- SUI has damaged key help at $3.11 and is buying and selling close to $2.99, with momentum closely favoring the bears.

- RSI, MACD, and Ichimoku indicators all verify bearish power, whereas $2.58 is now a important help stage.

- Except the value reclaims $3.11 quickly, additional decline towards $2.40–$2.57 seems seemingly.

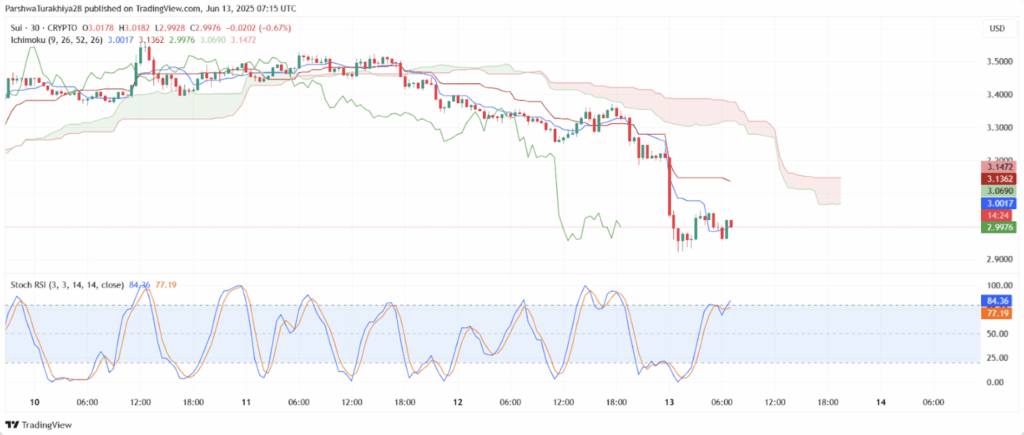

SUI’s latest worth motion has taken a flip for the more serious, and never in a small method. After making an attempt and failing to push previous the $3.35 mark, the token dropped onerous—slipping to round $2.99 on the time of writing. This newest rejection wasn’t simply any hiccup; it hit proper on the confluence of an outdated help block and a cussed descending trendline. Now, and not using a stable bounce quickly, issues may maintain trending down.

Zooming out a bit, you’ll see SUI has misplaced the 0.382 Fibonacci stage at $3.11, which had been appearing like a important pivot for weeks. Breaking beneath that’s kinda like shedding a security internet. Weekly losses are stacking up too, almost -7% in simply days. If this slide continues, it might fall all the way in which to $2.57, or worse, again towards that March help space round $1.71.

Technical Breakdown Spooks Bulls

Shorter timeframes present simply how brutal this breakdown has been. The $3.10–$3.15 vary as soon as regarded stable, held up by trendlines and a gaggle of key EMAs. That zone crumbled. Now, even a weak bounce close to $3.00–$3.02 is struggling. The value is caught beneath all main transferring averages, and the 200-EMA close to $3.39 is now a ceiling as an alternative of a flooring.

Bollinger Bands are widening quick too—traditional signal of volatility selecting up. The decrease help is shaping up close to $2.58, with a little bit of psychological backup at $2.40. If consumers can’t defend that area, SUI might spiral even decrease.

Momentum Indicators Sign Weak spot

Each momentum gauge is flashing purple proper now. The RSI dropped to 29.5, barely recovering from oversold territory. MACD? Nonetheless bearish throughout the board. Sign traces are buried, histogram’s caught within the purple.

The Ichimoku Cloud isn’t portray a reasonably image both. Worth is hanging beneath the cloud, and each the Tenkan-Sen and Kijun-Sen traces are aligned downward. Even the Stochastic RSI, whereas curling up a bit, doesn’t look assured—this might be a dead-cat bounce or only a pause earlier than extra purple candles.

Why SUI’s Getting Hammered

On the core of this downturn is the shortcoming to flip $3.30 into help. That key resistance, paired with the 50-day EMA, held agency and sparked a cascade of promote orders. As soon as stops beneath $3.10 had been hit, the slide gained steam. Broader market jitters and risk-off sentiment in altcoins haven’t helped both.

With that sort of strain, it’s no surprise SUI’s heading south. Merchants now have their eyes glued to the $2.58 zone, hoping it holds.

What’s Subsequent? The Clock’s Ticking

If SUI doesn’t reclaim $3.11 quickly, count on extra draw back—seemingly towards $2.58 and even $2.40. But when bulls can one way or the other regain management, the value might want to battle via a wall of resistance at $3.30, $3.55, and $3.92. It’s gonna be an uphill climb both method. For now, the pattern’s nonetheless down, and the burden’s on the bulls to flip the script.