As soon as a market centerpiece, Binance Alpha is now witnessing a pointy decline in each customers and buying and selling quantity.

Right here is how the flash crash of ZKJ and KOGE considerably hindered the fascinating development of this platform.

Binance Alpha Sees Drop in Buying and selling Quantity

Information from Dune reveals that energetic Binance Alpha customers plummeted from 233,000 on June 12 to 195,000 by June 15, equating to a lack of practically 40,000 customers in simply three days. Notably, energetic buying and selling customers have dwindled to round 55,000, signaling an virtually unstoppable decline in morale and belief.

The foundation trigger stems from the surprising flash crash of two key tokens, ZKJ and KOGE. The first set off lies with whale wallets, which massively withdrew liquidity, sparking a widespread sell-off impact, with the pool construction unable to resist collected dump orders.

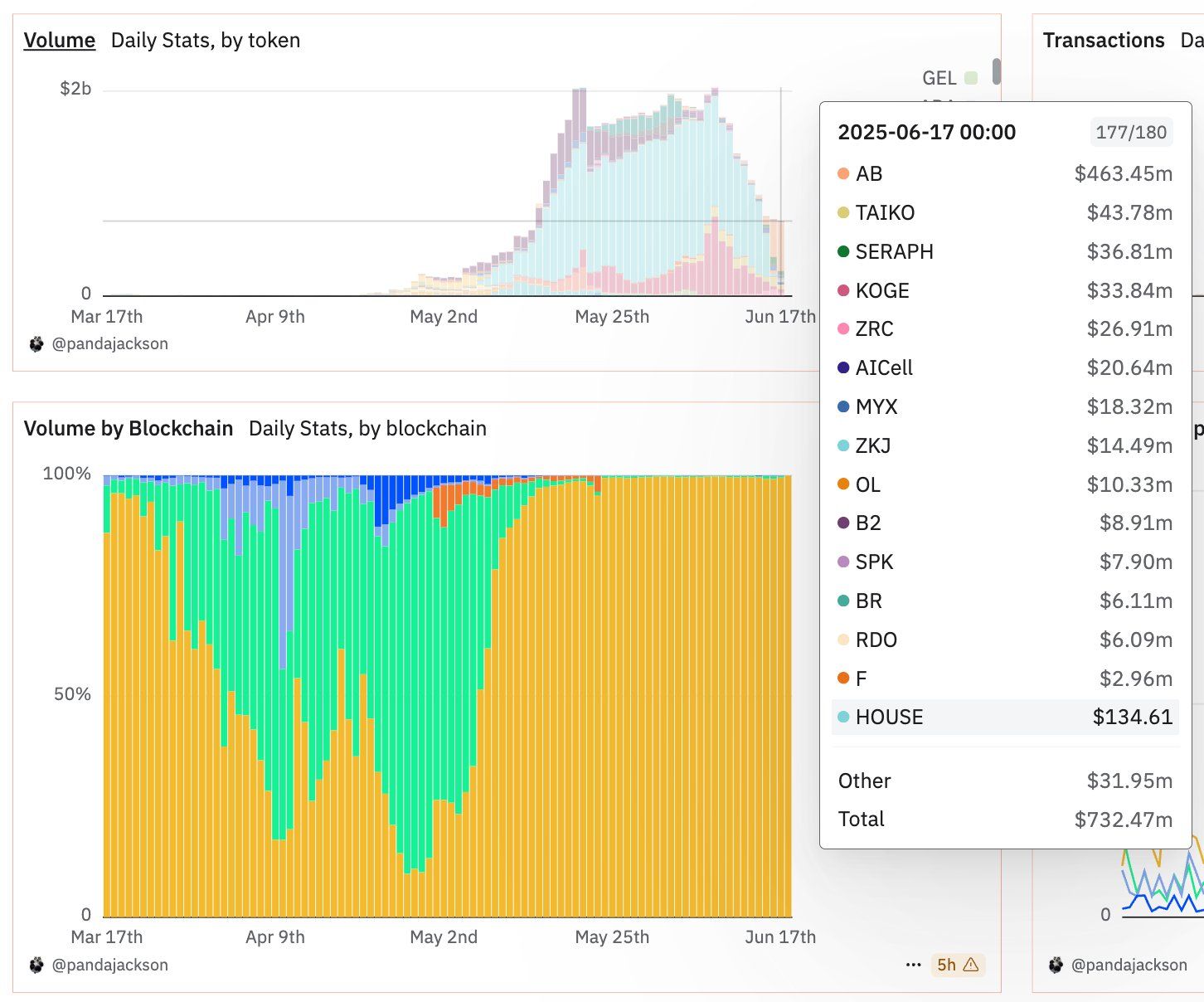

Following this collapse, Binance Alpha’s buying and selling quantity, beforehand peaking at $2.04 billion on June 8, plunged by 63% to roughly $749 million simply days later.

Instantly after the sharp token value drops, Binance introduced a brand new coverage geared toward curbing “pretend quantity” ways that present no actual market worth. Nonetheless, the neighborhood deemed this response “too late.”

Some customers have urged Binance to refund misplaced factors or rewards, emphasizing that the dearth of transparency throughout coverage changes brought about vital monetary and trust-related injury.

What Ought to Binance Alpha Do Subsequent?

Latest occasions uncovered main flaws within the Alpha system: its airdrop-based mannequin fosters short-term sentiment, resulting in concentrated quantity in simply manipulated tokens.

AB token now accounts for greater than 63% of the buying and selling quantity on Binance Alpha in a day. Beforehand, ZKJ & KOGE additionally held the highest place. When giant wallets withdrew, the system instantly collapsed.

“There is no such thing as a significantly good goal. Even when the wear and tear is low, there may be nonetheless a danger of value fluctuations,” an analyst on X commented.

To rebuild and recuperate, Binance may have to ascertain a clear level allocation mechanism to discourage synthetic quantity, cut back reliance on centralized tokens, and prioritize tasks with sturdy liquidity and distribution.

It additionally must implement anti-bot know-how to regulate irregular buying and selling exercise and improve coverage adjustment transparency, guaranteeing the neighborhood is knowledgeable early and has an opportunity to offer suggestions to keep up belief.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.