Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

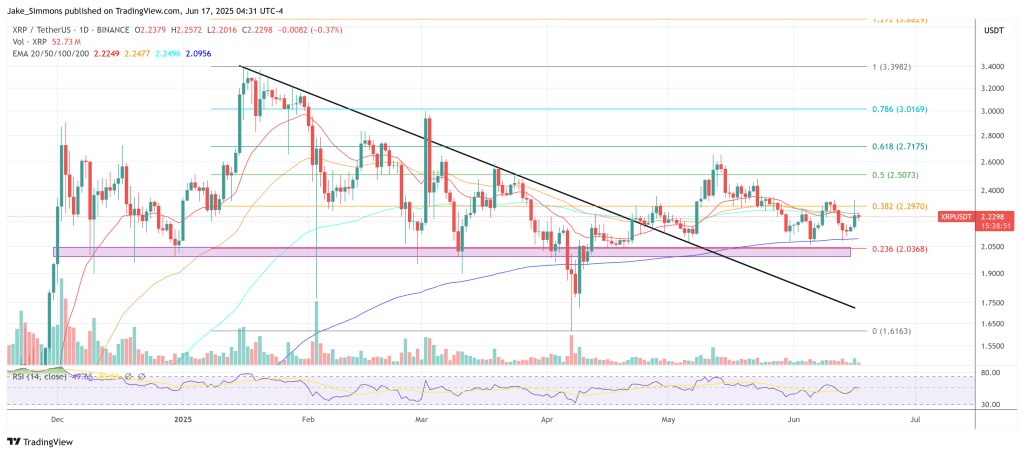

XRP bulls look like going through one final take a look at of conviction earlier than the market’s subsequent explosive part, in line with CryptoInsightUK’s video evaluation launched on 16 June. The British analyst argues that the token is sculpting an inverse head-and-shoulders formation whose proper shoulder “nonetheless must type across the high-$1.80s” earlier than any sustained rally can start.

How Low Should XRP Go?

Within the broadcast, he emphasised that “dense liquidity is under us,” pointing to a confluence of resting bids and stop-loss clusters between roughly $1.92 and $1.80. “I nonetheless assume it comes all the way down to make the correct shoulder which is round 1.88,” he mentioned, including {that a} swift wash-out into that pocket would “flush the lows, faucet in there and ship it.”

At current, XRP is altering fingers close to $2.24, up about 3% over the previous 24 hours, which means a potential drawdown of roughly 20% if the market fulfills his draw back state of affairs. From the analyst’s vantage level, such a retreat is much less a trigger for alarm than a prerequisite for the following main leg increased: “If we come down first, we’ve performed the draw back half. In any other case I’m nonetheless going to be frightened about happening even when we come as much as $2.42 or increased.”

Associated Studying

He linked the bearish short-term bias to structural forces past the XRP Ledger’s ecosystem. Bitcoin dominance, he famous, has crept towards a historic inflection zone that beforehand triggered alt-seasons: “Wherever on this field might be the beginning of alt-season… That might most likely coincide with Bitcoin dropping to between $100,000 and $93,000.” A dominance spike fed by a late-cycle Bitcoin dip, he argued, would sometimes inflict outsized proportion losses on main altcoins—together with XRP—earlier than liquidity rotates again into them.

Inside XRP’s personal order e-book, CryptoInsightUK highlighted a “liquidity vacuum” created by Could’s capitulation candle. Though the token has since retraced most of that single-session collapse, he described the rebound as “uneven corrective worth motion,” missing the conviction and quantity that accompanied earlier impulse waves. The appropriate-shoulder flush, in his view, would neutralise residual leverage, significantly amongst merchants who re-loaded longs too aggressively through the $2.15–$2.40 bounce.

How Excessive Can XRP Explode?

The inverse head-and-shoulders thesis additionally options prominently on his long-range chart, stretching again to mid-Could. The analyst first revealed the sample on X, exhibiting a left shoulder close to $2.42, a head at $1.47, and a neckline simply above $2.50. Finishing a symmetrical proper shoulder close to $1.88 would, by classical pattern-measuring guidelines, challenge an upside goal above $3.50—a degree not visited since late-2021’s cycle high.

Associated Studying

Liquidity dynamics throughout the broader market reinforce his warning. Open curiosity in perpetual swaps for Ether, he noticed, stays “as excessive because it’s ever been,” suggesting that any sudden drop in majors might spark a forced-liquidation cascade throughout altcoin pairs. “These folks shall be flushed out,” he warned, calling consideration to negative-funding episodes that trace at an overcrowded brief base ready to be squeezed—as soon as the ultimate draw back pocket has been crammed.

Regardless of the near-term jitters, CryptoInsightUK reiterated a resolutely bullish macro stance. “The following stage I’m most sure about is that we’re going to go considerably increased for crypto,” he instructed viewers. Drawing parallels with gold’s report weekly shut, he argued that an undercurrent of world danger aversion is quietly supporting non-sovereign shops of worth, positioning each Bitcoin and XRP for accelerated appreciation as soon as the technical reset concludes.

For long-term holders, his recommendation was unequivocal: keep away from wholesale portfolio shifts and as a substitute deal with any sub-$2.00 wick as a ultimate accumulation window. “Greenback-cost averaging from right here is an effective factor to do,” he mentioned, revealing that 97% of his personal capital stays in spot positions, with solely a single-digit proportion reserved for surgical bids within the $1.80–$1.92 zone.

Whether or not XRP respects that script will change into clear within the days forward. Ought to the market certainly sweep into the high-$1.80s and rebound with the aggressive thrust the analyst expects, the correct shoulder shall be full—and the runway clear—for the long-awaited take-off.

At press time, XRP traded at $2.23.

Featured picture created with DALL.E, chart from TradingView.com