In a big transfer for the worldwide Bitcoin mining business, three of China’s largest mining gear producers—Bitmain, Canaan, and MicroBT—are relocating their meeting operations to the US to keep away from new import tariffs imposed by President Donald Trump.

This determination displays a significant strategic shift. These corporations are responding to growing commerce strain from US tariff insurance policies. Traders predict this transfer will profit the Bitcoin mining sector in the US.

US-China Commerce Battle Reshapes Bitcoin Mining Trade

Based on Reuters, Bitmain, Canaan, and MicroBT plan to construct manufacturing services within the US. They purpose to make the most of native labor and infrastructure to fulfill the rising demand within the Bitcoin market.

This transfer is broadly seen as an effort to defend themselves from tariffs and restructure their provide chains.

“The US-China commerce struggle is triggering structural, not superficial, adjustments in bitcoin’s provide chains,” mentioned Guang Yang, Chief Know-how Officer at crypto tech supplier Conflux Community, as quoted by Reuters.

At the moment, these three corporations produce over 99% of the world’s ASICs (Software-Particular Built-in Circuits) used for Bitcoin mining.

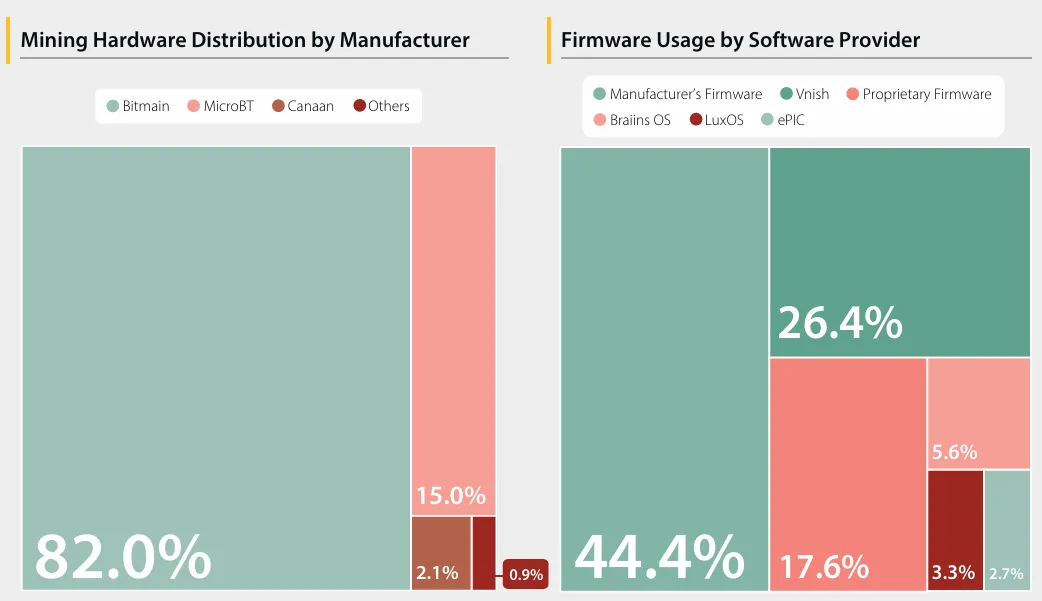

Based on analysis from the College of Cambridge, Bitmain leads with an roughly 82% market share. MicroBT follows with 15%, and Canaan holds about 2%.

This dominance makes the shift in manufacturing not only a tax-avoidance technique. It additionally has the potential to considerably reshape world provide chains.

Beforehand, in response to Bloomberg, US-based crypto miners confronted delays in receiving shipments of latest gear after Trump’s election victory.

This shift is anticipated to deliver substantial advantages. Most notably, it can shorten the time it takes for mining rigs to reach at US services. That can assist optimize provide chains and cut back logistics prices.

“Bullish for US Bitcoin mining,” an investor commented on X.

That is particularly essential as Bitcoin mining turns into more and more aggressive. Firms should preserve excessive effectivity to deal with rising mining issue after halving occasions.

A current report from BeInCrypto additional said that Bitcoin mining prices have jumped over 34% because the hashrate hits a brand new all-time excessive. Many mining companies are actually seeking to diversify their income streams with a view to survive.

Moreover, the US has already established itself because the world’s main Bitcoin mining hub, contributing greater than 75% of the worldwide hashrate. With this new plan, the US is gaining much more dominance, particularly as Trump positions himself as a Bitcoin-friendly president.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.