was launched to assist builders and enhance danger protocols.

Cetus stays a key piece of Sui’s DeFi infrastructure, so its bounce-back gave merchants a little bit of reassurance. With the protocol again on observe and SUI’s worth up 18% since early June (buying and selling at $3.47 ultimately verify), momentum is cautiously constructing once more.

What’s Subsequent? Altcoin ETF Summer time?

Mysten Labs President Kevin Boon known as Nasdaq’s ETF submitting a “highly effective second” for Sui. The transfer provides gas to what analysts like Bloomberg’s Eric Balchunas are already calling “Altcoin ETF Summer time.” Nonetheless, Balchunas warned to not anticipate each altcoin ETF to carry out like Bitcoin’s: “the additional away you get from BTC, the much less belongings there might be.”

In the meantime, Osprey is pushing arduous for a Solana ETF, which might drive the SEC to hurry up altcoin ETF choices. The Fee, nevertheless, simply delayed its ruling on the Hedera ETF, extending the remark window—once more.

For now, optimism across the SUI ETF is robust. Whether or not or not it clears the SEC, it indicators actual curiosity in giving institutional buyers simpler publicity to the following wave of Layer-1 platforms.