Following Technique’s instance, firms more and more put money into Bitcoin, a development bolstered by the cryptocurrency’s rising worth. Nevertheless, these large acquisitions elevate issues over market collapse if firms are compelled to promote and questions over Bitcoin’s decentralized ethos.

Representatives from Bitwise, Komodo Platform, and Sentora state that the advantages largely outweigh the dangers. Whereas small, overleveraged firms may go bankrupt, their market influence could be minimal. They foresee no imminent dangers, as profitable firms like MicroStrategy present no indicators of liquidating property.

The Rising Development of Company Bitcoin Adoption

The variety of firms becoming a member of the company Bitcoin acquisition development is rising. Whereas Customary Chartered just lately reported that not less than 61 publicly traded corporations purchased crypto, Bitcoin Treasuries reviews that the quantity has reached 130.

As Technique (previously MicroStrategy) continues accumulating billions in unrealized features from its aggressive Bitcoin acquisitions, bolstered by a rising Bitcoin worth, extra firms are prone to observe swimsuit.

“The Wilshire 5000 fairness index actually contains 5000 publicly listed firms within the US alone. It’s fairly doubtless that we’re going to see a big acceleration within the company treasury adoption of Bitcoins this yr and in 2026 as nicely,” André Dragosch, Head of Analysis for Bitwise in Europe, instructed BeInCrypto.

The explanations fueling his perception are multi-fold.

How Does Bitcoin’s Volatility Examine to Different Property?

Whereas unstable, Bitcoin has traditionally demonstrated exceptionally excessive returns in comparison with conventional asset lessons like shares and gold.

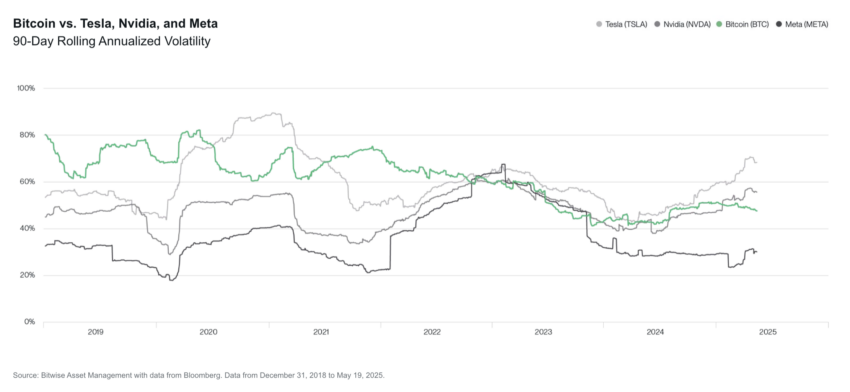

“One notably attention-grabbing knowledge level is the volatility of Bitcoin in contrast to main tech shares, such as Tesla and Nvidia. Many traders say, ‘I would by no means make investments in one thing as unstable as Bitcoin,’ Ryan Rasmussen, Head of Analysis at Bitwise, defined, including, “At the identical time, most traders personal Tesla and Nvidia (both immediately or by index funds like the S&P 500 and Nasdaq-100). In current months, Tesla and Nvidia have each been extra unstable than Bitcoin.”

Although previous efficiency doesn’t assure future returns, Bitcoin’s present efficiency, which has been notably secure, could inspire extra firms to buy the asset.

