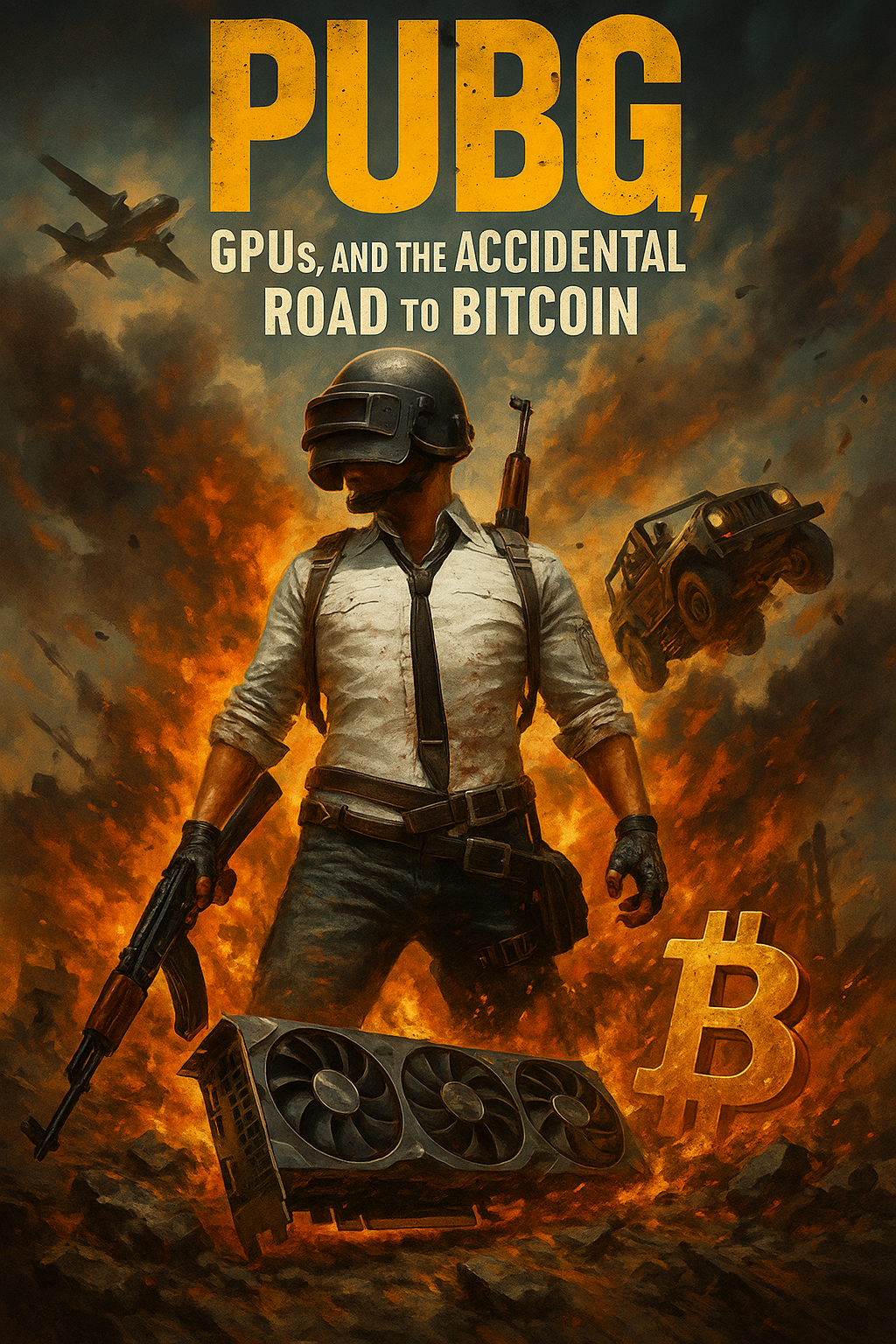

A private story of gaming {hardware}, misplaced Ethereum, and the layered nature of human progress

Bitcoin: An Concept Whose Time Had Come

There’s something unusually humbling about human progress: brilliance alone will not be sufficient.

You’ll be able to have the blueprints for an airplane, however with out industrial aluminum, it stays a fantasy.

You’ll be able to invent the best cryptographic algorithm, however with out world networks, it gathers mud.

Concepts should await the soil of civilization to be prepared. When it’s — they bloom seemingly in a single day.

