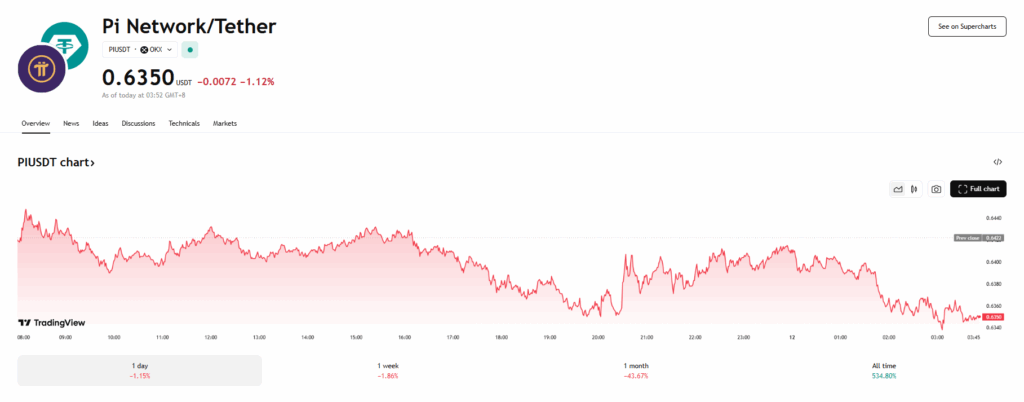

- Pi Coin is down almost 58% in a month, underperforming the broader crypto market and dropping to thirty sixth by market cap.

- Analysts predict additional draw back, with CoinCodex eyeing a 24% drop to $0.48 by September.

- A Fed charge minimize or Bitcoin hitting new highs may probably reignite bullish momentum for PI.

Pi Coin (PI) isn’t catching the identical break as the remainder of the market. Whereas Bitcoin has bounced again over the $109K mark, PI continues to wrestle, shedding almost 58% of its worth over the previous month and slipping to thirty sixth place by market cap. Its newest dip—down 0.4% on the day—provides to a troubling short-term development that has traders asking whether or not it’s time to purchase or bail.

From Hero to Hesitant: PI’s Fall from Its All-Time Excessive

Earlier this 12 months, PI was red-hot. It hit an all-time excessive of $2.99 again in February, driving the wave of early 2025’s crypto euphoria. However since then, it’s dropped almost 79%, with analysts pointing to a shift in investor desire towards safer, extra established belongings. As Bitcoin reclaims territory, altcoins like PI could also be bearing the price of a cautious market.

Bearish Forecasts, however a Glimmer of Hope?

CoinCodex isn’t portray a reasonably image both, forecasting PI will drop one other 24% to round $0.48 by early September. Nonetheless, not all hope is misplaced. If macro components shift—like a long-speculated Federal Reserve charge minimize or Bitcoin blasting by means of its all-time excessive—PI may catch a second wind as danger urge for food returns.

Will PI Experience the Subsequent Wave?

Whereas the chances aren’t at present in PI’s favor, crypto has a behavior of flipping the script. If BTC continues upward or if the Fed injects some dovish power into the markets, PI may rebound quicker than anticipated. Till then, warning is the secret—however so is alternative.