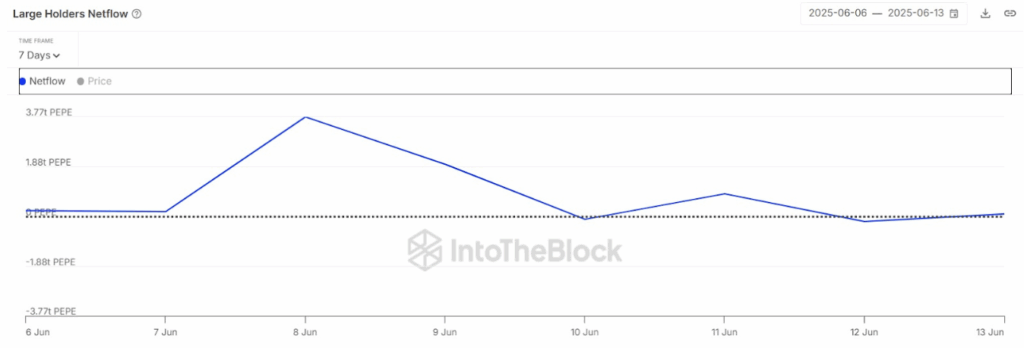

- Whale netflows for PEPE dropped 97% in a single week, signaling heavy distribution and lack of accumulation.

- A descending triangle and weak RSI/MACD trace at a bearish setup until $0.00000115 is reclaimed with quantity.

- Regardless of some bullish bets, the market is indecisive, with drying quantity and rising open curiosity suggesting merchants are ready for a transparent transfer.

Pepe Coin (PEPE) appears to be like prefer it’s slipping into shaky floor. A bunch of pink flags are popping up—whale wallets are scaling down, bearish patterns are forming on the charts, and the hype? Yeah, it’s cooling off quick. The market’s getting twitchy, particularly as PEPE hovers round its assist stage. With whale netflows plunging 97% in just some days, discuss of a 30% correction is not far-fetched—it’s knocking on the door.

Whale Conduct Alerts Weak Arms

In line with IntoTheBlock, whale netflows have nosedived from 3.77 trillion to simply 95 billion PEPE in a single week. That’s not only a dip—it’s an enormous unloading, and it smells like distribution. When the massive wallets bail like this, retail normally finally ends up holding the bag. Whereas PEPE’s up 6% within the final 24 hours and trades round $0.0000117, this mini rally could possibly be a trapdoor. If this dump sample retains going, we’d see a drop under $0.0000106 and perhaps even a fall towards $0.00000750 if the descending triangle breaks down.

Merchants Break up Whereas Quantity Dries Up

Even with warning indicators throughout, not everybody’s bearish. The worldwide lengthy/brief ratio is hanging round 1.0052—not precisely screaming panic, however not bullish both. Binance appears to be like impartial, however OKX customers are oddly bullish with a 2.34 lengthy/brief ratio. That mentioned, open curiosity is up 5.77% to $518M, however quantity’s down 33%. That’s normally an indication merchants are caught in limbo, ready for a transparent route. Liquidation stats present shorts getting squeezed a bit greater than longs, however nothing decisive—but.

Charts Level to Bearish Bias, However It’s Not Recreation Over

The technical facet? It’s wobbly. PEPE’s buying and selling simply above the $0.00000107 assist, which held earlier than however won’t this time. The candles are tiny, displaying no actual conviction. A descending triangle is forming too, not nice information. The MACD remains to be adverse however slowly inching towards a bullish crossover. RSI sits at 39, up from oversold, however it hasn’t cracked 50—so momentum is weak. If PEPE can maintain $0.00000107 and flip $0.00000115 with some first rate quantity, a restoration is likely to be within the playing cards. However for now, the pattern’s nonetheless leaning down.