Pi Community (PI) is down almost 6% over the previous seven days, displaying blended indicators throughout key technical indicators. Whereas the DMI suggests fading bearish momentum and a doable shift in development, the CMF signifies gentle however nonetheless optimistic shopping for stress.

On the similar time, EMA strains level to consolidation, with PI buying and selling simply above a crucial help degree at $0.601. Whether or not the worth breaks down or rebounds from right here will probably rely upon whether or not it may well maintain key help or push previous close by resistance ranges.

Pi Community DMI Alerts Fading Bearish Momentum

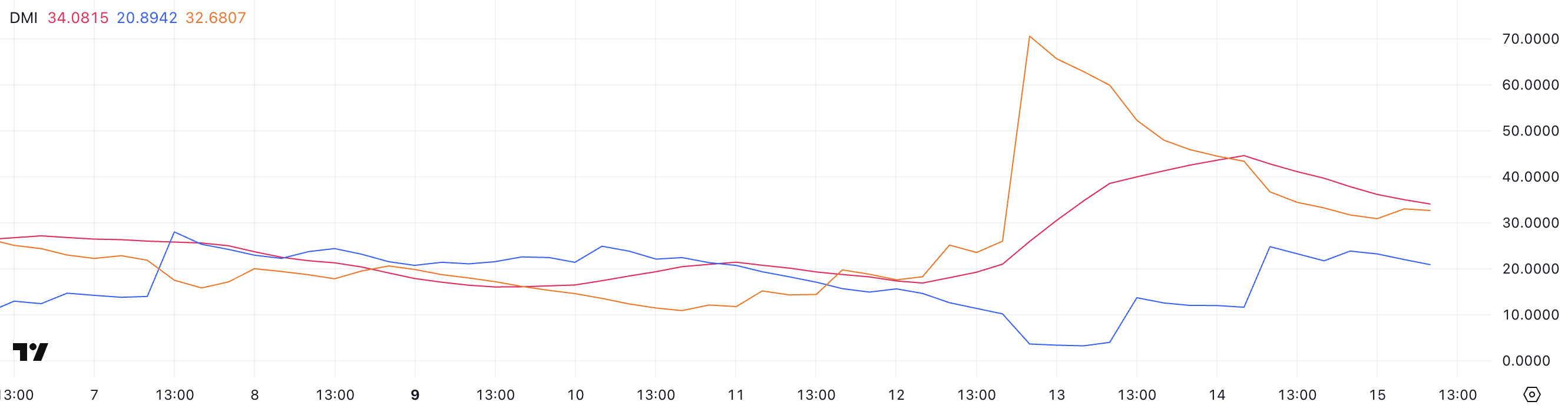

Pi Community’s Directional Motion Index (DMI) exhibits that its Common Directional Index (ADX) has dropped to 34, down from 44.59 only a day in the past.

This decline follows a pointy rise from 16.89 three days in the past, suggesting a latest however now weakening development. The ADX measures the energy of a development, no matter route.

Readings under 20 point out a weak or no development, whereas values above 25 sign a robust development. With the ADX nonetheless above 30, Pi is probably going in a trending section, however the momentum seems to be cooling off.

Wanting on the directional indicators, +DI has climbed to twenty.89 from simply 4 two days in the past, signaling rising bullish stress.

In the meantime, -DI has dropped considerably to 32.68 after peaking at 70.57 three days in the past, displaying that bearish momentum is fading.

This crossover in directional energy may trace at a possible shift in sentiment. If +DI continues to rise whereas -DI declines, Pi’s worth could begin recovering or enter a extra impartial section after a interval of intense promoting.

PI CMF Exhibits Mild Shopping for Stress After Current Spike

Pi Community’s Chaikin Cash Move (CMF) is at present at 0.07, down from 0.19 two days in the past however nonetheless increased than -0.05 three days in the past.

The CMF indicator measures the circulation of cash into or out of an asset over time, utilizing worth and quantity information. Values above 0 counsel shopping for stress, whereas values under 0 point out promoting stress.

Readings above 0.10 or under -0.10 are usually seen as stronger indicators of accumulation or distribution.

PI’s present CMF degree at 0.07 suggests delicate however optimistic shopping for stress.

Whereas not robust sufficient to verify aggressive accumulation, it exhibits that capital remains to be flowing into the asset, although much less intensely than two days in the past.

If CMF continues to carry above zero, it may help a stabilization or gradual restoration in worth. Nonetheless, if it dips again under zero, it could sign weakening demand and potential draw back threat.

Breakout or Breakdown? PI Trades Close to Essential Ranges

Pi Community’s EMA strains at present counsel a interval of consolidation, following a restoration from the sharp drop triggered by the Israel-Iran battle escalation.

Worth motion is hovering simply above a key help at $0.601. If this degree is damaged, PI worth may drop to $0.542, and if bearish momentum builds, it’d fall additional towards $0.40.

This construction displays uncertainty, with no clear bullish or bearish management in the intervening time.

On the upside, if PI manages to interrupt by the resistance ranges at $0.647 and $0.658, it may set off a brand new uptrend.

A profitable breakout above these zones may open the door for a transfer towards $0.796.

The EMA setup helps a impartial stance for now, awaiting a decisive transfer in both route.

Disclaimer

Consistent with the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.