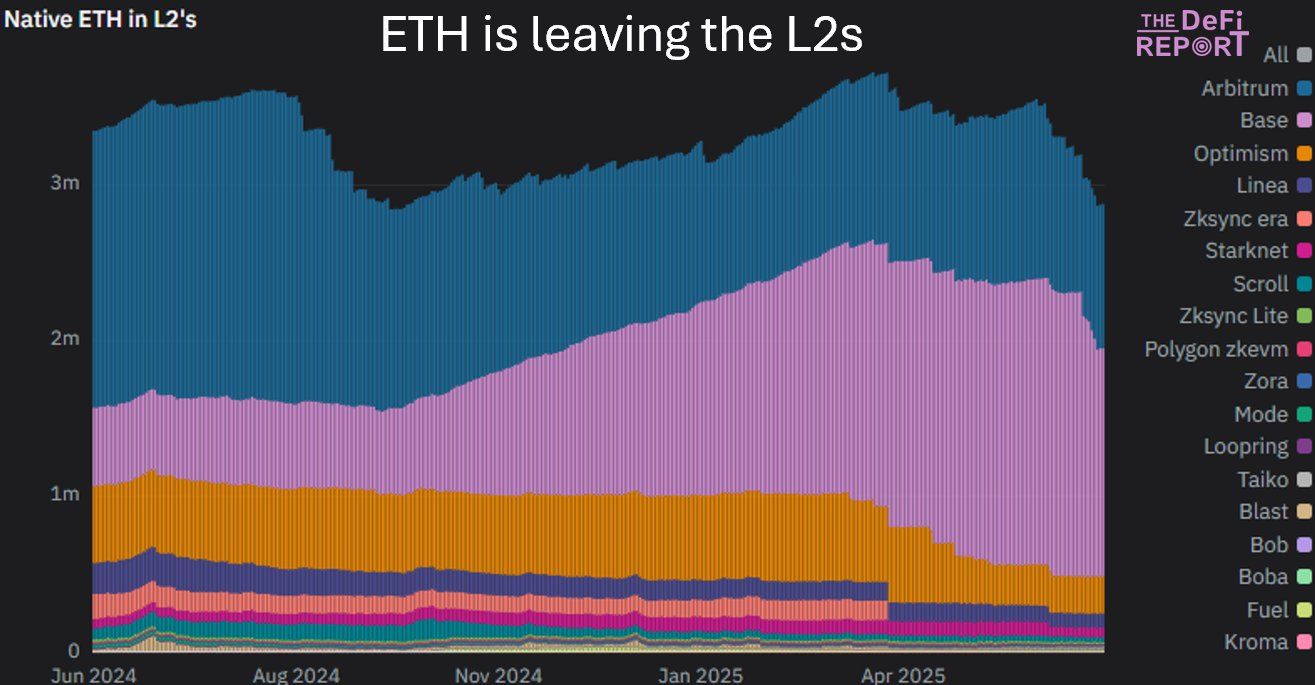

In latest months, Ethereum (ETH) reserves on Layer 2 (L2) networks have plummeted, with the general ETH steadiness dropping by roughly 25%.

ETH on Optimism has fallen by as a lot as 54% since March, whereas Arbitrum and Base have seen declines of 17% and 14%, respectively.

What’s driving this decline?

The chart from The DeFi Report clearly illustrates this development, notably since early 2025, when main L2 networks like Optimism and Base have witnessed important ETH withdrawals. In accordance with analyses, the weakening costs of native Ethereum L2 tokens are a important issue.

Tokens akin to OP from Optimism have dropped greater than 38% over the previous 90 days. In the meantime, ARB from Arbitrum has declined by 21%. This downturn has diminished investor enchantment, prompting them to shift to different platforms.

On the similar time, a portion of ETH is returning to the Ethereum mainnet, which is taken into account safer because of its excessive safety.

