- Bitcoin ETFs noticed over $1.3B in inflows regardless of Center East tensions, displaying robust investor urge for food.

- BTC rapidly recovered from a short dip and now trades close to $105K, simply 6% off its all-time excessive.

- Ongoing world instability and a weakening U.S. greenback are boosting Bitcoin’s enchantment as a hedge asset.

Bitcoin’s been holding its floor close to $105K recently—even with all of the chaos taking place on the earth proper now. That alone is fairly telling. Buyers don’t appear too spooked, which could be a sign of rising confidence in BTC as a hedge or possibly simply… resilience.

ETF Inflows Preserve Rolling In

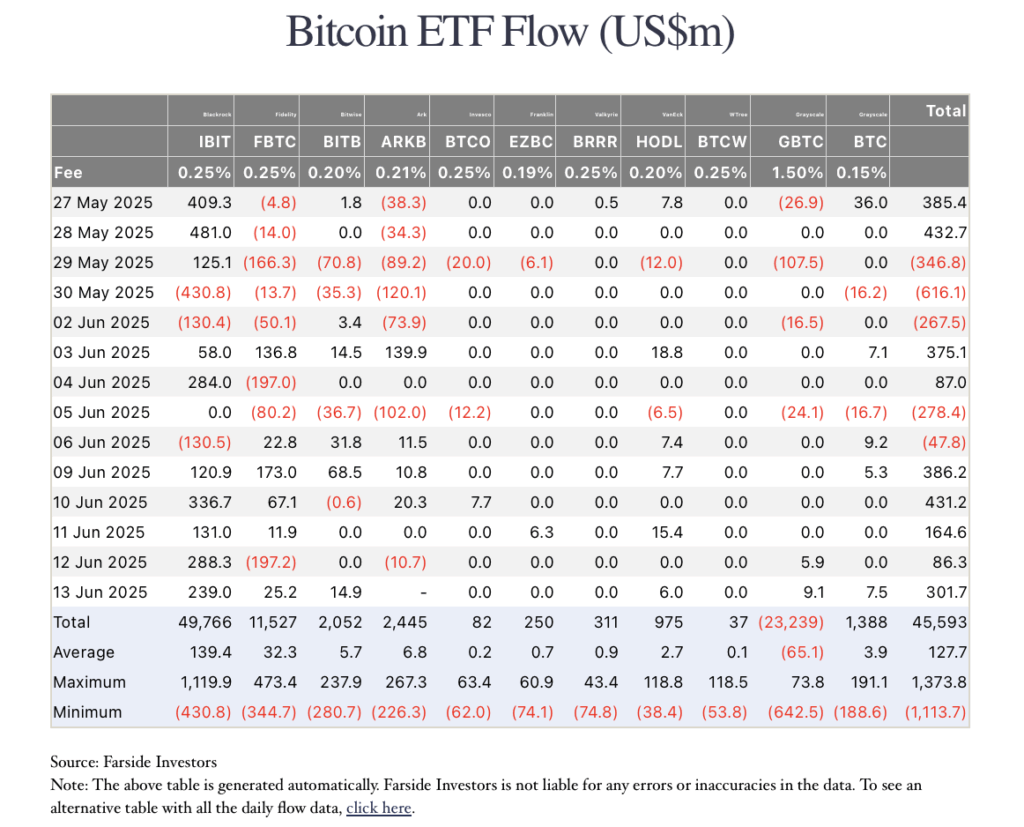

Regardless of tensions flaring between Israel and Iran, Bitcoin exchange-traded funds (ETFs) have seen 5 straight days of inflows. In line with information from Farside Buyers, issues kicked off Monday, June 9, with $386 million pouring in. And by Friday, one other $301 million had joined the combo—totaling over $1.3 billion in simply 5 days. That’s lots of money flowing in, particularly in a shaky macro surroundings.

Curiously, the Bitcoin worth barely flinched when information of the airstrikes hit. It dropped round 3% at first, however rapidly bounced again. Nic Puckrin from Coin Bureau identified that the U.S. greenback index (DXY) falling under 100 for the primary time in three years is a a lot greater deal long-term. BTC tends to maneuver in the other way of the greenback—and the greenback appears prefer it’s heading south.

Strait of Hormuz: A Actual Threat Issue?

Whereas Bitcoin’s been fairly steady, there’s nonetheless threat hanging within the air. Analysts are watching the Strait of Hormuz, which sees about 20% of the world’s oil stream by it. If Iran decides to close that down, power costs may explode, and which may ripple throughout each market—together with crypto. A full-blown regional conflict is one other wildcard nobody needs to see unfold.

Bitcoin’s Resilience Has Analysts Buzzing

Even after dipping to round $103K—triggering $422 million in lengthy liquidations—BTC snapped proper again to commerce above $105K. That’s lower than 6% off its all-time excessive of $112K from Might 22. This form of worth stability underneath stress has analysts considering we could be trying in the beginning of one other massive leg up.

With inflation nonetheless a fear, belief in conventional programs cracking, and debt ranges sky-high, Bitcoin is beginning to really feel like greater than only a speculative play. Its mounted provide and rising mainstream entry by ETFs are serving to it carve out a extra severe function in portfolios.