Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is navigating a extremely risky surroundings, as escalating Center East conflicts and intensifying macroeconomic dangers dominate world headlines. Regardless of mounting uncertainty, BTC continues to carry agency above the $104K stage, signaling robust purchaser curiosity at key assist zones. Bulls stay in management for now, however hawkish macro situations—resembling elevated US Treasury yields, persistent inflation considerations, and geopolitical turmoil—pose severe dangers that might drive BTC under the vital $100K mark.

Associated Studying

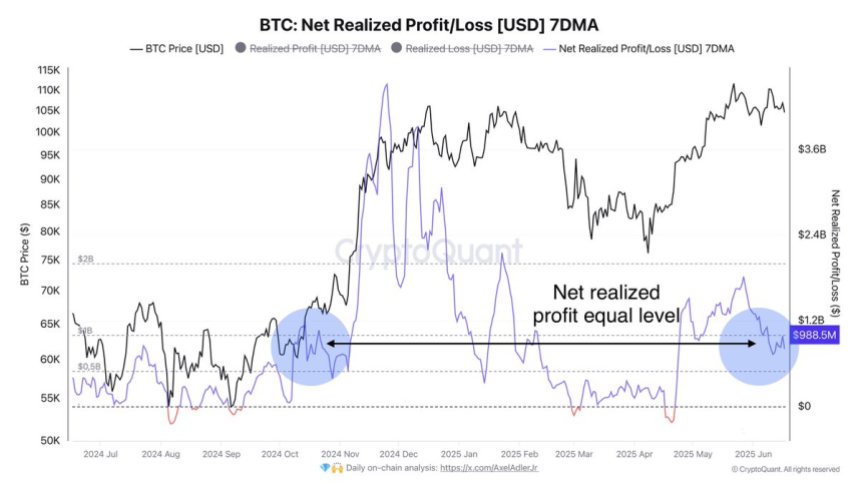

The market is split on what comes subsequent. Some analysts level to robust fundamentals and institutional adoption as gas for an enormous bull run, whereas others warn of a deeper correction earlier than any upward continuation. Prime analyst Darkfost emphasised the significance of monitoring on-chain conduct throughout such intervals of uncertainty. In keeping with CryptoQuant information, realized earnings on Bitcoin (7-day shifting common) present no main warning indicators. Present profit-taking exercise stays under $1 billion—just like ranges seen following the October 2024 correction—indicating that traders are neither panicking nor overly euphoric.

This muted revenue realization may very well be an indication that long-term holders are nonetheless assured within the broader pattern, setting the stage for an eventual breakout as soon as macro situations stabilize.

On-Chain Metrics Sign Calm Bitcoin Consolidates

Because the battle between Israel and Iran escalates, fears of a broader struggle—and the potential of US intervention—proceed to weigh closely on world markets. Traders stay on edge, with rising oil costs and weakening financial confidence feeding into macro uncertainty. But, Bitcoin appears largely unfazed. Regardless of the heightened geopolitical stress, BTC continues to consolidate slightly below its all-time excessive, displaying resilience that has each bulls and bears second-guessing their subsequent transfer.

Essentially, Bitcoin stays robust. Institutional adoption is steadily rising, and trade provide continues to say no, reflecting a pattern towards long-term holding and off-exchange accumulation. In some ways, BTC seems to thrive on this surroundings of volatility and uncertainty.

In keeping with on-chain information shared by Darkfost, realized earnings on Bitcoin—measured by the 7-day shifting common (7DMA)—present no main warning indicators. Present revenue ranges stay below $1 billion, a variety not seen for the reason that finish of the October 2024 correction. Even through the current ATH surge, realized earnings stayed nicely under the January 2025 peak. This lack of aggressive profit-taking suggests that the majority traders are nonetheless holding robust, neither panicking nor speeding to promote.

That restrained conduct is enjoying a key position in Bitcoin’s ongoing consolidation. With out a wave of revenue realization, there’s little strain to power the market down—but no catalyst robust sufficient to push it decisively increased both. Monitoring these on-chain indicators shall be vital within the coming days. If realized earnings spike or trade inflows surge, it could mark the start of a brand new section.

Associated Studying

BTC Technical Evaluation: Key Help Being Examined

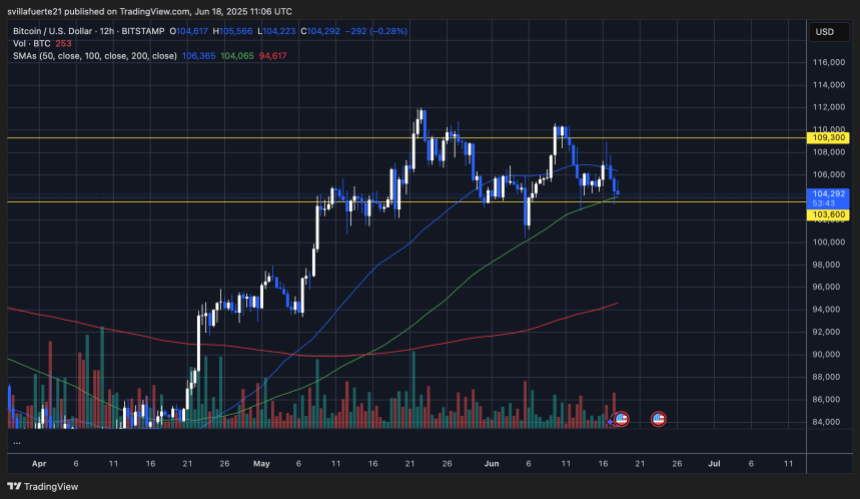

The 12-hour chart of Bitcoin (BTC/USD) reveals the asset at present buying and selling at $104,292, simply above a vital assist stage at $103,600. This space, which corresponds to the earlier all-time excessive set in late 2024, has develop into a key battleground for bulls and bears. BTC has repeatedly bounced from this stage in current weeks, and its capability to carry might decide the course of the following main transfer.

BTC failed to interrupt by way of the $109,300 resistance, forming a collection of decrease highs since tapping the $112,000 stage. This implies a weakening bullish momentum and highlights the significance of present worth motion across the 50-period SMA, which is now appearing as short-term dynamic resistance.

Quantity has remained comparatively steady however confirmed slight upticks throughout current pullbacks, hinting at cautious promoting quite than full-blown capitulation. The 100-period and 200-period SMAs, at present sitting at $104,065 and $94,617, respectively, supply further assist beneath the present vary, with the 100-SMA now immediately aligned with the horizontal $103,600 stage.

Associated Studying

If BTC breaks and closes under this demand zone with quantity affirmation, it might set off a transfer towards the $100K psychological assist. Conversely, a robust bounce from right here would reinforce the continued consolidation and maintain the trail open for one more take a look at of $109,300.

Featured picture from Dall-E, chart from TradingView