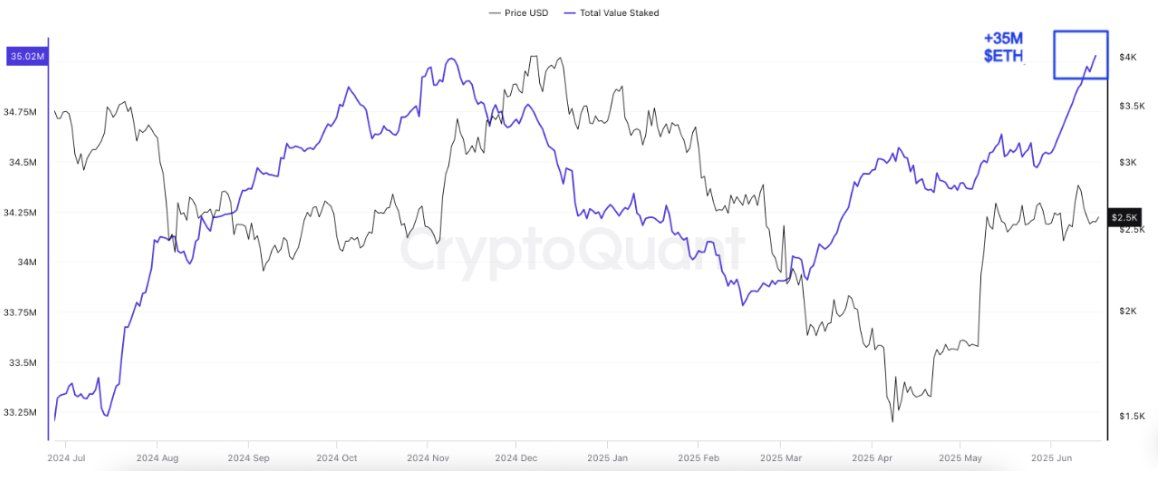

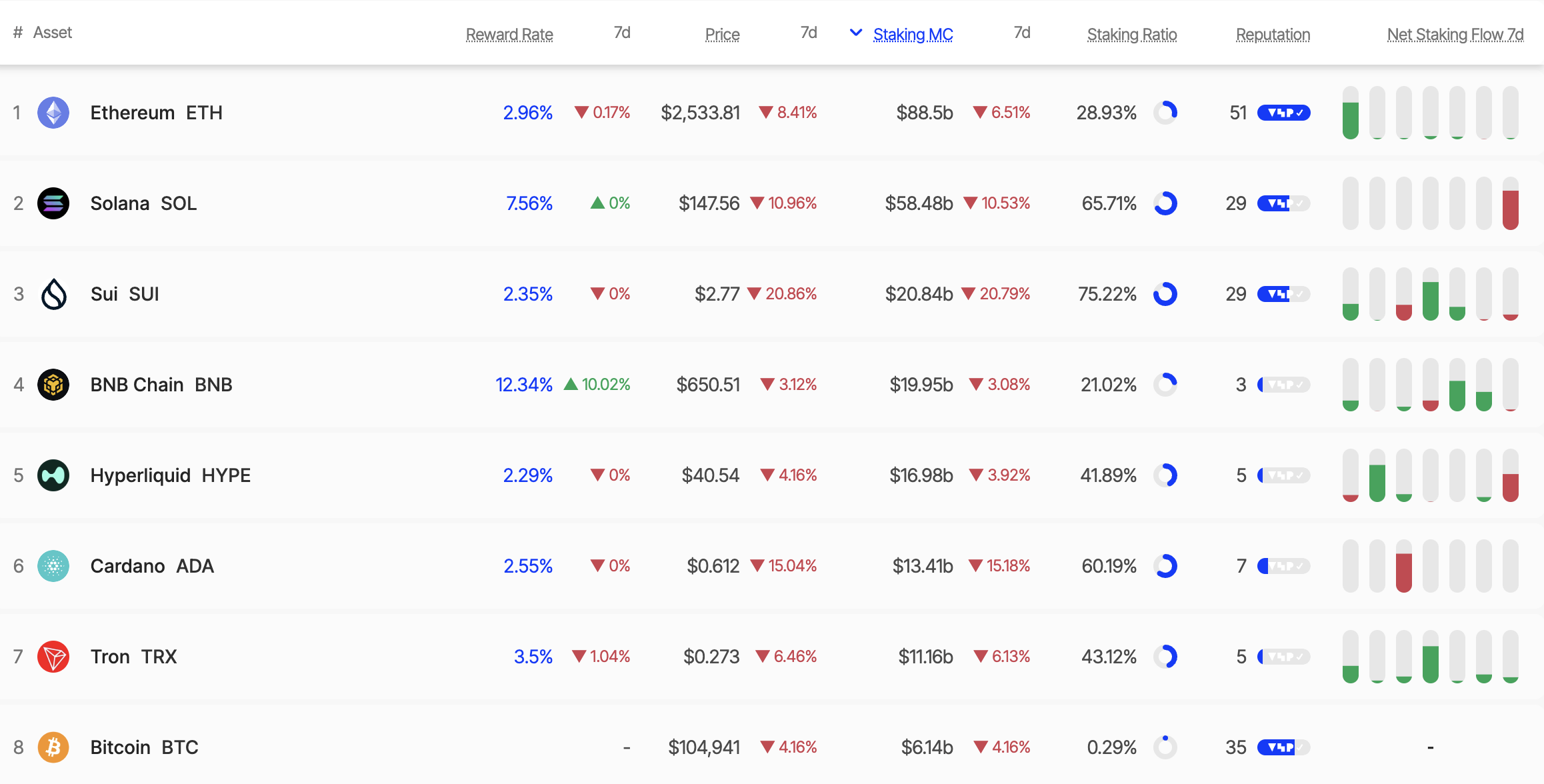

Moreover, the quantity of ETH being staked and the variety of long-term holding addresses have reached new highs, indicating that traders prioritize value-preservation methods over buying and selling on Ethereum L2.

One other potential issue is the motion of ETH from Accumulation Addresses. Knowledge from CryptoQuant signifies that enormous wallets are reallocating belongings, rising promoting strain on L2.

Accumulation Addresses (holders with no historical past of promoting) have reached an all-time excessive, now holding 22.8 million ETH. Many public firms additionally embody ETH as a reserve asset.

“In simply the primary half of June, greater than 500,000 ETH have been staked, pushing the full locked quantity to a brand new all time excessive of over 35 million ETH. This development alerts rising confidence and a continued drop in liquid provide,” a CryptoQuant analyst said.

Influence on the Ethereum Ecosystem

This decline marks a shift from 2024, when L2s have been seen as a risk to the mainnet because of their capacity to draw customers and transaction charges. Nevertheless, the reverse development is unfolding now, with the mainnet recording elevated exercise.

This might strengthen Ethereum’s place, particularly following the profitable Pectra improve final month, which enhanced efficiency and diminished prices. Nevertheless, L2s like Optimism and Base want to enhance to regain belief; in any other case, they danger dropping their important function in scaling the community.

ETH’s departure from L2s could final till this month’s profitable Pectra improve or technique changes amid market volatility. Nevertheless, to get well, L2s should give attention to bettering liquidity and decreasing reliance on simply manipulated tokens.

Builders might think about implementing extra clear incentive mechanisms whereas collaborating intently with centralized exchanges to stabilize capital flows.

Furthermore, the expansion of ETH staking—now accounting for almost 29% of the full provide—displays long-term confidence in Ethereum. If L2s fail to adapt promptly, they could lose their aggressive edge whereas the mainnet solidifies its main place.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.