Bitcoin was a type of concepts.

I. Progress Is a Layered Cake

I as soon as knew a pointy techniques engineer again within the late 90s. In 1996, he spent six grueling weeks putting in Sybase database software program — through floppy disks.

Not hours, not days — weeks.

Simply to get a fundamental enterprise database working was an epic of cables, patches, and persistence.

Quick ahead to 2015: the identical job may be accomplished in ten seconds with a Docker container. Or as we speak, with a Helm chart spinning up Kubernetes pods within the cloud — totally automated.

Why? As a result of progress is a layered cake. Every technology builds on the layers of the final.

Take airplanes. Even when Leonardo da Vinci had possessed excellent blueprints for a Boeing 747, he’d have been caught. Why? No aluminum.

Industrial-scale aluminum processing is just a few centuries previous. With out it, there’s no airframe robust and lightweight sufficient to fly.

Right here’s a pleasant historic twist: practically 2000 years in the past, a intelligent service provider demonstrated a shimmering new steel to Roman Emperor Tiberius.

It was made, he claimed, from sand — and extra stunning than gold.

Tiberius, whose wealth was largely plundered gold, grasped the risk immediately. If this “sand steel” unfold, his riches can be devalued. He had the service provider executed — and humanity forgot about bauxite-derived aluminum for one more 1500 years.

The ethical: progress waits for readiness. And even then, it typically faces resistance.

II. Why Bitcoin Might Not Have Been Born Earlier

Bitcoin is not only “software program” or “magic web cash.” It’s an emergent financial phenomenon — the kid of many converging applied sciences.

Bitcoin couldn’t have emerged in 1990. Nor in 2000. It required an ideal storm — which lastly arrived in 2008–2009.

The important components:

1️⃣ Cryptography Maturity

SHA-256, digital signatures, Merkle bushes — the Lego blocks of trustless computing needed to mature and standardize.

2️⃣ International Networks

A dependable, quick, inexpensive web was required — not fragile dial-up.

3️⃣ Inexpensive Compute

CPUs and GPUs needed to be widespread sufficient for common customers to run nodes and mine.

4️⃣ Cultural Catalyst

2008’s International Monetary Disaster shattered belief in fiat cash and central banks.

Satoshi’s Genesis Block contained a sly message:

“The Instances 03/Jan/2009 Chancellor on brink of second bailout for banks.”

Bitcoin was not simply code — it was a response to a damaged system.

5️⃣ Theoretical Breakthrough

Satoshi lastly solved the Byzantine Generals Drawback — attaining consensus throughout a trustless community by way of Proof of Work.

For the primary time in historical past, people had a scarce, decentralized, uncensorable digital cash.

III. Why Bitcoin Needed to Emerge Precisely When It Did

If Satoshi had launched Bitcoin in 1995, it might have failed.

The web wasn’t prepared. Cryptography wasn’t mature. The cultural second hadn’t arrived.

If Satoshi waited till 2035? Maybe state surveillance and monetary repression would have blocked it totally.

2009 was excellent:

- The expertise was ripe

- Cultural mistrust in fiat was excessive

- The necessity for an “exit” was visceral

In brief: Bitcoin was an thought whose time had come.

IV. How Bitcoin Helped Start the Trendy AI Period

Right here’s a pleasant hidden chapter of this story:

Bitcoin’s rise not directly funded the GPU revolution — which in flip made fashionable AI potential.

Early Bitcoin miners used CPUs. However GPUs — with their parallel structure — quickly dominated.

Then got here altcoins like Ethereum, driving much more demand for high-end GPUs.

This GPU demand sustained NVIDIA and AMD by way of years when gaming alone wouldn’t have justified huge R&D into graphics {hardware}.

And right here’s the kicker: with out these GPU advances, we might not have ChatGPT as we speak.

Coaching ChatGPT-3.5 reportedly value billions. In 2010, it might have value trillions — or just been infeasible, taking months or years to finish.

You possibly can have thrown infinite cash on the downside in 2005 — it wouldn’t have mattered. The muse wasn’t there.

Thus:

No Bitcoin → no GPU arms race → no fashionable giant language fashions.

Applied sciences don’t evolve in silos. They evolve entangled, like threads in an awesome tapestry.

A Private Detour

Personally, I stumbled into Bitcoin totally by chance.

