- Invesco filed to register a Solana ETF in Delaware, aiming to supply regulated publicity to the rising Solana ecosystem.

- The ETF may simplify entry to SOL for conventional traders, serving to bridge crypto and mainstream finance.

- Regulatory uncertainty stays a roadblock, because the SEC nonetheless hasn’t clarified the standing of altcoins like Solana.

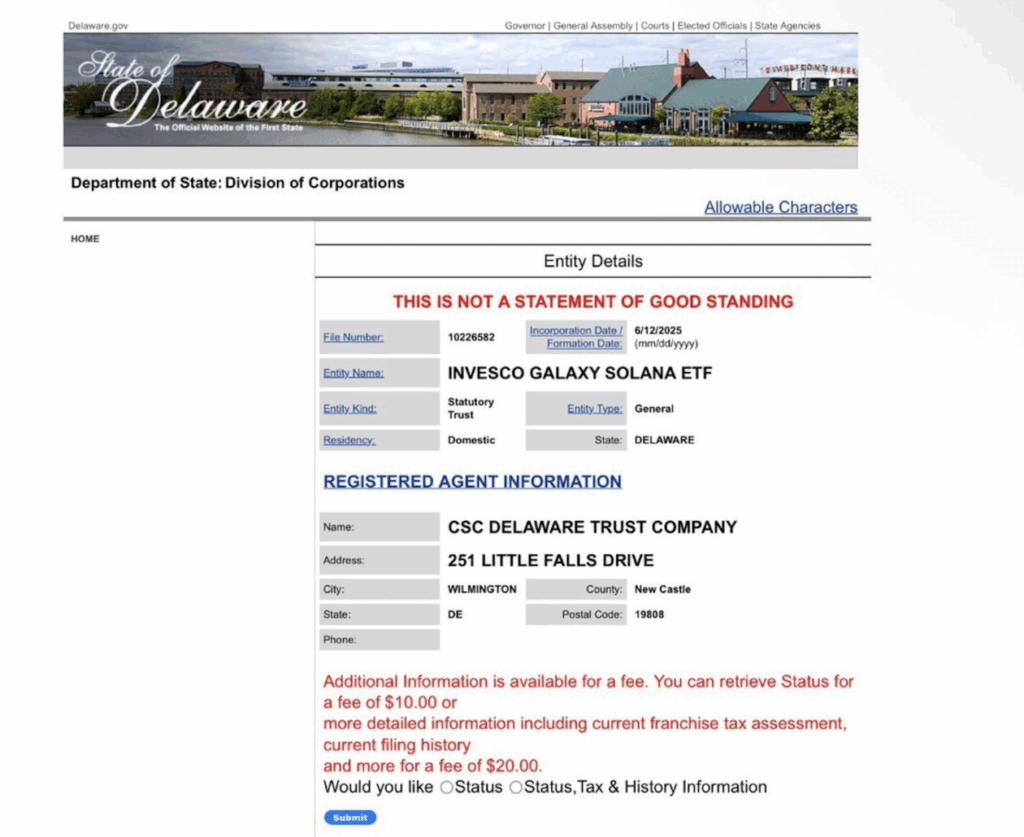

In a daring transfer that may shake issues up, Invesco simply filed to register its Galaxy Solana ETF in Delaware on June 13, 2025. That’s proper—after focusing closely on Bitcoin and Ethereum, the agency’s formally setting its sights on Solana. It’s a reasonably sturdy signal they imagine altcoins like SOL are prepared for the massive leagues.

This isn’t simply one other crypto submitting both. It displays a broader shift occurring in conventional finance. Traders are now not simply interested in Bitcoin or Ether—they’re beginning to look more durable at newer blockchains with actual utility. Solana, with its blazing-fast speeds and rising DeFi scene, is unquestionably a type of chains catching critical consideration.

Why Solana, and Why Now?

Solana’s been on a roll. Builders adore it, transactions are quick and low cost, and its ecosystem is increasing faster than most anticipated. That momentum has helped it place itself as a legit rival to Ethereum with regards to powering sensible contracts and DeFi platforms. For establishments, that makes it a reasonably engaging alternative.

This ETF, if it will get the inexperienced gentle, may open the doorways for traders who don’t wish to mess with wallets and keys. Identical to shopping for shares, they’d be capable to get publicity to SOL straight from their brokerage accounts. That type of entry could possibly be an enormous leap for Solana adoption, particularly in conventional finance circles.

Nonetheless Some Hurdles Forward

Now, let’s not get forward of ourselves. Simply because Invesco filed doesn’t imply the SEC’s going to rubber-stamp this. Regulatory uncertainty round altcoins remains to be very actual, particularly with questions on whether or not a few of them—Solana included—is likely to be labeled as securities.

The SEC’s been flooded with crypto ETF proposals these days (greater than 70, in reality), they usually’ve been slow-rolling approvals exterior of BTC and ETH. Nonetheless, the truth that huge gamers like Invesco are pushing ahead says rather a lot about how critical they assume this market’s getting.