The latest flash crash of ZKJ and KOGE tokens has shocked the crypto group, particularly since each are tied to Binance’s Alpha Factors program.

The most recent information suggests the ZKJ and KOGE incidents function a lesson on liquidity focus dangers and the function of “whales” out there.

What Sparked the Sudden Meltdown in ZKJ and KOGE Tokens?

Polyhedra confirmed that the flash crash‘s origin and development stemmed from irregular on-chain transactions. Polyhedra is carefully monitoring the ZKJ/KOGE buying and selling pair, which has skilled uncommon on-chain actions rapidly.

The contract linkage with ZKJ could have induced KOGE to be the primary token affected. This triggered a domino impact as heavy liquidity withdrawals occurred. On-chain information from Lookonchain signifies that enormous wallets withdrew liquidity from each swimming pools.

One pockets withdrew 61,130 KOGE, value $3.76 million, and 273,017 ZKJ, value round $532,000, earlier than the market plummeted. This transfer pushed KOGE’s value from $62 to $24 and ZKJ’s from practically $2 to $0.30, a decline of 61% and 85%, respectively.

Primarily based on these actions, on-chain analyst Ai Yi suggests this flash crash could possibly be a pre-planned “harvesting operation.”

“Three main addresses focused the massive buying and selling quantity and liquidity of the 2 tokens within the context of Binance Alpha. Tonight, the twin stress of ‘giant withdrawal of liquidity + steady promoting’ induced ZKJ and KOGE to break down one after one other, and nobody was spared,” Ai Yi commented.

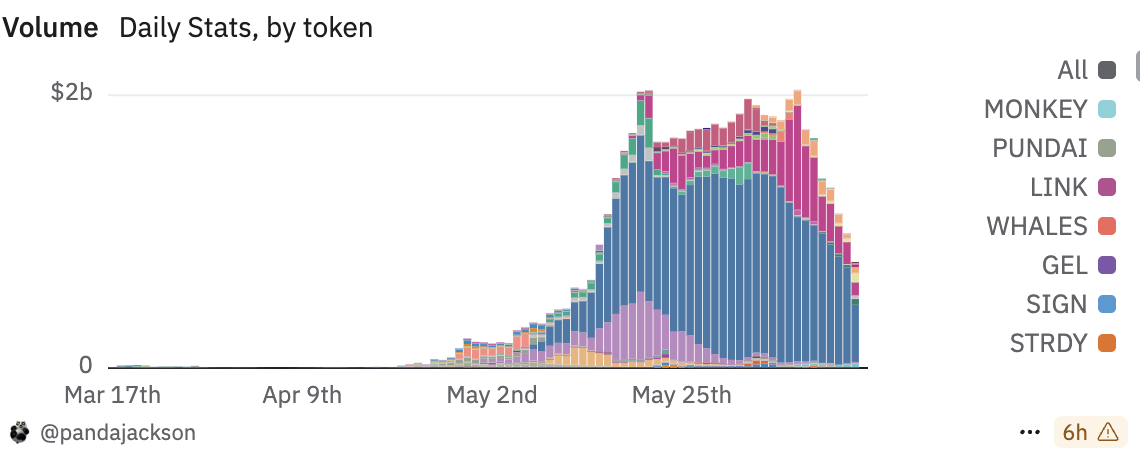

Ai Yi additionally believes the timing of this flash crash could also be linked to a consecutive decline in Binance Alpha buying and selling quantity over a number of days. Information from Dune additionally exhibits a downward pattern since early June. Notably, after the flash crash, buying and selling quantity on Binance Alpha dropped to roughly $770 million. It’s considerably decrease than the height of about $2 billion on June 8.

Worth Manipulation Allegations

Instantly after the sharp decline in ZKJ and KOGE costs, the group raised suspicions about 48Club, the issuer of KOGE, partaking in value manipulation. Nonetheless, 48Club rapidly denied the allegations. He additionally introduced a brand new buying and selling reward plan to revive confidence.

Binance adjusted the Alpha Factors calculation guidelines and shall be efficient from 00:00 UTC on June 17, 2025. In accordance with Binance, the change attributed the value volatility to giant holders withdrawing liquidity and a liquidation cascade impact.

The choice to exclude buying and selling quantity between Alpha tokens (resembling ZKJ and KOGE) from level calculations goals to cut back focus dangers and preserve market equity.

This incident raises questions concerning the sustainability of buying and selling incentive packages like Alpha Factors. Though Polyhedra asserts that the undertaking’s fundamentals stay strong and is reviewing the incident, buyers ought to carefully monitor updates from related events.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.