Argentina’s foray into cryptocurrency took a dramatic flip in February 2025 when President Javier Milei tweeted in assist of LIBRA, a Solana-based meme coin. Inside hours, LIBRA crashed practically 90%, sparking accusations of fraud and requires Milei’s impeachment.

Among the many outdoors entities concerned with the launch of LIBRA have been Kelsier Ventures, headed by CEO Hayden Davis; KIP Protocol, led by CEO Julian Peh; and Solana-based platform Meteora, which had beforehand facilitated launches for each the Donald and Melania Trump meme cash.

Following LIBRA’s collapse, Argentina’s inventory market dropped greater than 5% at its opening on February 17, 2025. This text will look at LIBRA and the scandal surrounding the most recent meme coin craze.

What’s LIBRA?

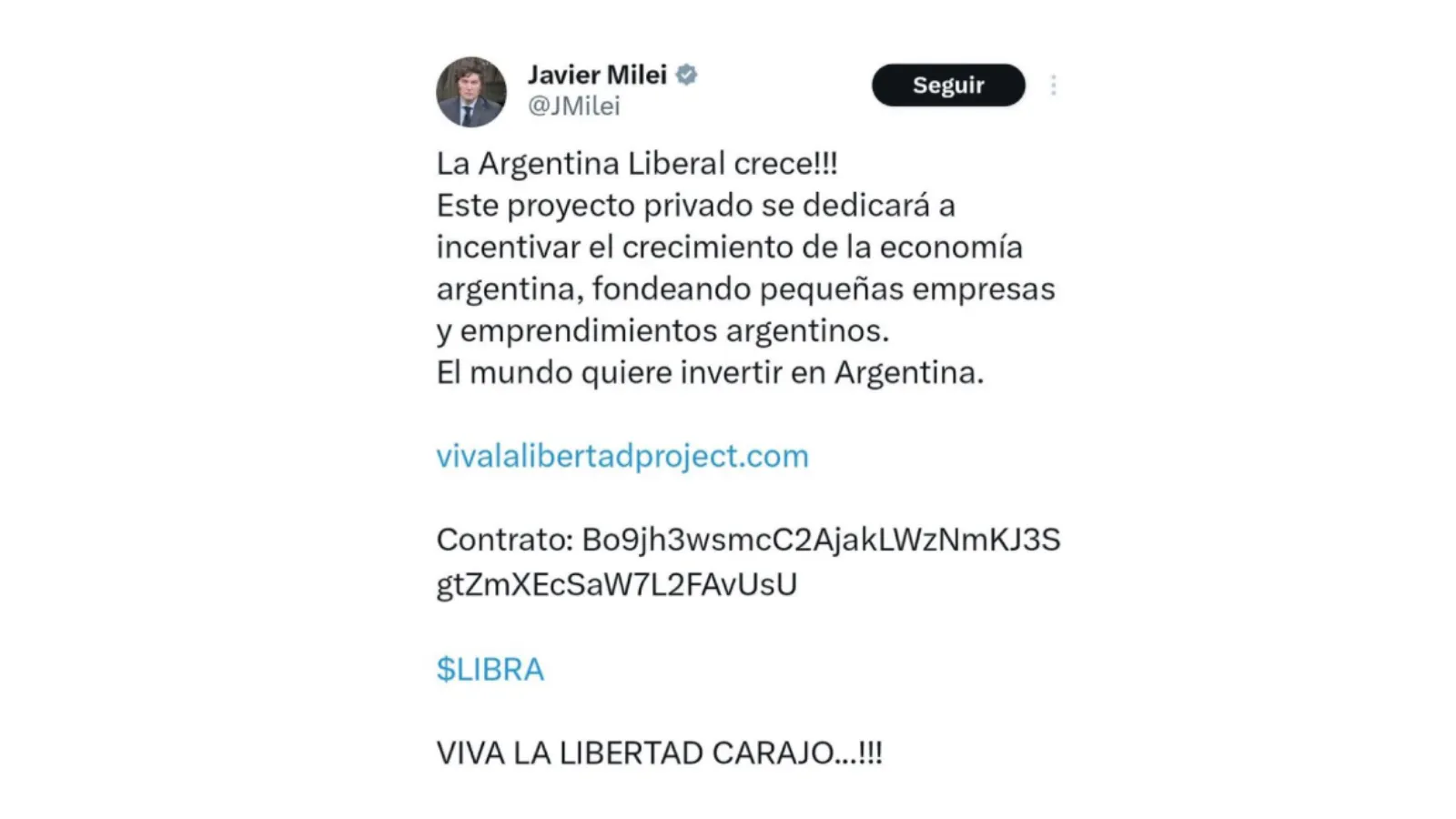

The LIBRA token, created by the Viva La Libertad Mission, was promoted as a funding instrument for Argentina’s small companies and modern initiatives—an uncommon use case for a meme coin, that are largely pushed by web phenomena, celebrities, and humor.

“This non-public mission can be devoted to encouraging the expansion of the Argentine financial system by funding small Argentine companies and startups,” Milei mentioned in a since-deleted publish that included the mission web site and contract deal with. Milei subsequently denied having any advance data of the LIBRA mission.

LIBRA has a max provide of 1 billion tokens. In keeping with the Libertad Mission web site, LIBRA token distribution would cut up 50% to Argentina Progress, 20% to Treasury, and 30% to Liquidity.

On February 17, 2025, the token reached an all-time excessive of $0.75, in accordance with CoinGecko information. On the time, LIBRA’s market capitalization had reached $4.5 billion. Hours later, it sharply declined, triggering fraud investigations and impeachment calls in opposition to Milei.

In Could 2025, Milei shuttered an investigative job drive set as much as look into potential wrongdoing on his half; a month later, the nation’s anti-corruption unit cleared the president over his involvement with LIBRA, stating that he was appearing in a private capability when tweeting concerning the mission. As of June 2025, a federal prison probe into the affair continues to be ongoing.

