- Solely 16.6% of Hyperliquid merchants are turning income, with common every day losses close to $5,600.

- Beneficiant HYPE token rewards favored high-volume customers, widening the hole between high and backside.

- Regardless of the losses, Hyperliquid now dominates 60% of DeFi perpetuals buying and selling and is gaining on Binance.

So, Hyperliquid’s gaining critical steam within the crypto world. It’s one of many hottest decentralized futures exchanges on the market proper now. However right here’s the factor: whereas extra individuals are leaping in, most of them? They’re not being profitable. In truth, the numbers are form of brutal.

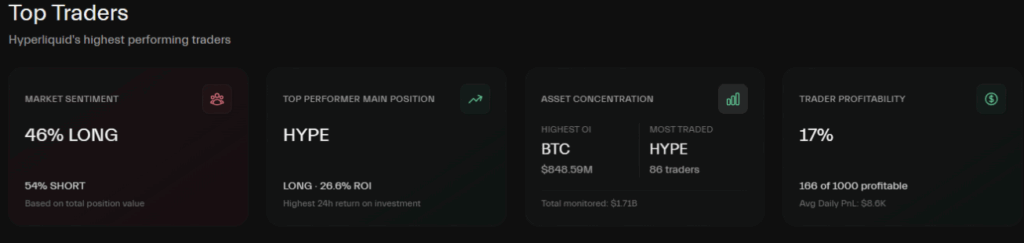

A contemporary report from Hyperdash analytics (June 2025) checked out 1,000 merchants utilizing the platform. Solely 166 of them — yep, simply 16.6% — got here out forward. On common, merchants have been shedding about $5,600 per day. Positive, a fortunate few managed to stack thousands and thousands, however the overwhelming majority? Deep within the crimson.

Leverage Offers… and Then It Takes Away

Hyperliquid lets customers commerce perpetual futures — which mainly means you’ll be able to hold your place open endlessly (in the event you can afford it). Add leverage to the combination — the place merchants borrow cash to go greater — and also you’ve obtained a recipe for both huge positive aspects… or painful losses.

Out of all of the customers, simply 170 merchants reportedly earned greater than $10 million, whereas 1,589 accounts made a minimum of 1,000,000. Sounds nice, proper? However most of those “winners” didn’t pull it off with wild proportion positive aspects — they simply began with large capital or obtained rewarded with hefty token drops.

That’s the opposite piece of the puzzle: rewards. Hyperliquid launched with beneficiant HYPE token airdrops for early customers, largely primarily based on how a lot you traded. The extra you traded, the extra you bought — and yeah, that helped some people guide huge wins. However once more, about 20% of customers ended up getting 80% of these tokens, so the wealth was closely concentrated on the high.

Danger Is Actual — And It’s Hitting Smaller Merchants Laborious

Leverage cuts each methods. Even a 5% transfer in opposition to you’ll be able to wipe your place in the event you’re utilizing 10× leverage. Add in stuff like slippage, buying and selling charges, and funding prices, and… it’s no marvel smaller merchants are getting wrecked. Actually, this isn’t even new — conventional futures markets present related outcomes, the place most retail merchants lose over time.

And but, regardless of the losses, Hyperliquid’s market share is exploding. It’s now the largest DeFi platform for perpetuals, proudly owning over 60% of the market in keeping with Dune Analytics. In simply the final month, buying and selling quantity hit $188 billion. That’s huge — and it’s lapping the likes of dYdX and GMX.

Much more attention-grabbing, Hyperliquid is beginning to chip away at centralized giants like Binance and Bybit. Again in late 2024, it had simply 2% of Binance’s every day buying and selling quantity. Now it’s near 9%, and analysts suppose it may hit 20% by the top of the 12 months. That’s a critical shift.

No Middlemen, No KYC — However Nonetheless a Excessive-Stakes Sport

One huge motive for Hyperliquid’s rise is its construction. The whole lot runs on-chain, so there’s no centralized trade holding your cash, and no annoying KYC course of. Merchants hold full management of their funds.

However that additionally means you’re by yourself. You’ve obtained to handle danger, eat the slippage, pay funding charges — and take care of the results if all of it goes sideways.

The platform’s exploding in reputation, little doubt. However the story beneath the floor is a tricky one. Most merchants are nonetheless shedding — usually huge — whereas a small group reaps the rewards, due to early positioning, huge capital, or simply excessive quantity.