Beijing urged to form international stablecoin guidelines amid sovereignty issues

Chinese language lecturers are warning that the expansion of stablecoins is a rising menace to China’s financial sovereignty by enshrining the worldwide dominance of the US greenback.

A commentary in China Financial Occasions argues that the rise of crypto comes with implications for sovereign credit score programs, international governance fashions and the way forward for cash.

China Financial Occasions is a every day newspaper sponsored by the Growth Analysis Heart of the State Council, one of many nation’s highest-ranking coverage analysis our bodies. Authorities officers are a part of the paper’s foremost reader base, and commentaries revealed by the paper usually goal to affect or advise on financial technique.

The authors — Deng Jun, vice dean on the College of Worldwide Enterprise and Economics, and Zhang Shuyu, affiliate professor at Beijing Expertise and Enterprise College — describe stablecoins like USDT and USDC as a digital greenback shadow system. Backed by US money or equivalents, their international growth enhances greenback liquidity and affect. They argue that if left unchecked, greenback-pegged stablecoins may erode China’s monetary autonomy and deepen worldwide reliance on the greenback.

However the authors additionally name stablecoins a double-edged sword. Within the occasion of mass redemptions, issuers may very well be pressured to liquidate massive volumes of short-term US debt. For instance, Tether — the issuer of USDT — held greater than $120 billion in US Treasury Payments on the finish of the primary quarter of 2025.

The piece provides that in nations with weak currencies and unstable alternate charges, crypto is more and more substituting for native cash. The commentary outlines a broader geopolitical technique for China that features internationalizing its personal fiat foreign money through the use of blockchain infrastructure to launch low-cost and localized digital yuan companies in growing markets.

That is at the least the second time in latest weeks {that a} main state-affiliated suppose tank in China has spotlighted crypto. In late Might, the Worldwide Financial Institute republished a report by the Bitcoin Coverage Institute that advocates for Bitcoin as a reserve asset.