Do you know?

The Solana-based meme coin LIBRA, although it shares its identify with the unique moniker of Fb’s abortive try at a digital forex (subsequently renamed Diem) has no affiliation with that mission.

A brief timeline of occasions: the LIBRA token scandal

On February 15, 2025, the Workplace of the President supplied a timeline of early occasions associated to the creation and launch of the LIBRA meme coin.

October 19, 2024 – Preliminary assembly with KIP Protocol

- The Workplace of the President reported that President Javier Milei met with representatives of the KIP Protocol in Argentina.

- The representatives knowledgeable Milei of their intention to develop a mission known as “Viva la Libertad” utilizing blockchain expertise to finance non-public ventures in Argentina.

January 30, 2025 – Assembly with Hayden Mark Davis

- President Milei held a gathering at Casa Rosada with Hayden Mark Davis.

- In keeping with KIP Protocol representatives, Davis would supply the technological infrastructure for the mission.

- The Workplace of the President clarified that Davis had no prior reference to the Argentine authorities and was offered as a associate of KIP Protocol.

February 17, 2025 – The rise and fall of LIBRA

- Milei promotes LIBRA: Argentina’s President Javier Milei introduced the launch of the Solana-based meme coin LIBRA, which was promoted as a option to fund small companies and startups.

- Pre-Launch insider exercise: In keeping with a report by TRM Labs, 20 minutes earlier than Milei’s announcement, an deal with obtained 1 million $LIBRA tokens and added them to a Meteora liquidity pool.

- All-time excessive: LIBRA reached $0.75, giving it a market capitalization of $4.5 billion.

- Fast decline: The worth crashed practically 90% inside hours, triggering accusations of fraud and a pump-and-dump scheme.

- Liquidity withdrawals: Wallets linked to the LIBRA group withdrew $7.8 million in SOL, contributing to the value collapse.

