On Monday, main coin Bitcoin surged to an intraday excessive of $108,952 as renewed shopping for curiosity pushed the asset greater. The rally triggered vital exercise throughout BTC-backed ETFs.

Bitcoin ETFs recorded a mixed internet influx exceeding $400 million for the day, with BlackRock’s IBIT main the cost. At present, the king coin has recorded a modest 1% acquire, with on-chain displaying rising skepticism amongst leveraged merchants.

ETF Inflows Surge on Bitcoin Rally

Bitcoin climbed to an intraday excessive of $109,952 on Monday as renewed investor curiosity drove a wave of shopping for strain.

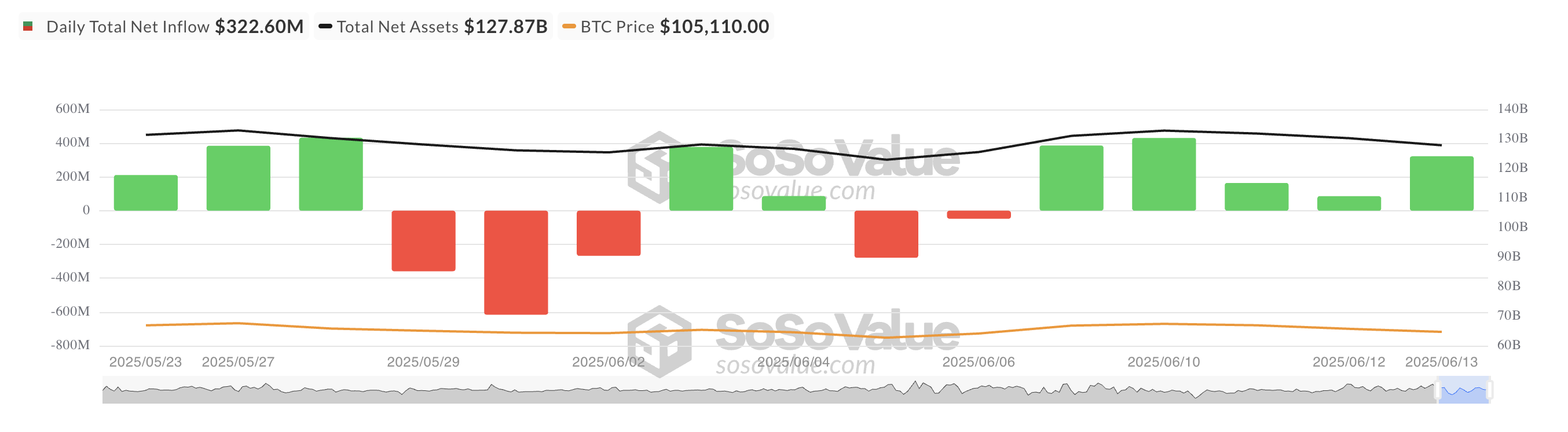

This resurgence in momentum helped gas a spike in inflows into US-listed spot BTC ETFs, which noticed a internet capital injection of $408.59 million, their largest single-day influx since June 10.

Complete Bitcoin Spot ETF Web Influx. Supply: SosoValue

BlackRock’s iShares Bitcoin Belief (IBIT) led the ETF pack in internet inflows, asserting its dominance amongst institutional-grade crypto funding autos. Per SosoValue, the fund’s inflows on Monday amounted to about $267 million, bringing its complete historic internet influx to $50.03 billion.

This robust influx means that institutional traders stay largely unmoved by near-term volatility and proceed seeing BTC as a invaluable portfolio hedge.

BTC Holds Regular, However Merchants Hedge for Draw back

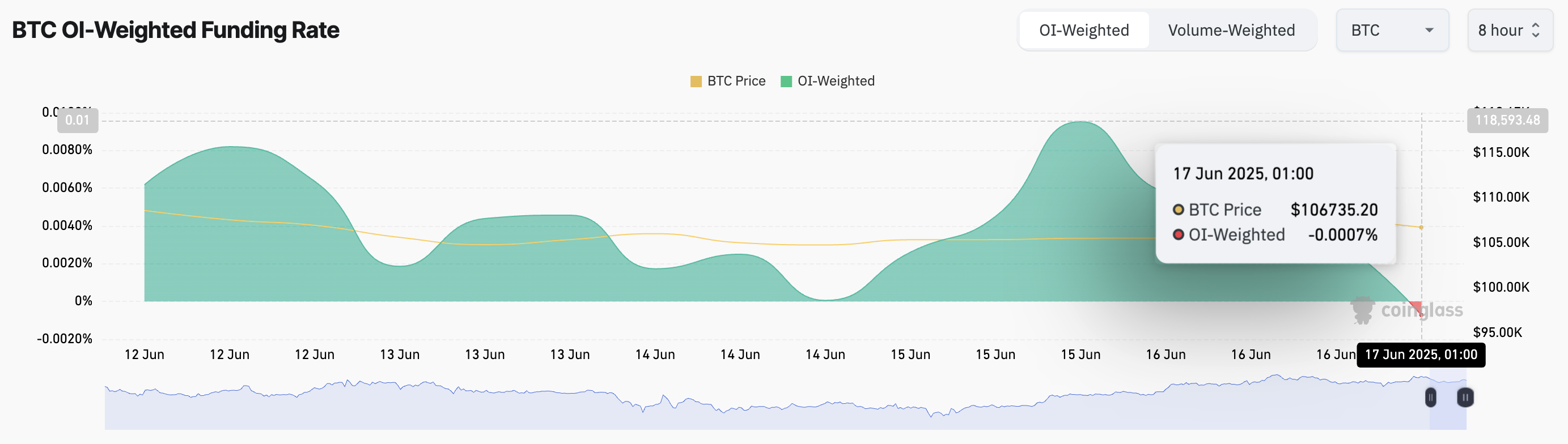

Whereas BTC is up a modest 1% immediately, the derivatives market is flashing warning alerts. Funding charges have flipped unfavourable once more, reflecting renewed bearish sentiment amongst perpetual futures merchants. In response to Coinglass, this presently stands at 0.0007%.

