Information reveals Dogecoin is at present main the highest cryptocurrencies when it comes to Funding Fee, suggesting a spike in lengthy positioning amongst merchants.

Dogecoin Funding Fee Is Sitting At 0.0092% Proper Now

In a brand new publish on X, the analytics agency Glassnode has talked about how the highest cryptocurrencies within the sector examine to one another when it comes to the Funding Fee.

The Funding Fee refers to an indicator that retains monitor of the common periodic quantity of charges that perpetual futures merchants of a given asset are exchanging between one another on the centralized derivatives platforms.

When the worth of this metric is optimistic, it means the lengthy traders are paying a premium to the brief ones with a purpose to maintain onto their positions. Such a development is an indication that almost all of the traders share a bullish mentality.

However, the indicator being underneath the zero mark suggests the brief traders outweigh the lengthy ones. This sort of development implies a bearish sentiment is dominant within the sector.

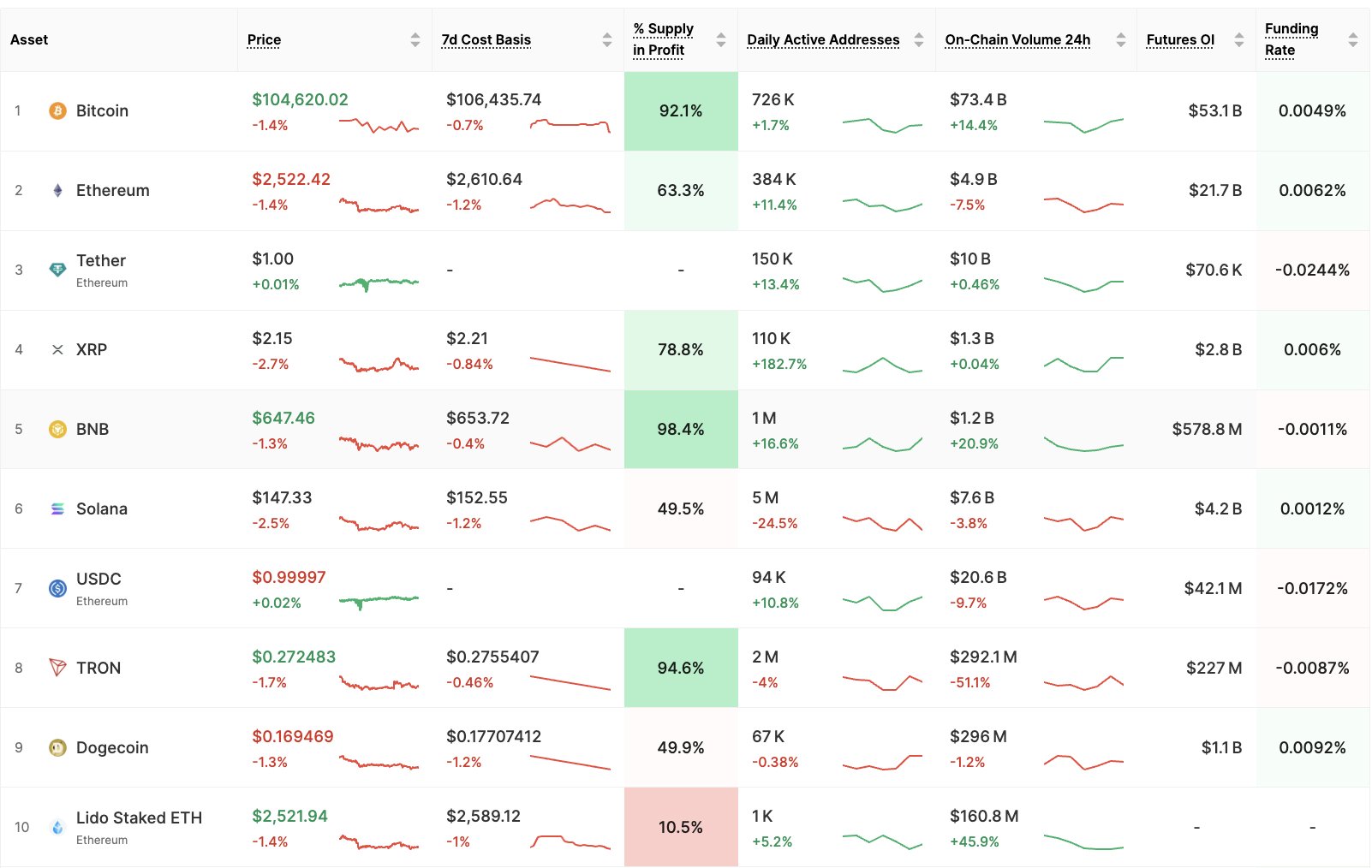

Now, right here is the desk shared by Glassnode that reveals how the highest cryptocurrencies by market cap look when it comes to the Funding Fee proper now:

The worth of the metric appears to be the very best for Dogecoin in the intervening time | Supply: Glassnode on X

As is seen above, the Funding Fee is at present optimistic for Bitcoin (BTC) and Ethereum (ETH). In keeping with the analytics agency, this can be a rebound in comparison with yesterday, when sentiment was bearish among the many merchants.

The indicator is standing at 0.0049% for BTC and 0.0062% for ETH. XRP (XRP), the fourth largest coin by market cap, additionally has an analogous diploma of bullish temper with the metric at 0.006%.

A coin that stands out for its sentiment, nevertheless, is the memecoin Dogecoin, as its Funding Fee is sitting at 0.0092%, notably greater than some other cryptocurrency

Then there’s Tron (TRX) on the precise reverse facet of the spectrum, with the bears paying the price at a charge of -0.0087%. Solana (SOL) is strictly between the 2 with a impartial Funding Fee of 0.0012%.

Usually, the facet that’s dominant on the Funding Fee is extra more likely to get wrapped up in a mass liquidation occasion. As such, for an asset like Dogecoin, the place a bullish sentiment appears to be robust relative to the remainder of the sector, the longs could also be at extra danger of getting squeezed.

In the identical desk, information for a couple of different indicators can be displayed. Amongst these, an attention-grabbing one is maybe the Provide in Revenue, measuring the share of an asset’s provide that’s at present being held at an unrealized achieve.

Whereas cash like Bitcoin, Tron, and BNB have greater than 90% of their provide within the inexperienced, others like Dogecoin and Solana have the metric at lower than 50%.

DOGE Worth

On the time of writing, Dogecoin is buying and selling round $0.1666, down greater than 15% during the last week.

Appears to be like like the worth of the coin has been sliding down | Supply: DOGEUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.