All of it started with a quest — not for financial sovereignty, however for frames per second.

Again when PUBG dominated PC gaming, I coveted the fabled NVIDIA 1080 Ti — a beast of a GPU, excellent for buttery-smooth gameplay.

But it surely was costly. I reasoned:

“Maybe if I mine a little bit of Ethereum or Bitcoin on the facet, I can offset the value.”

So I purchased the cardboard, mined diligently… and managed to supply about one Ethereum.

After which — in a basic crypto story — I forgot the pockets password.

Sure — my first foray into crypto ended with a strong GPU, many rooster dinners in PUBG, and a misplaced ETH.

Sarcastically, my gaming card was unknowingly fueling two revolutions: crypto and AI.

Such is progress — typically unintentional, typically poetic.

V. What Bitcoin Actually Is

Let’s be clear: Bitcoin will not be merely an “funding.”

Right here’s what it’s not:

❌ Only a speculative asset

❌ Only a tech curiosity

❌ Simply “quantity go up”

Right here’s what it is:

✅ The primary completely scarce, censorship-resistant, self-sovereign digital cash

✅ A financial community managed by no authorities and no company

✅ Freedom encoded in math

Makes an attempt to “ban” Bitcoin are like making an attempt to ban math or vitality. You can also make life tough, however you can’t uninvent an thought whose time has come.

VI. The place Do We Go From Right here?

The long run? Not possible to foretell. However tantalizing.

We stand on the cusp of latest frontiers:

- AI is accelerating quickly

- Robotics and bioengineering are merging

- Cash is coming into a brand new period

In 10–20 years, many people might function as cyborgs — people augmented by AI brokers dealing with every thing from funds to creativity.

In such a world, trustless, impartial cash turns into ever extra important.

Think about AI brokers transacting in your behalf — would you like these transactions mediated by central banks? Or settled freely on a impartial protocol like Bitcoin?

Bitcoin might not merely be an “various funding.” It could evolve into the base layer of worth for our rising machine-augmented civilization.

VII. Classes from Historical past

Keep in mind the story of Tiberius and the “sand steel”?

Concepts that threaten current energy buildings face suppression — however solely briefly.

Aluminum was as soon as extra treasured than gold. Immediately, we fly as a result of such suppression finally fails.

Bitcoin as we speak is ridiculed, feared, banned, embraced — however it’s merely the subsequent stage of financial evolution.

Simply as the commercial world wanted low-cost aluminum, the digital world wanted Bitcoin.

Now that it exists, there’s no going again.

VIII. A Bigger Philosophy of Progress

Zooming out, Bitcoin reminds us:

Progress is layered, contingent, and deeply fragile.

Good concepts fail when the world will not be prepared.

Weaker concepts succeed when the infrastructure occurs to help them.

Bitcoin succeeded as a result of the world was lastly prepared — technologically, culturally, politically.

And it speaks to one thing profound in us — the eager for freedom, equity, and sovereignty.

In an age of rising digital management, Bitcoin gives a uncommon counterweight:

Company restored.

It isn’t excellent.

It isn’t completed.

However it’s right here.

IX. Closing Reflections

In 1996, my buddy wrestled with floppy disks.

In 2025, children spin up world infrastructure with just a few traces of code.

In historic Rome, a disruptive steel was suppressed.

Immediately, we fly as a result of such suppression fails within the lengthy arc of historical past.

Bitcoin was an thought awaiting fertile soil. Now, that soil is world and digital — and rising richer by the day.

And in a scrumptious coincidence, the GPU arms race spurred by Bitcoin helped allow the AI revolution we now witness.

No Bitcoin, no ChatGPT.

No Sybase, no cloud.

No aluminum, no flight.

Concepts don’t stay alone. They’re entangled, woven into the good material of civilization.

The place this all leads? Nobody is aware of.

However I, for one, can envision a future the place people and AI brokers transact in seamless worth exchanges — with a humble protocol known as Bitcoin quietly buzzing on the coronary heart of it.

Freedom encoded into math.

An thought whose time had come.

And whose time is, maybe, solely simply starting.

The long run is unsure. However historical past rhymes. We’re lucky — or maybe fated — to witness the daybreak of digital cash. It’s price paying consideration.

PUBG, GPUs, and the Unintentional Highway to Bitcoin was initially revealed in The Capital on Medium, the place persons are persevering with the dialog by highlighting and responding to this story.