Bitcoin is navigating a high-stakes atmosphere as escalating Center East tensions and mounting macroeconomic dangers gas market volatility. The flagship cryptocurrency is holding above vital help, with bulls sustaining management for now. Nevertheless, hawkish situations—pushed by rising US Treasury yields, inflation considerations, and geopolitical instability—pose an actual menace to Bitcoin’s energy. A drop beneath the psychological $100,000 mark might shift sentiment sharply bearish.

Analysts are break up on what comes subsequent. Some level to the macro atmosphere and see potential for deeper corrections. Others stay assured, calling for an imminent breakout and new all-time highs, pushed by long-term structural demand.

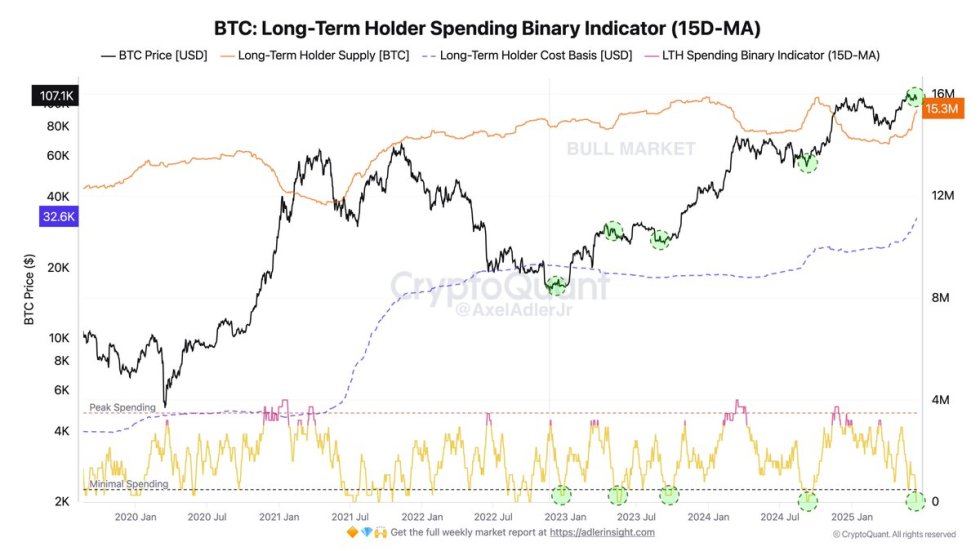

Supporting the bullish view, new information from CryptoQuant highlights a robust accumulation development amongst long-term holders (LTHs). Based on their analysis, spending exercise from this cohort is now close to historic lows—ranges sometimes related to early accumulation phases. In truth, in three of the final 4 comparable situations, Bitcoin rallied 18–25% within the following 6 to eight weeks.

Whereas short-term uncertainty clouds the outlook, the mixture of low LTH spending and resilient help ranges suggests {that a} important transfer may very well be forming. Whether or not it’s a breakout or breakdown will rely upon how world situations evolve within the coming days.

Bitcoin Consolidates Above $105K As Lengthy-Time period Holders Sign Energy

Bitcoin has entered a consolidation part following its highly effective rally from $74,000 to a brand new all-time excessive close to $112,000. Whereas the market has cooled off from its peak, BTC stays resilient above the $105,000 mark—a key stage that now acts as help. This tight buying and selling vary displays a broader sense of uncertainty, as traders await readability on rising geopolitical tensions within the Center East and macroeconomic shifts earlier than committing to the subsequent main transfer.

The approaching weeks shall be decisive. A decision to the Israel-Iran battle or a shift in financial expectations might ignite a breakout. Conversely, extended volatility or new macro shocks might delay the subsequent part of the cycle. Nonetheless, many analysts preserve a bullish long-term view, projecting that BTC might quickly enter worth discovery and break above its $112K ATH.

Including to this optimism, CryptoQuant’s analyst Axel Adler factors to a compelling on-chain sign. Your complete Lengthy-Time period Holder (LTH) cohort is displaying spending exercise close to historic lows, ranges sometimes related to accumulation phases. In three out of the final 4 comparable circumstances, Bitcoin rallied 18–25% over the next 6–8 weeks. This means sturdy conviction amongst skilled holders.

Adler additionally notes that the present weak spot within the LTH binary indicator is strengthened by different bullish indicators: a optimistic shift in CDD Momentum (Coin Days Destroyed) and a still-elevated MVRV Z-score. Each metrics traditionally align with development continuation and undervaluation intervals.

Collectively, these on-chain indicators counsel that Bitcoin is quietly constructing a base, with long-term holders accumulating fairly than distributing. Whereas short-term volatility might persist, the broader construction factors towards a possible breakout as soon as uncertainty clears.

BTC Worth Vary Holds as Market Awaits Breakout

Bitcoin is at present buying and selling round $105,569 on the every day chart, consolidating inside a clearly outlined vary between the $103,600 help and the $109,300 resistance. This vary has now been revered for a number of weeks, with BTC repeatedly testing each boundaries with no confirmed breakout or breakdown. The $103,600 stage—Bitcoin’s earlier all-time excessive from December 2024—has now change into a vital demand zone. Consumers have persistently stepped in close to this stage, stopping additional draw back regardless of latest macro volatility and Center East battle considerations.

From a shifting common perspective, BTC remains to be holding above the 50-day (blue) and 100-day (inexperienced) easy shifting averages, signaling that mid-term momentum stays bullish. The 200-day SMA (purple) sits far beneath the present worth, reinforcing BTC’s broader uptrend. A every day shut above $109,300 might sign a return to cost discovery, probably triggering renewed bullish momentum and a possible push past $112K.

Nevertheless, if $103,600 fails to carry within the occasion of renewed macroeconomic concern or adverse information, BTC might drop towards the $97,000–$98,000 vary. Till then, the market seems to be in a wait-and-see mode. The setup stays constructive so long as help ranges proceed to draw patrons and the upper time-frame construction holds.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.