Crypto scams derail Thailand’s tourism comeback

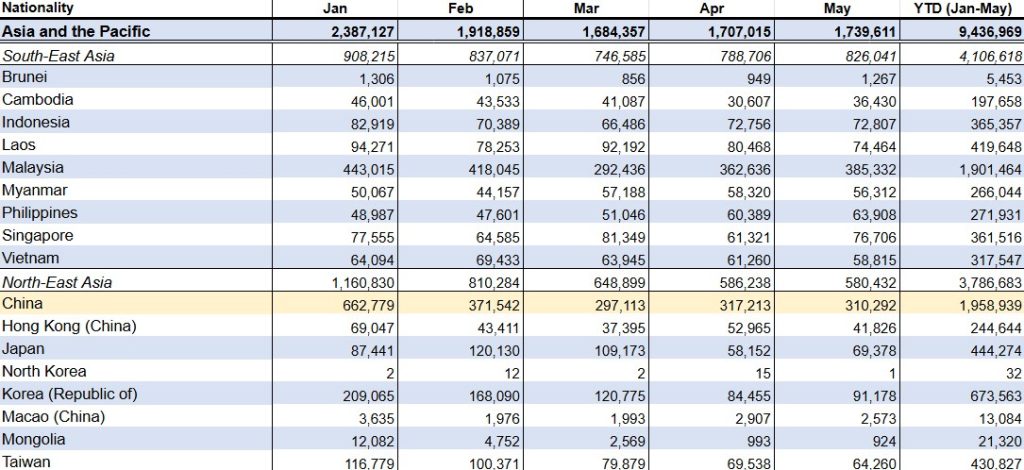

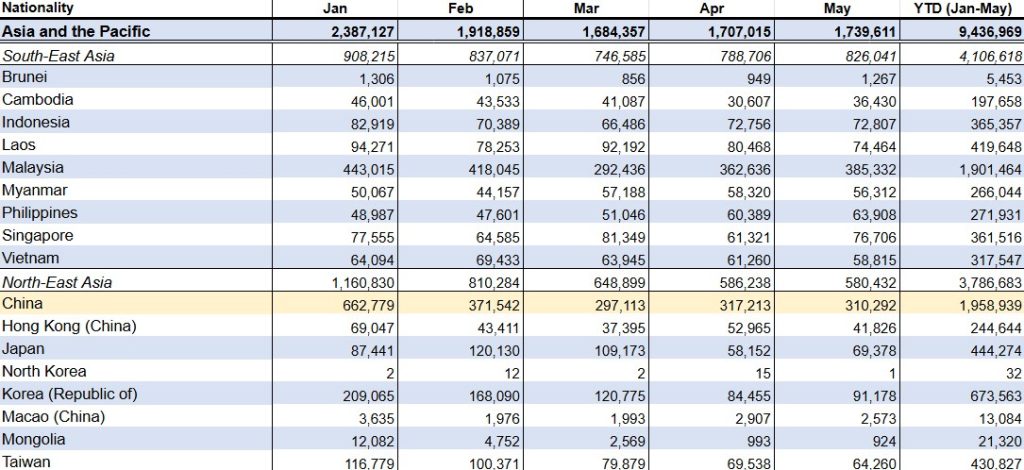

Thailand is grappling with a pointy decline in tourism, recording a 13.9% drop in whole customer arrivals in Might 2025 in comparison with the identical interval final 12 months, because the nation’s picture suffers in China from unfavorable publicity a few high-profile pig butchering scandal.

Pig butchering scams contain fraudsters constructing long-term belief with victims earlier than persuading them to spend money on pretend ventures, usually cryptocurrency schemes or suspicious blockchain transactions. These operations have been linked to rip-off compounds throughout Southeast Asia and are regularly tied to human trafficking, with victims pressured to work below coercion and menace.

The steepest fall in customer numbers has come from Chinese language vacationers, traditionally Thailand’s largest supply of arrivals, in accordance with knowledge from the Ministry of Tourism and Sports activities.

In Might, arrivals from China fell to 310,292 — a 44.5% year-on-year decline — marking the third-largest proportion drop amongst all nations. Solely North Korea and the Maldives recorded steeper declines, although each contribute negligible customer volumes, with North Korea registering nearly no arrivals.

Earlier than that, China reported a 30% year-on-year improve in January, however momentum reversed after the kidnapping of Wang Xing, a 31-year-old Chinese language actor. Thai police mentioned Wang was kidnapped throughout a go to to Thailand and trafficked throughout the border into Myanmar, the place he was held in a compound suspected of working a pig butchering rip-off.

Though Wang was finally rescued, the incident ignited widespread outrage on Chinese language social media and has forged an extended shadow over Thailand’s popularity amongst Chinese language vacationers.

Tourism stays an important a part of Thailand’s economic system, accounting for roughly 12% of gross home product and supporting as much as 20% of whole employment by direct and oblique roles.

The downturn comes regardless of efforts to revitalize the sector, together with new crypto fee trials in main vacationer areas earlier this 12 months. Thailand is reportedly exploring deeper crypto fee integrations to draw worldwide vacationers. Nonetheless, these efforts have restricted enchantment to Chinese language vacationers, on condition that crypto transactions are banned in mainland China.

Learn additionally

Options

Now you can clone NFTs as ‘Mimics’: Right here’s what meaning

Options

Bitcoin payday? Crypto to revolutionize job wages… or not

WEMIX enchantment escalates as South Korea eyes tighter token oversight

South Korean recreation developer Wemade has filed an enchantment after a Seoul courtroom rejected its first try to dam the delisting of its cryptocurrency, WEMIX, from main home exchanges.

The delisting drama comes amid rising tensions between crypto companies and regulators as South Korea prepares sweeping reforms that might centralize token itemizing authority below authorities management.

