- Establishments and whales are closely accumulating HYPE, with one pockets shopping for $29M price of tokens.

- Retail merchants are cautious on spot however very lively within the futures market, anticipating additional upside.

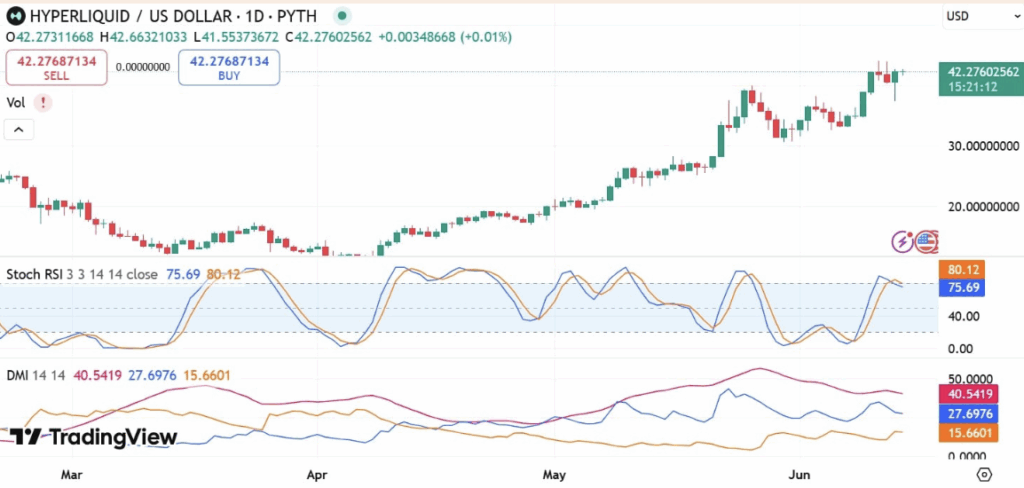

- Indicators like Stoch RSI and DMI recommend short-term momentum is likely to be weakening, with a doable pullback to $38.50.

Hyperliquid (HYPE) has had a strong run these days. After holding the road at $33, it popped to a brand new all-time excessive of $43.90 simply three days in the past. This newest soar provides to a rising two-month uptrend that’s been grabbing the eye of huge gamers throughout the board—from whales to establishments. Now, it’s wanting an increasing number of like HYPE is being seen as a critical altcoin contender.

Main Buys Sign Institutional Confidence

The current wave of accumulation is tough to overlook. First off, Tony G Co-Funding Holdings Ltd, a Canadian funding agency, scooped up over 10,000 HYPE tokens—price simply shy of $440K—at round $42.24 every. That’s not pocket change. This was a part of their longer-term DeFi recreation plan, which exhibits they’re not on this for a fast flip.

However that wasn’t the one whale sighting. Onchain Lens noticed a large purchase from one other massive pockets—this one picked up greater than 715,000 tokens, totaling almost $30 million. The value? Roughly $41.16 per token. Strikes like these usually get the remainder of the market buzzing, particularly retailers who see these buys as vote-of-confidence alerts from the “good cash” crowd.

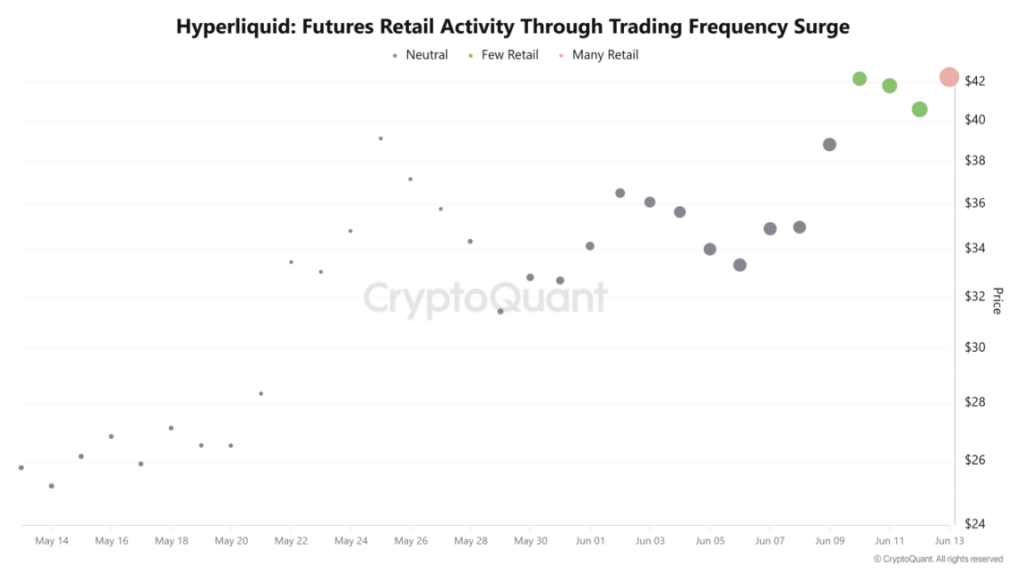

Retail Merchants Lean Into Futures, Not Spot

Apparently, retail merchants aren’t diving in the identical manner—not less than not on the spot market. Spot buying and selling exercise has truly been on the decline for just a few days now. It’s not whole disinterest, simply… neutrality. The info exhibits retail is watching however not speeding.

Futures, although? That’s the place issues get scorching. Retail merchants appear far more lively there, taking lengthy positions and mainly betting on HYPE’s subsequent breakout. It’s a combined message: cautious on one entrance, aggressive on the opposite.

Is a Pullback Brewing, or Only a Pause?

For the time being, HYPE is buying and selling round $42.32, up about 6% up to now 24 hours. Zooming out, that’s a 70% achieve in a month and 25% in simply the previous week. Momentum’s been sturdy—nevertheless it is likely to be beginning to wobble a bit. The Stoch RSI flashed a bearish crossover within the overbought zone, which normally hints at short-term promoting stress.

DMI ranges inform the same story. The +DI dropped under the -DI, signaling that draw back momentum is quietly constructing. If issues maintain tilting this fashion, a pullback to round $38.50 may very well be subsequent. But when whales and establishments maintain stacking, HYPE would possibly simply maintain sturdy and make one other run at $44 and even larger.