February 18, 2025 – The fallout begins

- Argentina’s inventory market dropped greater than 5% on the opening in Buenos Aires, including to monetary instability.

- Milei deleted his publish selling LIBRA and denied prior data of the mission, as a decide was assigned to go a probe into fraud allegations.

- Traders accused KIP Protocol and its CEO, Julian Peh, Kelsier Ventures and its CEO, Hayden Davis, Mauricio Novelli, and Manuel Godoy of the Tech Discussion board Argentina of wrongdoing within the LIBRA scandal.

Insider buying and selling allegations

Consultants suspect the LIBRA token collapsed as a consequence of insider exercise. In keeping with San Francisco-based analytics agency TRM Labs, 20 minutes earlier than President Milei’s tweet, one deal with obtained 1 million LIBRA tokens, added them to a Meteora liquidity pool, and distributed extra to different addresses that did the identical.

Quickly after, on-chain investigation agency Bubblemaps recognized that wallets linked to the LIBRA group had withdrawn $87 million in SOL from the pool, progressively crashing LIBRA’s worth.

Along with allegations of fraud in opposition to Milei, buyers accused KIP Protocol and its CEO, Julian Peh, Kelsier Ventures and its CEO, Hayden Davis, Mauricio Novelli, and Manuel Godoy of the Tech Discussion board Argentina of wrongdoing within the LIBRA scandal.

On February 17, 2025, Davis informed Barstool Sports activities founder Dave Portnoy that Davis was “sitting on $100 million” following LIBRA’s launch—additional fueling the controversy. Davis claimed he didn’t intend to run off with the cash.

“It’s not mine,” Davis mentioned. “It’s Argentina’s.”

That very same day, on-chain evaluation revealed that the Solana-based platform Meteora—identified for creating the TRUMP and MELANIA meme cash—was additionally behind the LIBRA token. Following the collapse of LIBRA and rising insider buying and selling allegations, Meteora co-founder Ben Chow resigned.

A month later, Argentine lawyer Gregorio Dalbon formally sought Davis’ worldwide detention; as of June 2025, Interpol has but to approve a Pink Discover.

In a tweet, Solana-based trade Jupiter mentioned that the launch of LIBRA had been an “open secret” in meme coin circles. The trade mentioned that it discovered no proof of insider buying and selling or “sniping” by its personal group members following an inside investigation, including that the corporate takes claims of insider buying and selling “EXTREMELY severely.”

On $LIBRA

For the reason that begin, Jupiter has at all times positioned an enormous premium on transparency. The memecoin launch sport is a unclean sport with loads of ugly conduct. We, nevertheless, don’t have anything to cover.

So listed here are the details as clearly as we are able to say them.

A couple of members of the…

— Jupiter (🐱, 🐐) (@JupiterExchange) February 16, 2025

“The memecoin launch sport is a unclean sport with loads of ugly conduct,” Jupiter wrote. “We, nevertheless, don’t have anything to cover.”

“We have been fully unaware of the dealings between the principals, on this case Milei and the market makers, and weren’t concerned in it in any method, form, or type,” Jupiter added.

In keeping with a report by Nansen, solely 14% of LIBRA buyers turned a revenue, collectively making $180 million from the token’s launch, whereas 86% of those that invested in LIBRA misplaced $251 million.

Notably, per information from Nansen, two wallets that bought $LIBRA at 22:01 UTC and bought by 22:44 UTC on February 14 collectively profited $5.4 million, with one pockets, HyzGo2, pocketing $5.1 million. In the meantime, Barstool Sports activities Founder Dave Portnoy misplaced $6.3 million by way of investing in Libra however was later refunded $5 million.

This text was revealed in February 2025 and up to date in June 2025.

Each day Debrief Publication

Begin every single day with the highest information tales proper now, plus unique options, a podcast, movies and extra.