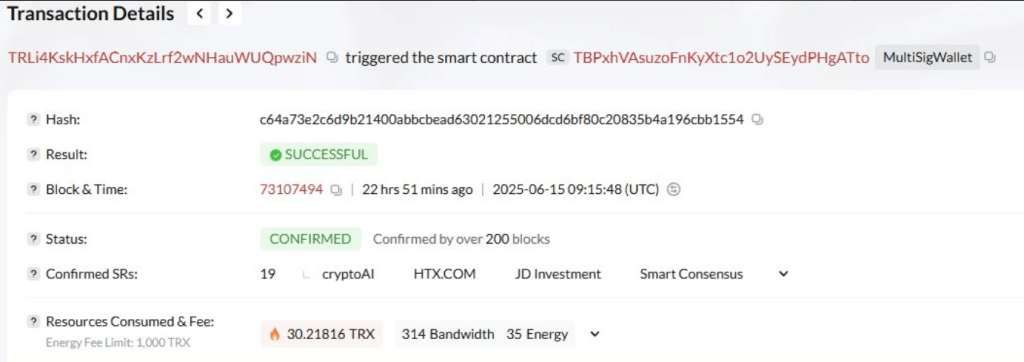

Tether acted swiftly Sunday when it froze $12.3 million value of USDT on the Tron blockchain. Primarily based on studies from Tronscan, this step targets wallets allegedly linked to cash laundering and sanctions evasion. The corporate has not issued a public assertion but, however on‑chain knowledge left little room for doubt.

T3 Monetary Crime Unit Reveals Muscle

Based on Tether, its T3 Monetary Crime Unit (FCU) companions with Tron and TRM Labs to trace suspect transactions in actual time. Since late 2024, the FCU has frozen over $126 million in questionable property.

Within the final quarter of that yr alone, $100 million was blocked. This means a pointy uptick in enforcement efforts simply as regulators worldwide tighten the screws.

LATEST: Tether freezes $12.3M in $USDT tied to suspicious TRON addresses. pic.twitter.com/WJr2ApEfyp

— MrRebel.eth (@rebelethpromos) June 16, 2025

Focusing on Excessive‑Danger Entities On Sanctions Record

Following regulatory synchronization with the US Treasury’s Workplace of International Property Management (OFAC), Tether recurrently blacklists wallets related to sanctioned entities. People on the Specifically Designated Nationals (SDN) checklist are the pure targets.

In March 2025, for instance, Tether froze $27 million value of USDT on the Russian-linked change Garantex following the EU’s sixteenth bundle of sanctions. Garantex later suspended companies and claimed that over 2.5 billion rubles of person funds had been held up.

Lazarus Group Faces $374K Blacklist

Experiences present that North Korea’s Lazarus Group has moved greater than $3 billion in stolen crypto since 2009. In November 2023, Tether blacklisted $374,000 in USDT tied to Lazarus‑related addresses.

Different stablecoin firms joined collectively to lock up $3.4 million in an identical wallets. These numbers spotlight how giant issuers can upset state-sponsored hacking teams.

Diversifying With Gold Royalties

Tether diversified past digital forex on June 12, 2025, by shopping for a 32% fairness stake in Elemental Altus Royalties. The deal concerned the acquisition of over 78 million shares at CAD1.55 per share, valued round $89 million.

This transfer to grow to be a public gold royalty firm exhibits Tether’s dedication to backing its stablecoin with actual property. It additionally exhibits an effort to appease risk-averse regulators that demand robust reserves.

A Twin Method To Stablecoin Governance

As per Tether executives, this mixture of robust enforcement and asset diversification can grow to be a brand new benchmark. By freezing felony funds and backing USDT with real-world worth, Tether goals to strengthen confidence in its stablecoin.

Featured picture from Unsplash, chart from TradingView