- CoinShares has filed with the SEC to launch a spot Solana ETF, becoming a member of seven different corporations within the race.

- The ETF would observe the CME CF Solana-Greenback fee and embrace chilly storage custody, with attainable staking rewards.

- Approval odds sit round 70%, however analysts don’t count on a choice earlier than This fall 2025.

CoinShares, one among Europe’s high digital asset managers, simply threw its hat into the ring within the U.S. Solana ETF race. The agency filed an S-1 with the SEC on June 13, aiming to launch a spot Solana (SOL) exchange-traded fund on Nasdaq—one other main push from institutional gamers making an attempt to get direct publicity to this fast-moving blockchain ecosystem.

The proposed ETF would observe the CME CF Solana–Greenback Reference Charge, giving traders a clear, regulated option to faucet into SOL with out the trouble of direct custody. Talking of which, Coinbase Custody Belief and BitGo have been tapped to maintain the property locked away in chilly storage. Curiously, among the holdings may additionally be staked by means of chosen suppliers to generate passive rewards, the submitting famous.

Eight Corporations within the Race – However When Will the SEC Blink?

This newest submitting provides CoinShares to a rising record of asset managers going all in on Solana. VanEck began the wave earlier this 12 months, and now massive names like Constancy, 21Shares, Grayscale, Franklin Templeton, Bitwise, and Canary Capital have adopted. That brings the whole to eight contenders, in line with Bloomberg ETF professional Eric Balchunas.

Nonetheless, whereas the curiosity is heating up, the SEC isn’t speeding something. Regulators have reportedly requested issuers to make clear how they’ll handle in-kind redemptions—a core characteristic for ETF performance—and though there’s been some openness towards staking, there’s no inexperienced mild simply but.

Approval Odds at 70%—However You May Be Ready a Bit

James Seyffart from Bloomberg thinks approval will come—however not instantly. His newest forecast pegs the chances round 70%, with the primary attainable inexperienced mild coming no sooner than late June or early July. Extra realistically? Most likely someday in This fall this 12 months.

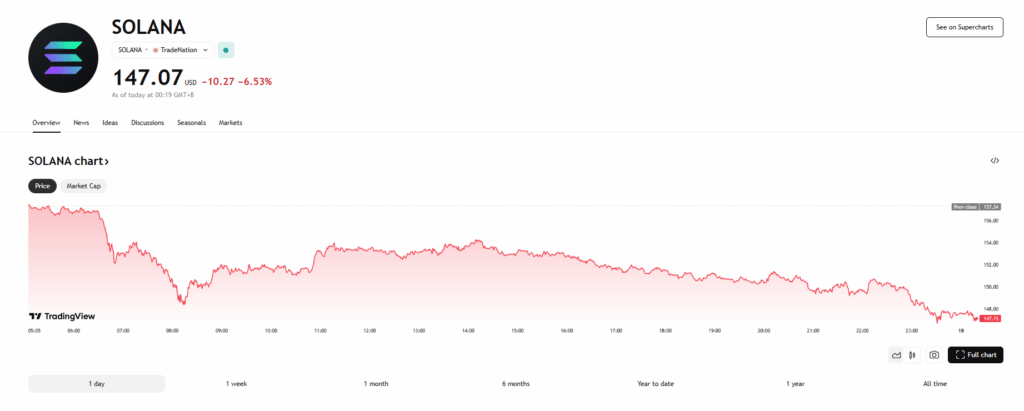

Solana’s enchantment is clear: it’s quick, scalable, and quite a bit cheaper to make use of than Ethereum. Builders adore it, and institutional curiosity is clearly ramping up. That mentioned, considerations round volatility, safety hiccups, and regulatory readability nonetheless hover overhead.

Even so, CoinShares’ submitting is only one extra signal of the place the market is heading. Because the SEC sifts by means of this contemporary batch of ETF proposals, everybody—from hedge funds to retail merchants—is ready to see what doorways would possibly open subsequent within the regulated crypto funding world.