- Bitcoin dipped to $103,300 forward of the Fed’s rate of interest determination and amid geopolitical unease.

- Lengthy-term holders are nonetheless HODLing, however mid-term merchants locked in almost $1B in income this week.

- $102K–$104K could possibly be the bounce zone, however a break beneath $98K may set off a sharper drop.

Bitcoin’s having a little bit of a wobble. After holding regular for some time, the worth dropped to round $103,300, down from the $104K+ vary. This little slide comes proper earlier than the upcoming FOMC assembly, the place everybody’s anticipating to listen to whether or not the Fed will tweak rates of interest once more. Toss within the rising tensions between Israel and Iran, and also you’ve bought a cocktail of warning brewing throughout each crypto and conventional markets.

But it surely’s not simply macro stuff weighing on Bitcoin. In accordance with Bitcoin Vector—a Swissblock-backed market tracker—there’s seasonal weak spot setting in, and on-chain development’s been sort of… meh. Demand from spot patrons has cooled off a bit too. Over $434 million in leveraged BTC futures bought liquidated in simply 24 hours, which suggests merchants aren’t within the temper to gamble massive proper now.

U.S. Demand Regular, However Not Sufficient

One shiny spot? U.S. buyers are nonetheless exhibiting up. The Coinbase Premium Index, which compares BTC costs on Coinbase versus Binance, has stayed constructive for many of June. That’s normally an indication that American patrons are stepping in. However even with that regular demand, value motion’s been underwhelming. The general temper feels hesitant.

After which there’s profit-taking. Glassnode says of us who’ve been holding BTC for six–12 months cashed out a hefty $904 million in income on Monday alone. That’s 83% of all realized positive factors for the day. It’s a shift—longer-term holders had been main that cost, however now it’s mid-term of us locking in wins. That doesn’t scream panic, nevertheless it does present a rotation in who’s shifting the market.

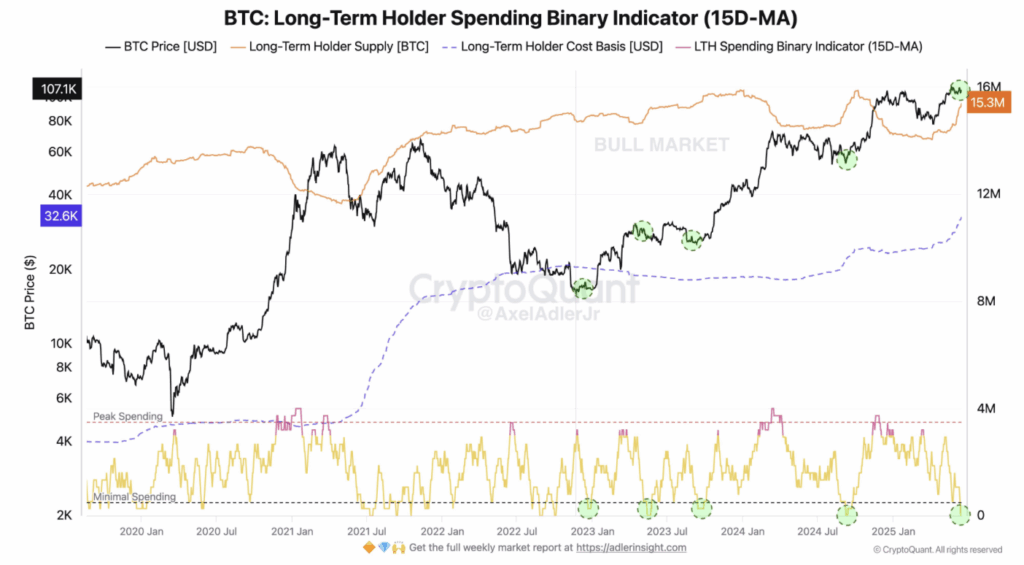

Nonetheless, long-term holders aren’t promoting. Axel Adler Jr. identified that LTHs are simply sitting tight, which—if historical past’s any information—is an efficient signal. Their habits normally units the tone for the larger image, and proper now, they’re not flinching.

A Bounce at $102K? May Be

From a technical view, there’s a stable likelihood Bitcoin’s heading right into a short-term bounce zone. The $102K to $104K vary is dense with liquidity and aligns with a key historic order block. The Bollinger Bands are getting tight too—normally a setup for a volatility spike. The center band, sitting round $106K, has acted like dynamic resistance earlier than, particularly throughout that chop zone in early June.

If BTC can reclaim $106,748 and shut above it, that might kick off a transfer again to $112K. But when it fails and falls below $100K, we may be watching a drop towards $98K.

In accordance with information from Alphractal, the $98,300 zone is the magic quantity. That’s the place short-term holders nonetheless maintain income. If Bitcoin dips exhausting beneath that degree, the market tone might shift from cautiously bullish to completely defensive. As Alphractal put it, “So long as Bitcoin stays above the STH Realized Value, we will nonetheless contemplate the market bullish. However shedding $98K exhausting? That’s the place issues might get messy.”