Information reveals the Ethereum spot exchange-traded funds (ETFs) have seen weekly inflows 5 occasions the latest common, whereas Bitcoin has seen a slowdown in momentum.

Ethereum Spot ETFs Have Seen 154,000 ETH In Inflows This Week

In a brand new publish on X, the analytics agency Glassnode has talked in regards to the newest pattern within the netflow associated to the US-based Ethereum spot ETFs. The “spot ETFs” check with funding autos that enable an alternate technique of publicity to a given asset.

Which means with a spot ETF, a dealer can ‘make investments’ into an asset with out having to instantly personal it. Within the context of cryptocurrencies, that is particularly related, because the ETFs commerce on conventional platforms. Some buyers could not need to fiddle with digital asset exchanges and wallets, so the ETFs provide them a well-known path into cryptocurrencies.

The choice of the spot ETFs is a comparatively latest one within the sector, with Bitcoin’s model gaining approval from the US Securities and Trade Fee (SEC) firstly of 2024 and Ethereum’s in mid-2024.

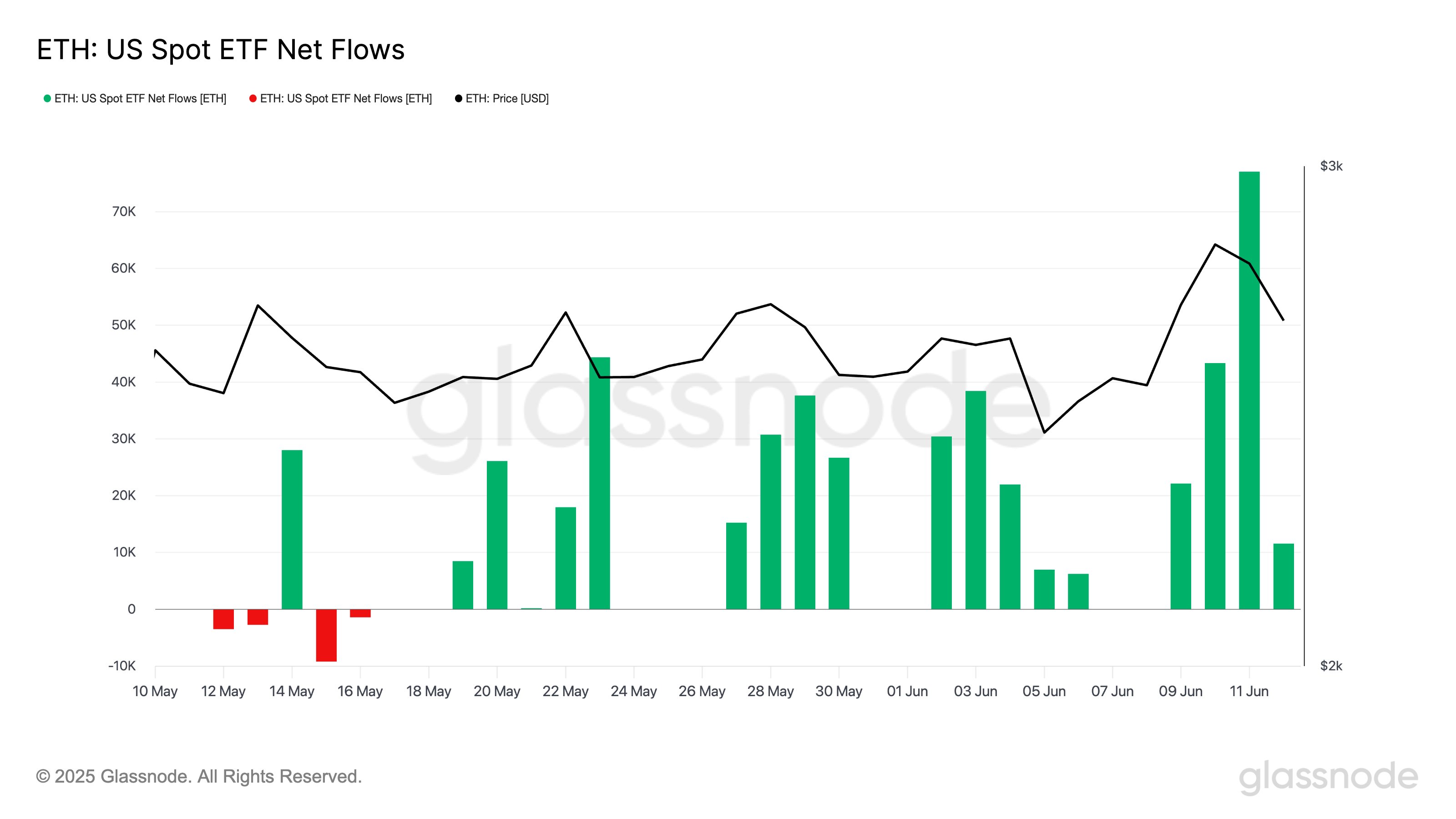

Under is a chart that reveals how the netflows associated to the latter’s spot ETFs have seemed in the course of the previous month.

From the graph, it’s seen that the Ethereum US spot ETFs have been witnessing web inflows for the previous few weeks, an indication that there was demand for the coin from the standard buyers.