The funding price is a periodic fee exchanged between merchants in perpetual futures markets to maintain contract costs aligned with the spot market. When the funding price is unfavourable, quick merchants are paying lengthy merchants, indicating that bearish sentiment dominates the market.

If this lingers, it may exacerbate the downward strain on the coin’s value.

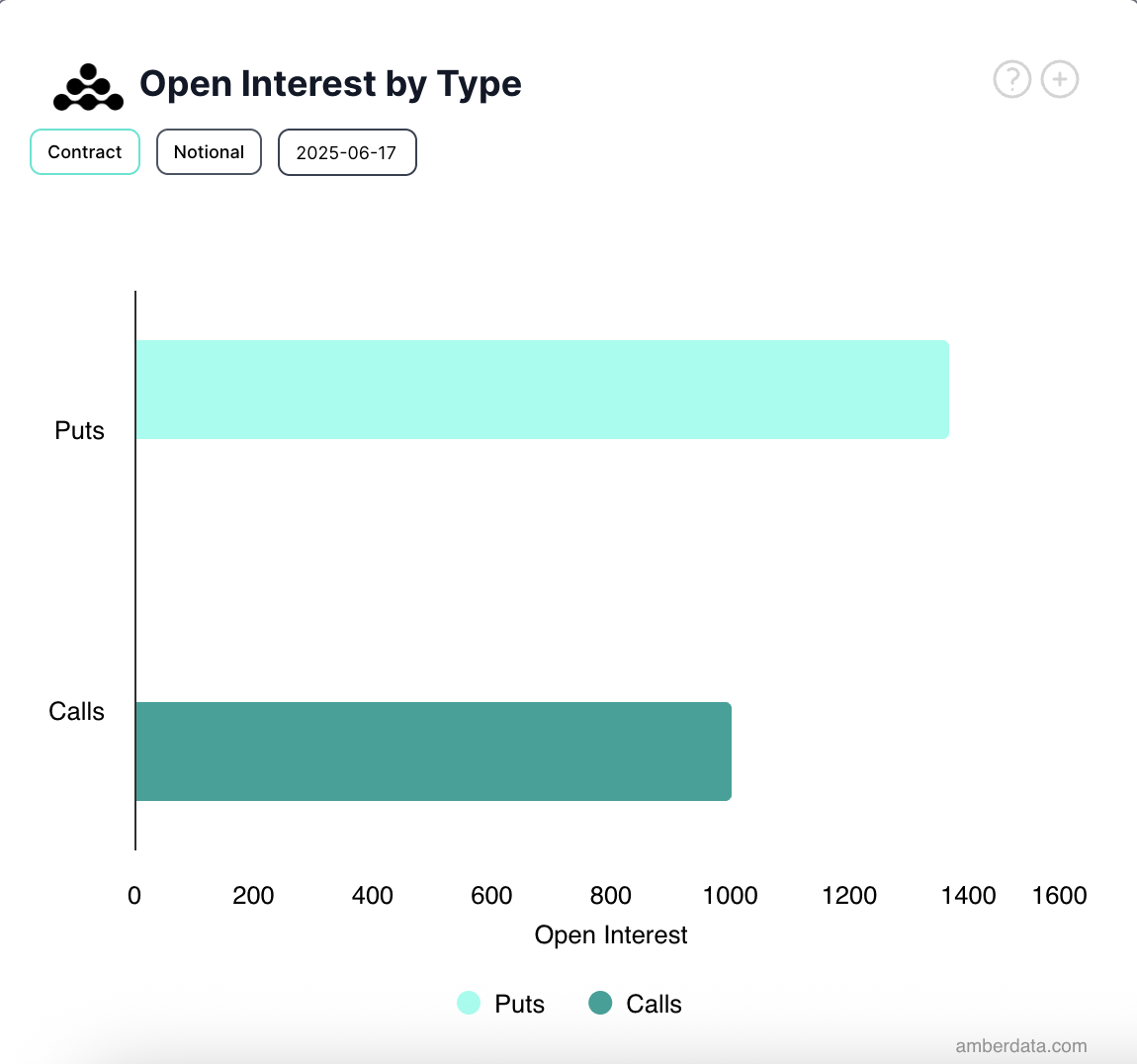

In the meantime, choices merchants are additionally leaning defensive. Information from Deribit exhibits an elevated demand for put contracts over calls immediately, suggesting traders are in search of draw back safety amid rising uncertainty.

Whereas ETF inflows level to robust institutional demand, the underlying market alerts counsel merchants are treading fastidiously. With funding charges turning unfavourable and put choices gaining traction, traders could also be bracing for short-term volatility regardless of the bullish influx narrative.

Disclaimer

Consistent with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.