Solana (SOL) is down over 11% over the previous seven days, as a number of technical indicators level to weakening momentum and rising bearish strain. The Relative Power Index (RSI) has fallen sharply, signaling a shift towards a extra cautious market stance.

On the similar time, each the Ichimoku Cloud and EMA constructions present bearish setups, with key resistance ranges holding agency and help zones now in danger. Until a transparent reversal takes form, SOL might proceed dealing with downward strain within the brief time period.

Solana RSI Drops Under 45 as Momentum Fades

Solana’s Relative Power Index (RSI) has dropped to 40.77, a notable decline from 64.25 simply two days in the past.

This sharp shift displays weakening bullish momentum and means that current promoting strain has outpaced shopping for curiosity.

The transfer down alerts a possible transition from impartial or bullish situations right into a extra cautious or bearish sentiment zone, as merchants start reassessing Solana’s short-term outlook.

The RSI is a extensively used momentum indicator that measures the pace and magnitude of current worth adjustments. It ranges from 0 to 100, with readings above 70 sometimes indicating overbought situations—usually previous worth pullbacks—whereas values under 30 counsel oversold situations, doubtlessly signaling worth rebounds.

A studying close to 40.77 locations Solana in a neutral-to-weak zone, hinting that the asset is shedding upward momentum however hasn’t but reached oversold territory.

If RSI continues to say no, it may point out additional draw back threat, whereas stabilization above 40 would possibly counsel consolidation earlier than the subsequent transfer.

Bearish Ichimoku Construction Retains SOL Underneath Stress

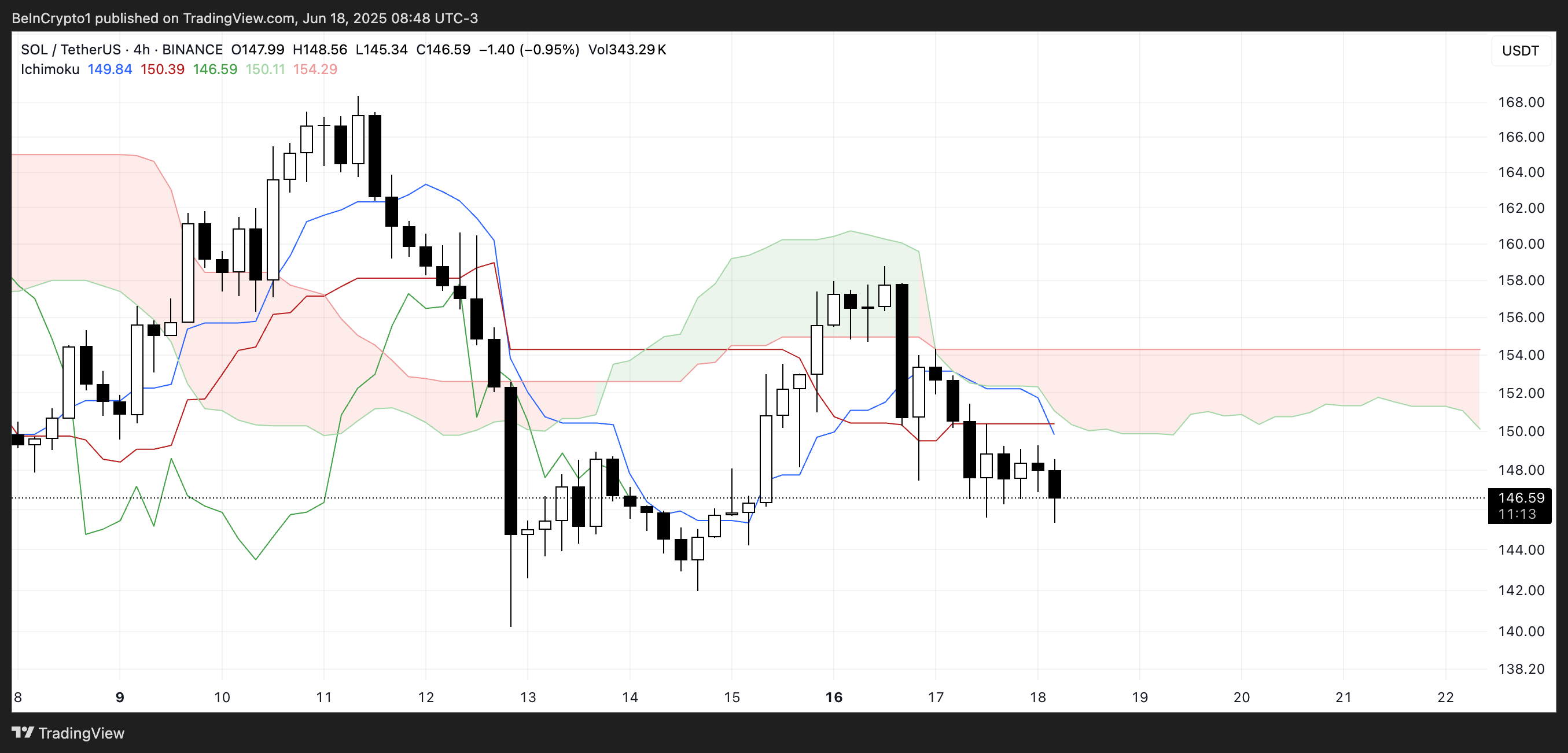

Solana’s Ichimoku Cloud chart reveals a bearish setup. Value motion is presently buying and selling under the Kumo (cloud), which is shaded purple.

This purple cloud signifies prevailing downward momentum and acts as dynamic resistance. The Main Span A (inexperienced line forming the higher fringe of the cloud) stays under Main Span B (purple line forming the decrease edge), reinforcing the bearish construction.

The cloud forward additionally stays purple and comparatively thick, suggesting robust overhead resistance quickly and making a bullish reversal harder except vital momentum builds.

The Tenkan-sen (blue line) is presently under the Kijun-sen (purple line), one other traditional bearish sign. These two strains have additionally flattened out, signaling consolidation somewhat than any robust directional motion.

With candles struggling to interrupt above the Tenkan-sen, short-term momentum seems weak.

Until a bullish crossover happens or worth motion penetrates the cloud, Solana stays beneath bearish strain from an Ichimoku standpoint.

Solana EMA Construction Stays Bearish Regardless of Latest Rebound Try

Solana’s EMA construction stays bearish, with shorter-term transferring averages positioned under the longer-term ones—signaling continued downward momentum.

This setup emerged after a failed bullish try two days in the past, the place SOL tried to reverse the development however confronted rejection. If the bearish alignment holds, the asset may check its rapid help stage at $141.53.

A breakdown under that would open the door to additional draw back, doubtlessly pushing SOL under $140 for the primary time since April 21.

On the flip aspect, if the development reverses and short-term EMAs start to curve upward, Solana may retest the resistance zone round $150.59.

A clear break above this stage can be the primary signal of a possible development shift. If shopping for momentum strengthens past that, greater resistance targets lie at $163.64 and $168.36.

Within the case of an prolonged rally, SOL would possibly even goal for $179.41 as the subsequent main upside stage.

Disclaimer

According to the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.