“This week alone, they’ve seen 154K ETH in inflows – 5x greater than their latest weekly common,” notes Glassnode. “For context: the largest single-day ETH influx this month was 77K ETH on June eleventh.”

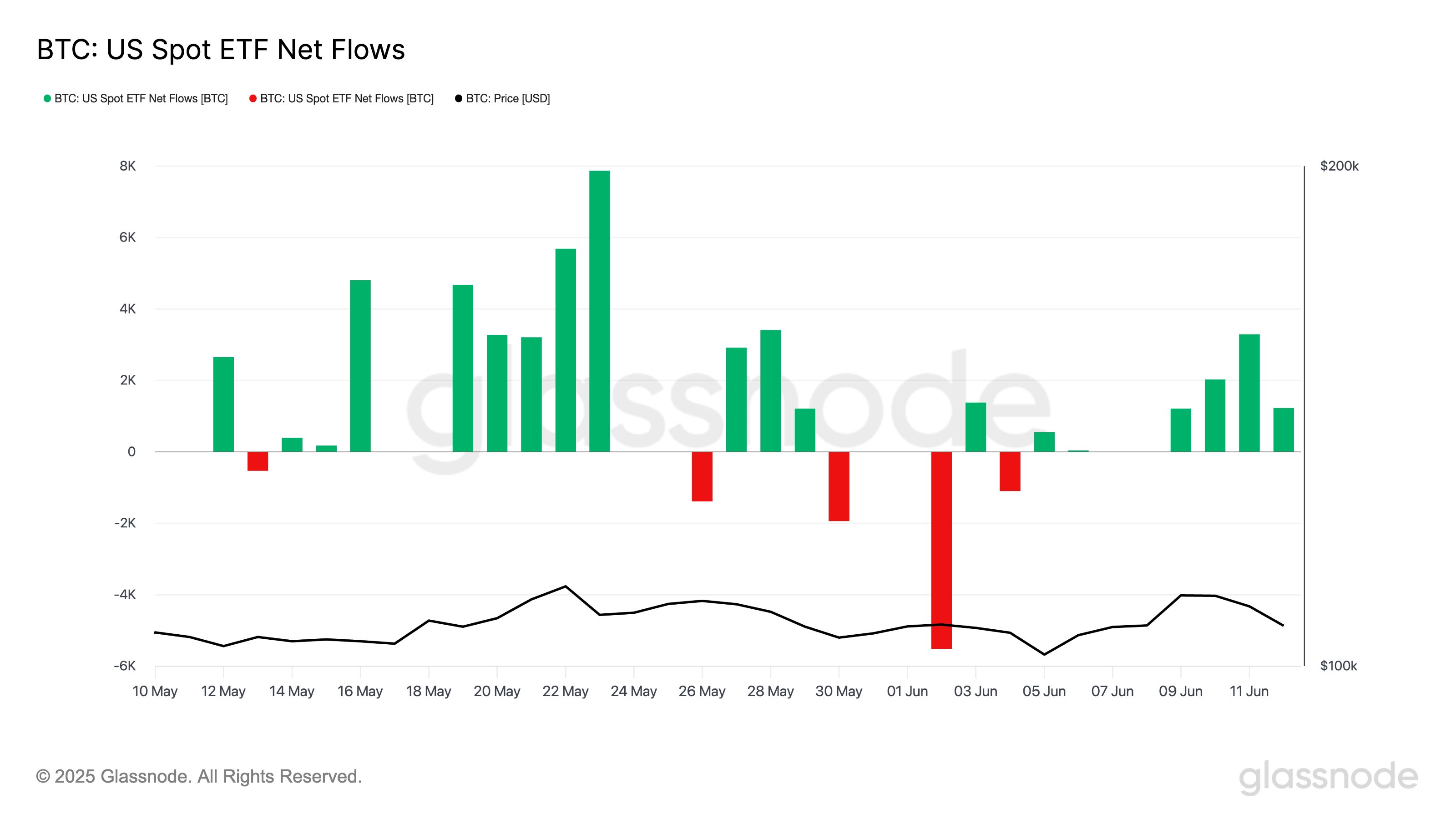

Whereas the pattern has been that of development for Ethereum, it has seemed a bit extra combined relating to the primary digital asset, Bitcoin.

As displayed within the above graph, the Bitcoin US spot ETFs have additionally seen constructive netflows this week. The size of the inflows, nevertheless, hasn’t been something spectacular, as solely round 7,800 BTC has entered into the ETFs.

That is above common, however far decrease than the highs witnessed in Could, when at one level the every day influx had reached a peak of seven,900 BTC, greater than the inflows for your entire present week.

Final week, the Bitcoin spot ETFs witnessed an outright destructive netflow, so it appears the momentum has just lately simply been slower for the asset. In distinction, issues have seemed rather more inexperienced for Ethereum certainly.

ETH Worth

Whereas Ethereum has been seeing constant ETF inflows, its value has nonetheless underperformed in opposition to Bitcoin over the previous day because it has dropped to $2,540, a decline of seven% in comparison with BTC’s 2% loss.