Solana (SOL) is down almost 13% during the last 4 days, reflecting a pointy lack of momentum throughout key technical indicators. The Ichimoku Cloud stays bearish, with value motion caught under a thick resistance zone and short-term traces reinforcing downward strain.

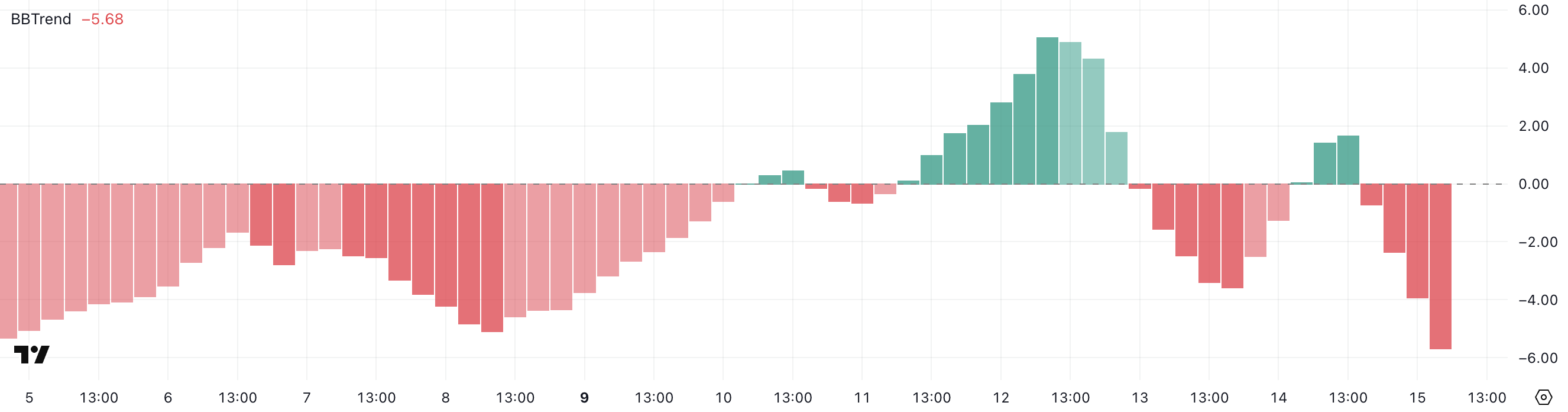

In the meantime, SOL’s BBTrend has plunged to -5.68, its lowest degree in 11 days, signaling intensified promoting exercise. With EMA traces nonetheless in bearish formation and value struggling to reclaim $150, Solana continues to face robust resistance and unsure short-term route.

Bearish Ichimoku Setup Weighs on Solana Value

Solana’s Ichimoku Cloud chart exhibits a persistently bearish setup. The value motion stays under the Kumo (cloud), which has transitioned from pink to inexperienced within the close to future however nonetheless signifies overhead resistance.

The blue Tenkan-sen (conversion line) is under the pink Kijun-sen (final analysis), reflecting continued short-term bearish momentum.

Candlesticks are struggling to achieve traction above the Tenkan-sen, signaling weak purchaser energy and restricted upward strain.

Trying forward, the cloud itself thickens and flattens, suggesting that even when value makes an attempt a restoration, it can face robust resistance when it approaches the cloud zone.

The main span traces—Senkou Span A (inexperienced) and Senkou Span B (pink)—are comparatively large aside, reinforcing uncertainty and low bullish conviction.

The general development stays tilted to the draw back till value decisively breaks into or above the cloud.

Solana BBTrend Dives Into Bearish Territory

Solana’s BBTrend has sharply dropped to -5.68, marking its lowest studying up to now 11 days.

This decline comes after a quick surge yesterday when the indicator approached the 1.5 zone, hinting at momentary bullish momentum that has since reversed.

The sharp swing into destructive territory indicators rising weak point and fading shopping for strain within the quick time period.

The BBTrend (Bollinger Band Pattern) measures the energy and route of value actions relative to the Bollinger Bands.

Values above 1 counsel a robust uptrend, whereas readings under -1 point out a robust downtrend.

A BBTrend of -5.68 locations Solana deep in bearish territory, signaling an aggressive downward transfer and suggesting that volatility is increasing in favor of sellers. If this persists, it may enhance the chance of additional draw back strain within the close to time period.

SOL Struggles at $150 Resistance After Sharp Drop

Solana’s EMA traces stay in a bearish alignment, with short-term averages nonetheless positioned under the long-term ones—confirming a downtrend construction.

Value motion has struggled to reclaim the $150 degree over the previous few days, following a pointy drop of greater than 10% triggered by the latest escalation within the Israel-Iran battle.

This failure to regain momentum reinforces the present weak point in shopping for strain.

If Solana manages to interrupt by the $150 resistance, it may set off a restoration towards the $163 and $168 ranges, with additional upside potential if bullish momentum builds.

Nevertheless, if the correction resumes, draw back strain could push the value again towards the $141 help zone.

The EMA setup means that any rally makes an attempt could face robust resistance till short-term averages begin curving upward and crossing over long-term ones.

Disclaimer

According to the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.