On June 11, Wemade reportedly submitted its enchantment to the Seoul Excessive Courtroom, difficult a Might 30 district courtroom ruling that dismissed its injunction towards the delisting. The injunction sought to dam the Digital Asset eXchange Alliance (DAXA) — a coalition of South Korea’s main exchanges — from continuing with its deliberate elimination of WEMIX. In consequence, the delisting of WEMIX was finalized, and buying and selling on home won-based exchanges was halted beginning June 2.

DAXA cited Wemade’s delayed disclosure of a $6.5 million pockets breach in February as the explanation for delisting.

The case unfolds as the federal government pushes the Digital Asset Primary Act, which might place token listings and delistings below the oversight of a brand new government-supervised analysis committee, in accordance with the workplace of lawmaker Min Byoung-dug, who’s main the invoice, as cited by native outlet NewsPim. Whereas exchanges would retain the flexibility to conduct inner critiques, they need to report the outcomes to the committee.

Critics say the reforms quantity to de facto state management and danger driving customers to international platforms. Lawmakers argue the measures are important for investor safety, although exchanges would nonetheless be responsible for any investor hurt from delisting selections.

Learn additionally

Options

What do crypto market makers truly do? Liquidity, or manipulation

Options

Off The Grid’s ‘largest replace but,’ Rumble Kong League evaluation: Web3 Gamer

Tokyo to highlight North Korean crypto heists at G7

Japan is reportedly making ready to lift issues at this week’s G7 summit over North Korea’s use of stolen cryptocurrency to finance weapons growth.

In line with a number of authorities sources cited by Kyodo Information, Prime Minister Shigeru Ishiba is predicted to name for coordinated worldwide countermeasures through the June 15–17 summit in Canada. If the dialogue proceeds as deliberate, it could mark the primary time North Korea’s crypto-related cyberattacks are formally addressed at a G7 leaders’ assembly. Bloomberg beforehand reported in Might that the difficulty was more likely to seem on the agenda.

Ishiba is predicted to lift the subject throughout periods centered on Indo-Pacific safety, with the objective of strengthening multilateral surveillance and chopping off illicit digital funding streams tied to the regime’s weapons applications.

Tokyo’s concern stems from rising proof that North Korea is more and more counting on cryptocurrency theft and cybercrime as sanctions reduce off extra conventional income channels. Investigations in each Japan and the USA have uncovered schemes wherein North Korean IT staff pose as distant freelancers, earn earnings in crypto, and covertly repatriate the funds.

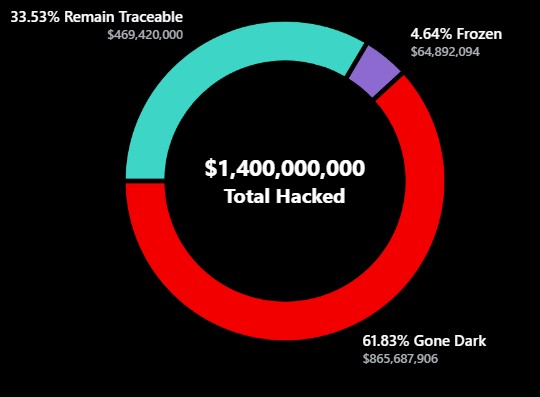

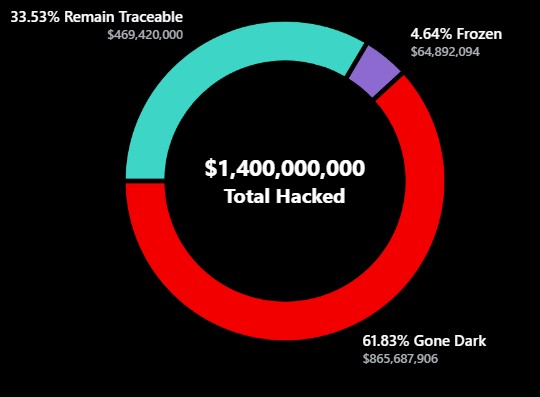

North Korea has been linked to a number of the most damaging crypto heists in historical past, together with a $1.4 billion assault on Bybit earlier this 12 months.

Subscribe

Probably the most participating reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist masking blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has lined Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.