Hedera (HBAR) is up greater than 4% within the final 24 hours however stays down practically 7% over the previous week, persevering with to battle under the $0.19 mark. Regardless of the short-term rebound, technical alerts stay combined, with the BBTrend pointing to rising bearish momentum and EMA traces nonetheless favoring a downward bias.

Nonetheless, a pointy restoration in RSI suggests that purchasing stress is starting to return, hinting at a potential shift in market sentiment. With worth motion nearing key resistance and assist ranges, HBAR is coming into a important zone that would decide its subsequent main transfer.

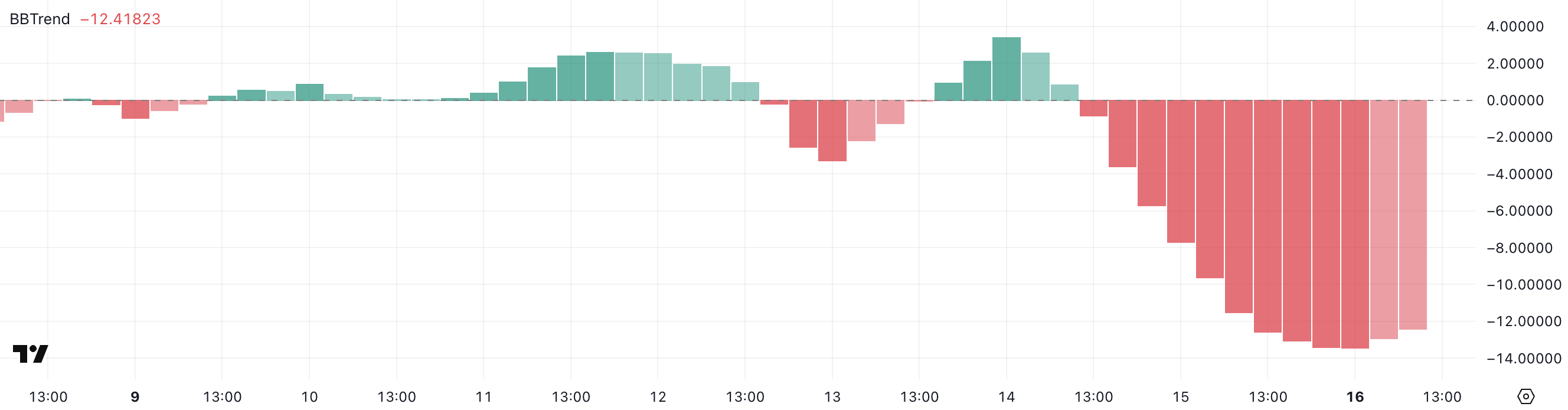

Hedera Slides as BBTrend Turns Deeply Detrimental

Hedera is displaying indicators of weakening momentum as its BBTrend has sharply declined to -12.41, down from -0.83 simply two days in the past.

Earlier right this moment, the indicator hit a low of -13.43 earlier than barely recovering, underscoring a possible intensification in bearish stress.

This fast shift means that HBAR is coming into a stronger downtrend part, with sellers more and more dominating current worth motion.

BBTrend, brief for Bollinger Band Development, is a technical indicator that measures the energy and route of worth actions based mostly on the width and slope of the Bollinger Bands.

When the BBTrend turns deeply damaging, it usually alerts that the worth is trending downward with growing volatility. Within the case of HBAR, the present BBTrend studying of -12.41 signifies that bearish momentum is gaining traction.

If this pattern persists, it could result in additional worth declines or on the very least, extended consolidation close to decrease assist ranges.

HBAR Momentum Recovers as RSI Rebounds from Oversold Zone

Hedera is displaying a notable shift in momentum as its Relative Energy Index (RSI) has climbed to 50.39, up considerably from 26.6 simply two days in the past.

This sharp rise suggests that purchasing curiosity has picked up, doubtlessly marking the tip of an oversold part.

The restoration towards the impartial zone signifies a potential pattern reversal or at the least a pause within the current promoting stress.

RSI is a momentum oscillator that measures the velocity and alter of worth actions on a scale from 0 to 100. Readings under 30 typically point out that an asset is oversold, whereas readings above 70 recommend it could be overbought.

With HBAR’s RSI now hovering round 50, the token is neither overbought nor oversold, signaling steadiness between patrons and sellers.

This stage may act as a pivot level—both paving the best way for a bullish breakout if upward momentum continues, or triggering renewed promoting if resistance holds.

Hedera Faces Make-or-Break Second Between $0.160 and $0.155

Hedera worth stays below a bearish technical construction as its short-term Exponential Transferring Averages (EMAs) proceed to sit down under the long-term ones.

This configuration usually alerts downward stress, however worth motion is now approaching a key resistance stage at $0.160.

A confirmed breakout above this zone may open the door for a transfer towards $0.175, with additional upside potential to $0.183 and even $0.193 if bullish momentum strengthens.

Nonetheless, if HBAR fails to maintain upward stress and will get rejected close to resistance, it could retest the rapid assist at $0.155. A breakdown under this stage may result in a slide towards $0.150, reinforcing the present bearish construction.

Disclaimer

Consistent with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.