Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is buying and selling simply above the vital $104K stage after enduring a number of days of promoting stress triggered by escalating tensions within the Center East. The current assaults between Israel and Iran have injected recent volatility throughout monetary markets, however BTC has proven notable resilience. Presently down about 5% from its all-time excessive of $112K, Bitcoin continues to commerce inside a broader consolidation vary as macroeconomic uncertainty persists.

Associated Studying

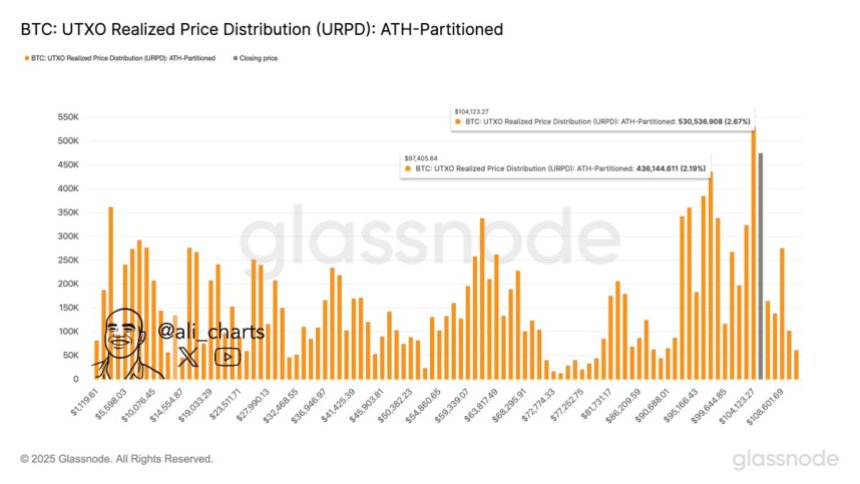

Regardless of the geopolitical instability and rising bond yields, Bitcoin’s construction stays bullish, with bulls defending key assist zones. In accordance with prime analyst Ali Martinez, the $104,124 stage is a vital threshold to observe. He highlights that this stage aligns with a powerful cluster of Unspent Transaction Outputs (UTXOs) primarily based on the Realized Worth Distribution metric. This implies a heavy focus of patrons who acquired BTC at or close to this vary, probably reinforcing it as a stable assist base.

Holding above this stage might mark a turning level, paving the best way for an additional push towards value discovery. Nonetheless, a breakdown under this zone might set off a deeper correction towards decrease demand ranges. For now, all eyes stay on Bitcoin’s response to this key stage as international dangers proceed to evolve.

Bitcoin Holds The Line Above $100K Amid Geopolitical Dangers

Bitcoin is displaying notable resilience amid international turmoil, holding above the $100K mark regardless of rising uncertainty linked to escalating Center East tensions. Because the market heads into Monday, buyers are bracing for probably unstable classes, relying on additional developments between Israel and Iran. A pointy rise in oil costs might add extra macro stress, making the beginning of the week a decisive second for danger property.

BTC continues to commerce inside a consolidation vary after falling 5% from its all-time excessive of $112K. Analysts extensively agree that Bitcoin is in a transitional part—both making ready for an explosive breakout into value discovery or setting the stage for a deeper retracement. Many imagine {that a} confirmed breakout above $112K might set off the following main leg greater, marking the start of a brand new growth cycle for your complete crypto market.

Nonetheless, warning stays vital at present ranges. Martinez pointed to key on-chain information from the UTXO Realized Worth Distribution, figuring out $104,124 as a pivotal assist zone. This value stage is the place a big quantity of BTC final moved, suggesting robust purchaser curiosity. If BTC holds this stage, it might type a stable base for continuation. But when it breaks down, the following space of curiosity lies round $97,405—probably sparking broader worry throughout the market.

Within the coming days, Bitcoin’s response to geopolitical information and macroeconomic indicators, significantly oil value actions and bond yield reactions, might be essential. For now, the bulls stay in management, however the path ahead calls for shut consideration and calculated positioning.

Associated Studying

BTC Worth Evaluation: Bulls Defend Key Help

Bitcoin is at the moment buying and selling at $105,502, displaying indicators of energy after defending the essential $103,600 assist stage. This value zone has acted as a constant flooring over the previous week and continues to be a key pivot for short-term market construction. After a steep drop from the $112K excessive, BTC bounced off this assist with a powerful wick on excessive quantity, signaling purchaser curiosity and a possible short-term backside.

The chart exhibits that Bitcoin is consolidating between $103,600 and $109,300, with the 50, 100, and 200-period SMAs converging simply above the present value, indicating a choice level is close to. A transparent break above $106,800 might set off momentum to check $109,300 once more, whereas a failure to carry above $104,500 would expose BTC to draw back danger.

Associated Studying

Quantity stays comparatively muted in comparison with the spike through the June 13 drop, suggesting that many of the panic promoting has cooled for now. Nonetheless, value stays under the 200 SMA, reinforcing that bulls should reclaim this zone to substantiate continuation.

Featured picture from Dall-E, chart from TradingView