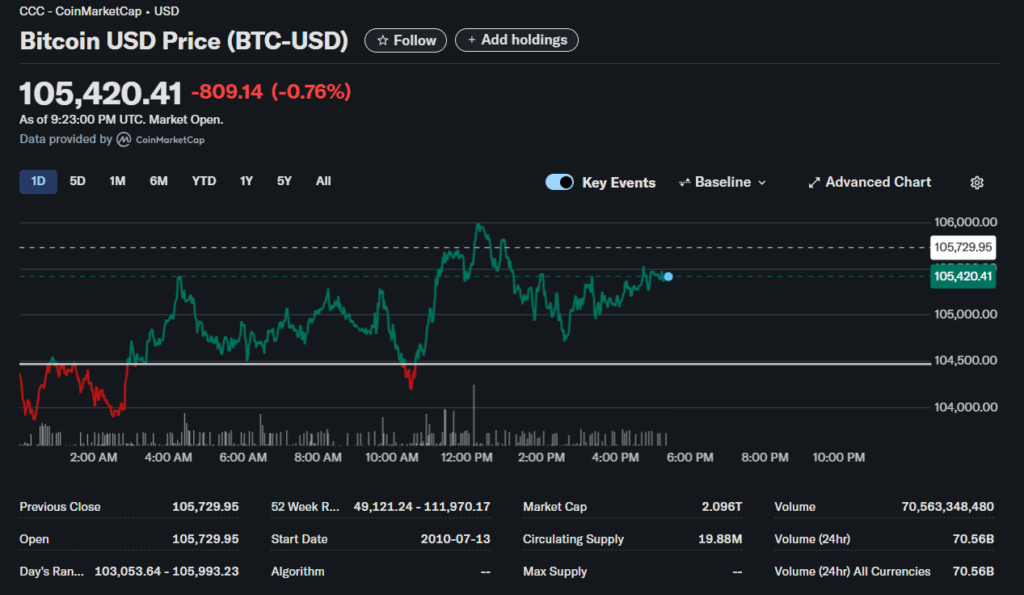

- Bitcoin rebounded from $102,600 to $106,000 earlier than settling at $105,200, amid escalating Center East tensions.

- Altcoins and crypto shares suffered heavier losses, with Circle bucking the pattern on stablecoin optimism.

- Analysts warn of a possible deeper correction to $88K–$93K earlier than Bitcoin resumes its push towards $130K.

The crypto market noticed a modest restoration after Friday’s panic-driven dip triggered by the intensifying battle between Israel and Iran. Bitcoin briefly fell to $102,600 earlier than bouncing again to round $106,000, although it later retraced barely amid studies of recent airstrikes. As of now, BTC is down 1.6% over the previous 24 hours, buying and selling at $105,200 and nonetheless inside putting distance of its all-time excessive.

Altcoins and Crypto Shares Stay Beneath Strain

Whereas Bitcoin managed a light restoration, broader market indicators stay within the pink. The CoinDesk 20 index dropped 4.4%, with altcoins like ether, avalanche, and toncoin falling between 6% and eight%. Crypto shares mirrored the weak spot, notably bitcoin miners like MARA and RIOT, which declined by 5% and 4% respectively. One vibrant spot was Circle (CIRCL), whose shares rose 13% amid pleasure over potential stablecoin adoption by Amazon and Walmart.

Conventional Markets Steady, Analysts Divided on Bitcoin’s Trajectory

Regardless of geopolitical tensions, conventional markets stayed comparatively steady. Gold rose 1.3%, reflecting safe-haven shopping for, whereas the S&P 500 and Nasdaq every slipped solely 0.4%. Analysts stay break up on Bitcoin’s near-term outlook. Skew famous the market’s resilience, whereas Markus Thielen from 10x Analysis cautioned that BTC’s drop beneath $106K represents a failed breakout. He suggested merchants to attend for higher setups, with a key assist zone between $100,000 and $101,000.

Potential for Deeper Correction Earlier than Rebound

John Glover of Ledn advised that Bitcoin could also be in a corrective part that might dip as little as $88,000–$93,000. Nevertheless, he believes this transfer would merely set the stage for a bigger rally towards $130,000. If BTC revisits the $90,000 vary, he considers it a super entry level for traders betting on a continued bull cycle.