- Crypto market misplaced 5% in worth after softer-than-expected PPI information and rising Center East tensions.

- BTC and ETH fell over 2.5%, with $326M in liquidations led by ETH and BTC futures.

- Analysts say the dip is a macro-driven, wholesome correction—not a significant collapse.

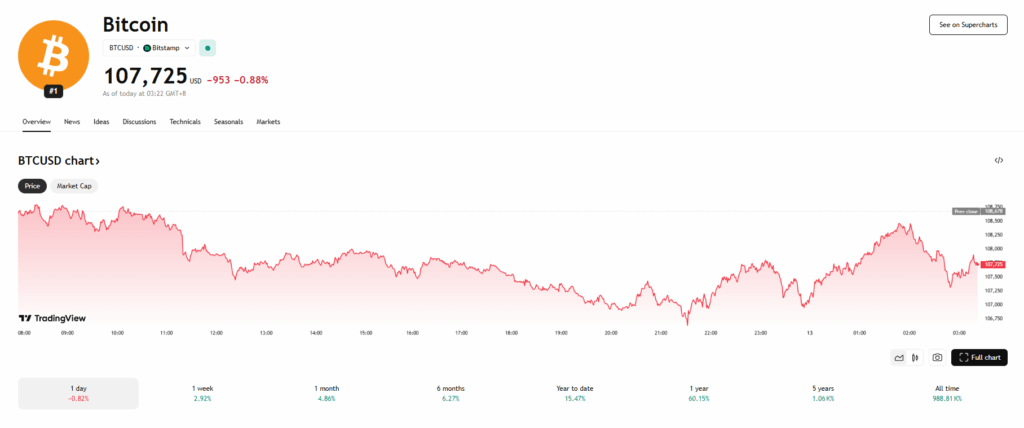

The broader cryptocurrency market slipped into the crimson on Thursday following the discharge of the newest U.S. Producer Value Index (PPI) report, which hinted at cooling wholesale inflation. Bitcoin dropped 2.4% to $107,100, whereas Ethereum shed 5% to commerce round $2,724. Different main altcoins like XRP and Solana declined by 4% and 6%, respectively.

Market Cap and Liquidations Mirror Bearish Sentiment

The overall crypto market capitalization fell 5% to $3.49 trillion during the last 24 hours. In line with CoinGlass, over $326 million in leveraged positions have been liquidated, with Ethereum contributing $90 million and Bitcoin $72 million to the whole. Regardless of the pullback, U.S.-listed spot Bitcoin ETFs noticed $165 million in inflows on Wednesday, whereas ETH spot ETFs recorded increased curiosity with $240 million in inflows.

PPI Report Beats Forecasts, Influences Market Response

In line with the U.S. Bureau of Labor Statistics, Might’s PPI rose simply 0.1%, coming in under the forecasted 0.3%. On an annual foundation, wholesale inflation climbed 2.6%, barely up from April’s 2.5%. Core PPI was additionally mushy, rising simply 0.1% month-to-month, with the yearly price declining to three.0% from 3.2%. The subdued inflation information adopted a equally cooler CPI studying, providing momentary reduction earlier than markets turned decrease.

Analysts Weigh In: Danger-Off, Not Collapse

Ryan Grace, head of digital belongings at TastyTrade, stated the dip displays broader danger aversion pushed by macro uncertainty and geopolitical tensions. “Bitcoin and Ethereum are down over 2.5%, mirroring declines in tech and progress shares,” he famous. Seraph CEO Tobin Kuo added that though inflation issues are easing, expectations round rate of interest cuts stay unchanged.

Ben Kurland of DYOR emphasised that this isn’t a panic-driven sell-off. “It’s a wholesome reminder that macro nonetheless issues, and the trail to $120K isn’t going to be a straight line,” he stated, highlighting leverage resets and long-term holder resilience.