Tether’s affect within the crypto house has grown considerably over the previous few years, particularly in Q1 this yr. Whereas Tether has not publicly endorsed any political payments, its presence out there has had an unintended affect.

With the rise of stablecoins and Tether’s dominant position, it’s clear that Tether’s place holds sway in international monetary markets and even inside US politics.

Tether Has Affect

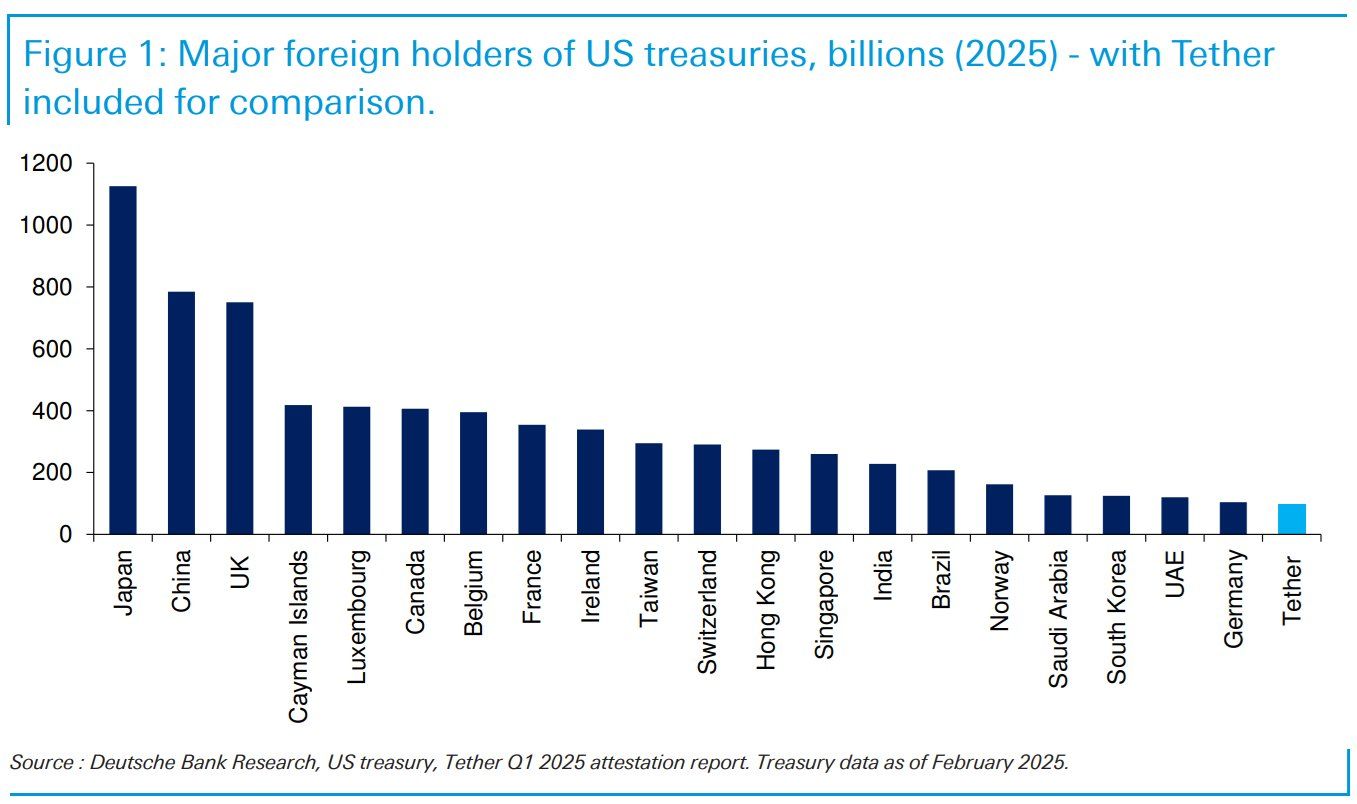

At present, Tether is likely one of the largest holders of US Treasuries on the earth. With over $120 billion price of US Treasuries, Tether is nearing the scale of some nations like Germany when it comes to its holdings.

The flexibility of a single firm to carry such substantial property provides Tether a singular affect over international monetary markets. This huge holding means that Tether’s actions and selections can form political discourse, particularly on the subject of insurance policies associated to finance and cryptocurrency.

Tether additionally dominates the stablecoin market, controlling 62% of its whole worth. With a market cap of $156 billion, Tether makes up the lion’s share of the $251.8 billion stablecoin market. Regardless of its important market presence, Tether has remained cautious about direct political involvement.

Tracy Jin, COO of MEXC, solely instructed BeInCrypto that Tether prefers to remain impartial on political issues, avoiding any public interventions.

“Tether doesn’t have the identical lobbying presence in Washington that U.S.-based corporations like Circle or Coinbase do. What it does have is plain market gravity. With $120 billion parked in Treasuries, Tether’s monetary footprint within the US economic system is already there, no matter the place the corporate is registered.

She added that Tether-issued USDT could possibly be an element of curiosity to the worldwide economic system.

“Some officers might even see USDT as a web optimistic for the greenback’s international attain – a form of Malicious program that exports US financial affect into components of the world the place the standard banking system doesn’t attain. That narrative might’ve made Tether appear much less threatening and extra strategically helpful.”

Tether’s avoidance of direct political engagement is noteworthy, because it permits the corporate to keep up a extra unbiased stance within the unstable crypto market. Regardless of this, Jin added that Tether’s affect can’t be understated.

“I don’t consider Tether straight engineered the invoice’s progress, however its sheer scale completely influenced the urgency… Tether has primarily turn out to be a systemically related actor in international markets. When a personal stablecoin issuer holds extra US debt than most nations, it forces regulators to take a tough take a look at the ecosystem they function in.”

Is The GENIUS Act Receiving Particular Remedy?

The GENIUS Act has shortly gained assist from each liberal and conservative sides, making it one of the vital broadly supported cryptocurrency payments. Final week, the GENIUS Act handed the cloture vote and is now awaiting the ultimate Senate vote. This transfer places it on observe to turn out to be the first-ever crypto invoice to be authorized within the US, possible inside this week.

Tracy Jin famous that the race to turn out to be a pro-crypto nation is probably going fueling the urgency that has fast-tracked the approval of the GENIUS Act.

“The US noticed Europe transfer ahead with MiCA, and it was a wake-up name. The GENIUS Act lets America step in and outline what a compliant, dollar-backed stablecoin seems to be like – and do it by itself phrases. That’s interesting to each Republicans and Democrats. It’s a gentle energy play that reinforces the greenback while not having to launch a central financial institution digital foreign money… the political window was open. Crypto has matured, stablecoins have confirmed utility, and banks are getting extra concerned. Lawmakers noticed an opportunity to guide – not react – and that chance doesn’t come typically. So assist coalesced shortly.”

Because the invoice heads in the direction of a ultimate vote, it’s clear that the assist it has acquired displays the rising significance of stablecoins like Tether within the international economic system.

Disclaimer

Consistent with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.