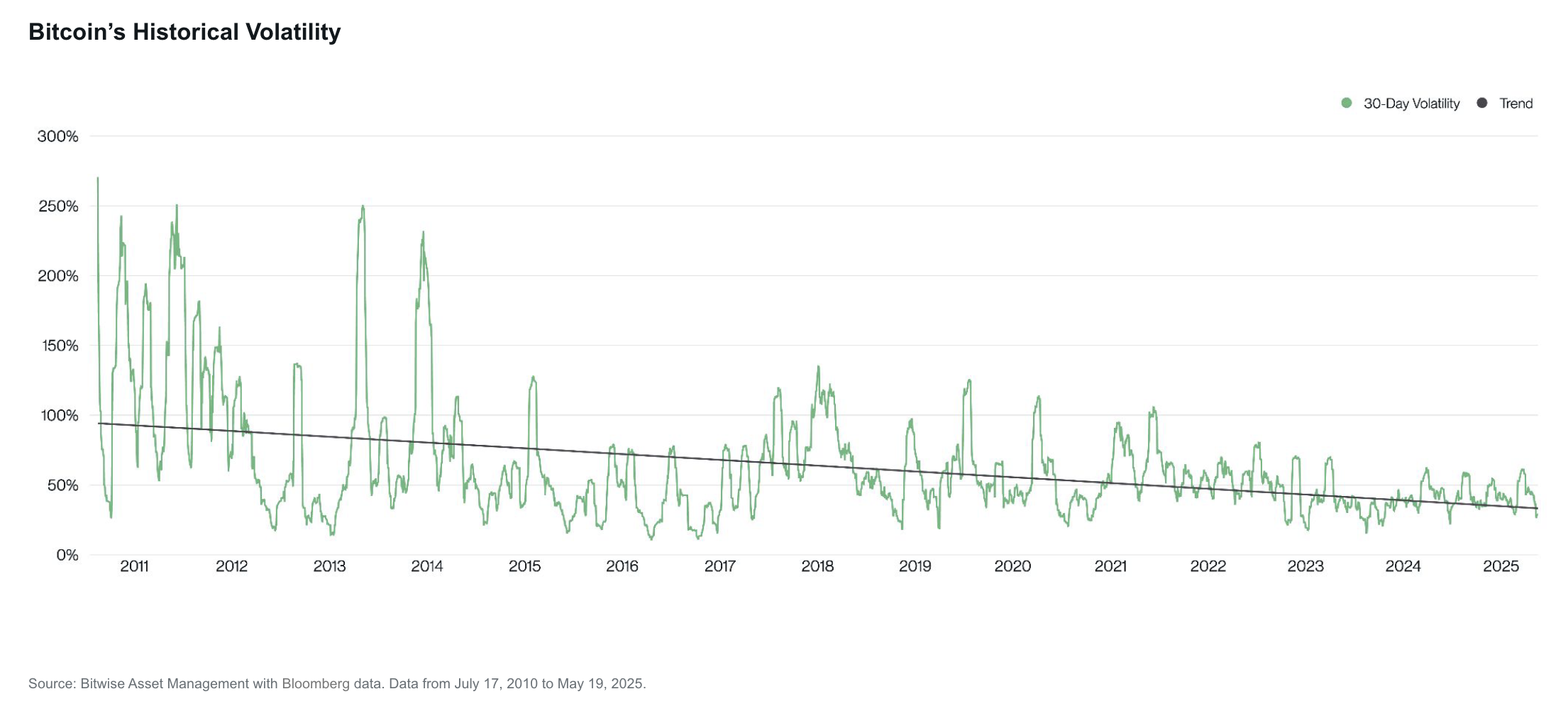

“Bitcoin’ s volatility has decreased over time—a development that will be maintained for the foreseeable future. As Bitcoin discovers its true worth, the volatility will shrink to close to zero, and that is the level at which demand might sluggish. As lengthy as there is volatility in Bitcoin, it might doubtless be rising in worth on a long-term time horizon, if the previous is any indication,” Kadan Stadelmann, Chief Expertise Officer at Komodo Platform, instructed BeInCrypto.

In the meantime, as international markets grapple with financial challenges, Bitcoin might change into an interesting possibility for bettering weak monetary steadiness sheets.

Will Bitcoin Outcompete Conventional Secure Havens?

The US and the larger international economic system have suffered geopolitical tensions, rising inflation charges, and worrisome fiscal deficits. Seen as “digital gold” and a sovereign-neutral retailer of worth, Bitcoin has piqued the curiosity of various shareholders, particularly after Technique’s triumph.

“Stress from present shareholders will definitely improve over time as extra firms undertake such a company coverage, particularly if inflation charges ought to begin to re-accelerate on account of rising geopolitical dangers and rising fiscal debt monetization by central banks. Many firms are additionally working in a saturated low-growth business with excessive quantities of debt the place an adoption of Bitcoin can actually enhance returns for present shareholders,” Dragosch defined.

He predicted that the day Bitcoin outperformed conventional secure havens like US Treasury payments and gold would ultimately come. As adoption surges, Bitcoin’s volatility will fall, making it an all-around aggressive asset.

“Bitcoin’s volatility has been on a structural downtrend for the reason that very starting. The important thing causes behind this structural decline are rising shortage because of the halvings and rising adoption, which tends to dampen volatility. Our expectation is that Bitcoin’s volatility will finally converge in direction of gold’s volatility and change into a chief contender for another store-of-value and reserve asset,” he stated.

In the meantime, Bitcoin’s technological backdrop would additionally give it a aggressive edge over different asset lessons.

“As a consequence of its technical superiority relative to gold, we predict there’s a excessive chance that Bitcoin might finally disrupt gold and different stores-of-value like US Treasury bonds over the long run. This can change into more and more related in [the] face of rising sovereign debt dangers globally,” Dragosch added.

Nevertheless, not all firms are created equal. Whereas some stand to profit, others don’t.

Differentiating Company Bitcoin Methods

In keeping with Rasmussen, there are two kinds of Bitcoin treasury firms.

They’re both worthwhile companies investing spare money, like Coinbase or Sq., or corporations that safe debt or fairness to purchase Bitcoin. Whatever the sort, their accumulation boosts Bitcoin demand, pushing its worth up within the brief time period.

Worthwhile companies that purchase Bitcoin utilizing extra money are unusual and current no systemic danger. Rasmussen anticipates these firms will proceed accumulating Bitcoin in the long run.

