Bitcoin faces intensified promoting strain at present, with a noticeable uptick in spot market outflows. This comes as markets grapple with the aftermath of Israel’s strike on Iran on Friday, sparking geopolitical uncertainty.

The coin is down 3% over the previous 24 hours, and technical indicators level to waning purchaser momentum. If the bearish strain persists, BTC may slide additional, doubtlessly testing decrease assist ranges within the days forward.

Bitcoin Faces Extra Losses as Indicators Flip Pink

Over the previous 24 hours, BTC has declined by nearly 5%, hovering across the $105,000 mark. The heightened risk-off sentiment is driving capital out of the spot market, signaling waning confidence amongst merchants and institutional contributors.

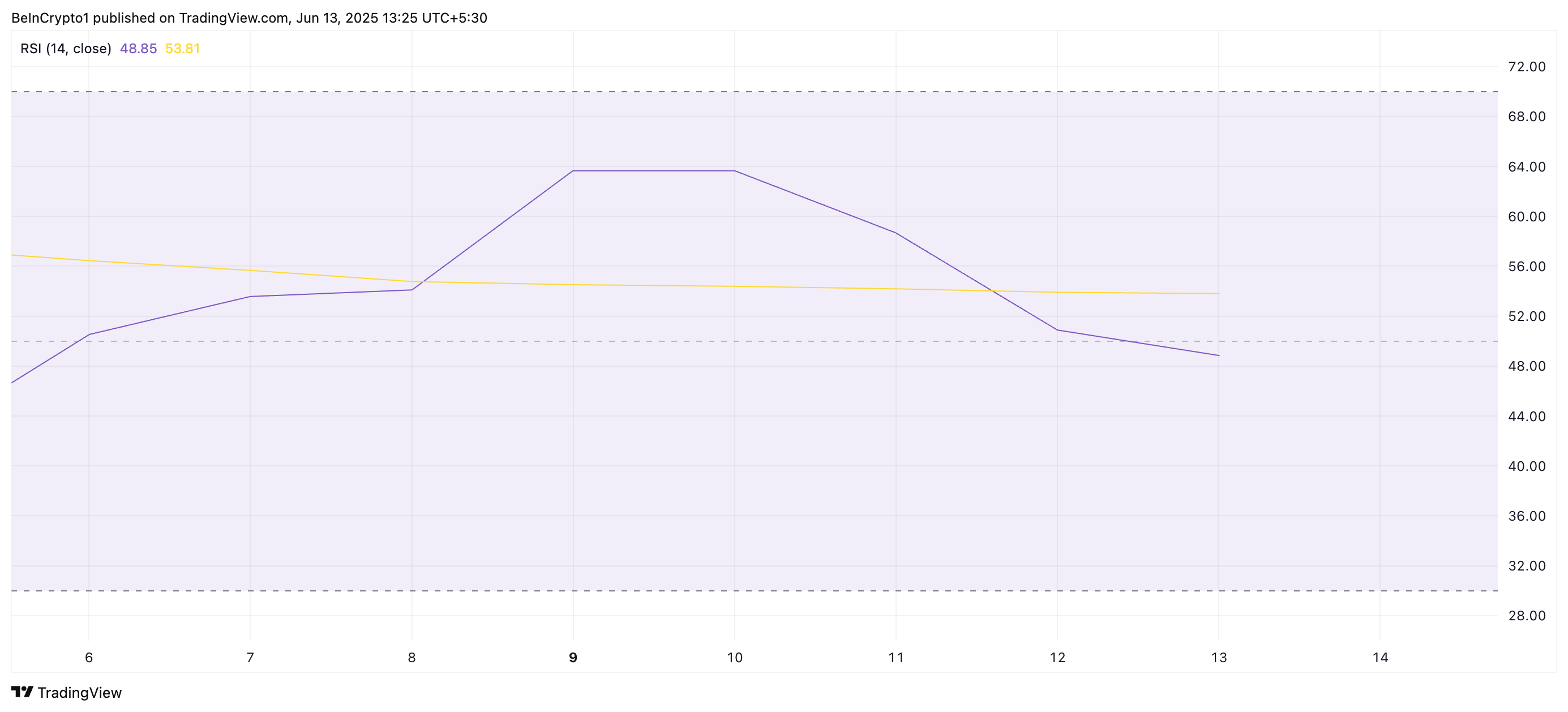

On the each day chart, BTC’s Relative Power Index (RSI) has damaged under the 50-neutral ranges, confirming the quickly declining shopping for momentum. As of this writing, this indicator is at 48.85, dealing with downward.

The RSI indicator measures an asset’s overbought and oversold market situations. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a value decline. Converesly, values beneath 30 point out that the asset is oversold and should witness a rebound.

BTC’s present RSI studying displays the weakening bullish momentum and hints on the probability of additional value dips within the close to time period.

Furthermore, the setup of the coin’s Transferring Common Convergence Divergence (MACD) helps this bearish outlook. As of this writing, BTC’s MACD line (blue) rests under its sign line (orange), a pattern that signifies the dominance of sell-side strain.

An asset’s MACD indicator identifies tendencies and momentum in its value motion. It helps merchants spot potential purchase or promote indicators via crossovers between the MACD and sign traces. When arrange this fashion, promoting exercise dominates the market, hinting at additional value drops.

BTC Bears Tighten Grip as Value Slips

BTC presently trades at $105,304, marking its third consecutive purple candle on the each day chart. With demand for the coin persevering with to wane, it dangers a drop towards the assist ground at $103,061. If the bulls fail to defend this stage, a deeper decline to $101,610 may happen.

Nonetheless, if new demand emerges, BTC could get away of its downtrend and rally towards the $106,548 resistance stage.

Disclaimer

According to the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.