The Bitcoin (BTC) value hovers beneath the $107,000 threshold, and a provide overhang limits additional upside.

In the meantime, merchants’ consideration is on the US Federal Open Market Committee (FOMC) rate of interest choice within the June 17/18 assembly.

Bitcoin Stalls Beneath $107,000 as Fed Determination Looms

The FOMC’s rate of interest choice tomorrow is vital after final week’s CPI (Shopper Value Index) report. BeInCrypto reported that inflation elevated in Could for the primary time since February.

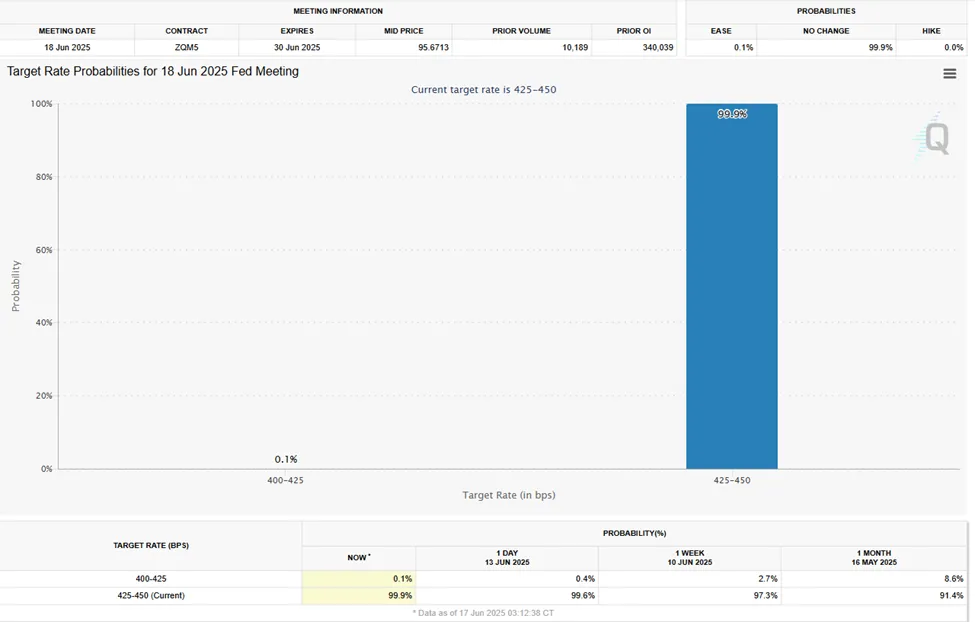

Information on the CME FedWatch Instrument reveals markets pricing in a close to certainty of no rate of interest reduce.

Towards this backdrop, hypothesis has shifted to subtler sources of liquidity, particularly modifications to the Supplementary Leverage Ratio (SLR), as a hidden set off for the following crypto bull run.

“Bitcoin tried one other break on the vary excessive however has didn’t push larger but once more. This ~$108K resistance stays an vital space to look at and and not using a clear break above, it’s not the time to get excited simply but. Nonetheless on this bigger vary,” stated analyst Daan Crypto Trades.

Whereas the Fed is broadly anticipated to carry charges regular, with Polymarket odds giving a 98% likelihood of no change in June and 84% in July, a number of crypto analysts are extra targeted on what’s not being stated.

“No fee cuts this week. Everybody’s watching fee cuts. However the true liquidity comes from SLR,” analyst Quinten wrote.

The SLR, or Supplementary Leverage Ratio, is a regulatory capital requirement that restricts how a lot publicity banks can must sure belongings, notably Treasuries.

SLR, Not Price Cuts, May Set off the Subsequent Crypto Liquidity Wave

Loosening this rule successfully provides banks the inexperienced mild to soak up extra debt, rising market liquidity with out immediately resorting to quantitative easing (QE).

In the meantime, investor sentiment round rate of interest coverage stays deeply divided, with Fed chair Jerome Powell nonetheless resisting political stress from President Trump.

“The US might be too late with chopping rates of interest once more. However as soon as they begin chopping charges… Crypto will explode,” said analyst Mister Crypto.

Chamath Palihapitiya’s current commentary on The All-In Podcast provides to the hypothesis. The Canadian-American enterprise capitalist (VC) argued that the Fed’s hesitation is in the end political.

“If the numerical justification is there to decrease charges and it has all of those different optimistic externalities for the US economic system, why don’t (you) do it? The one reply is political,” he stated.

Citing the VC, the All-In Podcast indicated that the Fed chopping charges by 100 foundation factors (bps), which Trump advocates for, would cut back the curiosity on nationwide debt by $300 billion and stimulate financial progress via elevated borrowing and GDP growth, regardless of potential inflation dangers.

Nonetheless, whereas the Fed’s choice could also be predictable, the true motion might observe in Jerome Powell’s press convention. Even delicate shifts in tone might transfer markets.

“There’s one thing else which might be much more vital than the speed reduce choice. The ‘Powell Press Convention’… If negotiations [in the Iran-Israel conflict] occur earlier than FOMC, the Fed might trace in direction of ending QE and doable fee cuts. On this case, the markets might rally, and alts might pump. In any other case, it’ll be a dump-only occasion,” wrote Cipher X.

Elsewhere, analyst Marty Social gathering speculated that the GENIUS Act, alongside the FOMC rate of interest choice, is one other bullish basic for Bitcoin’s value.

“Bitcoin Wyckoff Accumulation Feb/June sixteenth – getting into remaining Part. IMO: GENIUS Act or FOMC might be used because the markup narrative,” wrote Marty Social gathering.

Based mostly on the Wyckoff market cycle, an asset’s value transitions into the markup section after the buildup section, with sustained upward motion and elevated shopping for stress.

This signifies the start of a possible uptrend, the place the value rises to new highs.

Bitcoin Value Outlook Forward of FOMC Curiosity Price Decision

Information on TradingView reveals Bitcoin was buying and selling for $106,700 as of this writing, with a low-hanging demand zone between $101,461 and $105,923.

Purchaser momentum is anticipated inside this vary, with the bullish quantity profiles (inexperienced nodes) displaying buyers ready to work together with BTC as soon as it drops to this zone.

Elevated shopping for stress might see Bitcoin value retest the availability zone between $109,242 and $111,634. A break and shut above the $110,478 midline on the one-day timeframe might set the tempo for a brand new all-time excessive for Bitcoin.

Conversely, if promoting stress will increase and Bitcoin value drops beneath the imply threshold of $103,529, an in depth beneath this help might exacerbate the losses. Likewise, bearish quantity profiles (crimson bars or nodes) present bears ready to work together with the BTC value round this value space.

With each macro dangers and technical stress mounting, merchants are watching not simply the Fed’s fee stance.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.