Companies that resort to debt or fairness may face a unique destiny.

“Bitcoin financing firms solely exist as a result of public markets are keen to pay extra than $1 for $1 of Bitcoin publicity. This is unsustainable lengthy-term until these firms can improve their Bitcoin per share. Issuing fairness to purchase Bitcoin does not improve Bitcoin per share. The solely method to improve Bitcoin per share is to situation convertible debt or most popular inventory,” Rasmussen defined.

The success charges of those firms depend upon how a lot revenue they need to pay again their money owed.

Mitigating Company Bitcoin Danger

Bigger, established firms at all times have extra sources than smaller ones to handle their debt.

“The giant and well-known Bitcoin treasury firms, such as Technique, Metaplanet, and GameStop, ought to be ready to refinance their debt or situation fairness to elevate money to repay their debt with relative ease. The smaller and lesser-known firms that do not have worthwhile companies are most at danger of having to promote Bitcoin to meet their obligations,” he added.

In keeping with Dragosch, the important thing to avoiding such a state of affairs for smaller firms is to stop overleveraging. In different phrases, borrow what you’ll be able to afford to repay.

“They key factor that usually breaks any sort of enterprise technique is overleverage… potential dangers quite lie with different firms which might be copying MSTR’s Bitcoin acquisition technique and begin with the next price foundation. This will increase the danger of compelled liquidations and chapter within the subsequent bear market, particularly if these firms accumulate an excessive amount of debt within the course of and overleverage,” he stated.

Nevertheless, these liquidations would have minimal market results.

“That would create short-term volatility for Bitcoin and be detrimental to these firms’ share costs, however it’s not a blow-up danger to the broader crypto ecosystem. It’ll doubtless be a comparatively small quantity of small firms that have to promote a comparatively immaterial quantity of Bitcoin to pay again their debt. If that’s the case, the market will hardly blink,” Rasmussen stated.

The true downside emerges when bigger gamers resolve to dump their holdings.

Are Massive Holdings a Systemic Danger?

Extra firms including Bitcoin to their steadiness sheets create decentralization, not less than on the market stage. Technique is now not the one company using this technique.

That stated, Technique’s holdings are monumental. Right this moment, it owns practically 600,000 Bitcoins– 3% of the full provide. Any such centralization does certainly include liquidation dangers.

“Extra than 10% of all Bitcoin is now held in ETF custodial wallets and company treasuries; a sizable share of the whole provide. This focus introduces a systemic danger: if any of these centrally managed wallets are compromised or mishandled, the fallout might ripple by the whole market,” Juan Pellicer, Vice President of Analysis at Sentora, instructed BeInCrypto.

Some consultants consider such a state of affairs is unlikely. If it have been to occur, Stadelmann predicts preliminary detrimental outcomes would ultimately stabilize.

“If MicroStrategy have been to promote a giant portion of its Bitcoins, it will develop a plan to do so with out affecting the market at first. Finally, folks will notice what is occurring, and that will lead to a broader sell-off and depressed Bitcoin costs. Nevertheless, the decrease costs mixed with Bitcoin’s restricted provide of solely 21 million cash will lead to demand for Bitcoin by completely different gamers, together with different firms and nation-states,” he stated.

Nevertheless, the numerous quantity of Bitcoin held by a couple of giant firms raises renewed issues concerning the centralization of the asset itself quite than the competitors.

Centralization as a Commerce-Off for Adoption

Massive company accumulation raises issues about concentrated possession of Bitcoin’s restricted provide. This challenges a core DeFi precept and generates nervousness over the disruption of its foundational construction.

In keeping with Dragosch, this isn’t the case. Nobody can change Bitcoin’s guidelines by proudly owning a lot of the provide.

“The sweetness about Bitcoin’s proof-of-work consensus algorithm is that you just can’t change Bitcoin’s guidelines by proudly owning the vast majority of the availability which is completely different to different cryptoassets like Ethereum. Within the case of Bitcoin, a majority of hash price is quite wanted to alter consensus guidelines or corrupt/assault the community. Establishments that make investments into Bitcoin might want to play by Bitcoin’s protocol guidelines in spite of everything,” he stated.

In flip, Pellicer does see some reality in these issues. Nevertheless, he views them as a trade-off for the opposite benefits of widespread adoption.

“Whereas this centralization conflicts with Bitcoin’s ethos of particular person, self-sovereign possession, institutional custody may nonetheless be the most sensible path to widespread adoption, offering the regulatory readability, liquidity, and ease of use that many new contributors count on,” he stated.

With firms more and more leveraging Bitcoin for strategic monetary advantages, its path towards changing into a extensively accepted reserve asset is accelerating. For now, the danger of a market collapse appears to be contained.

Disclaimer

Following the Belief Challenge pointers, this characteristic article presents opinions and views from business consultants or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially mirror these of BeInCrypto or its workers. Readers ought to confirm data independently and seek the advice of with an expert earlier than making selections based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.