Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

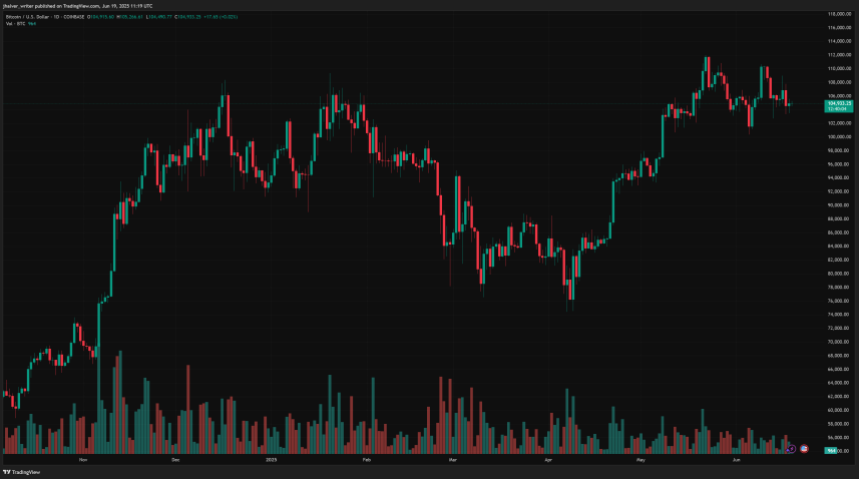

The Bitcoin worth and the crypto market stay beneath strain because the sector enters a low volatility interval. Whereas loads of merchants had been anticipating a giant transfer yesterday, following the US Federal Reserve (Fed) choice on price cuts, the cryptocurrency held its present ranges.

Associated Studying

Regardless of the relative resilience within the high crypto and different cryptocurrencies, the Bitcoin worth is displaying indicators of potential draw back. On the time of writing, BTC trades at round $105,000 with a 2.3% decline over the previous seven days.

Bitcoin worth transferring sideways over the previous 2 months as seen on the each day chart. Supply: BTCUSD on Tradingview

Bitcoin Value’s Caught, However Not for Lengthy?

Analyst Daan Crypto shared insights relating to the present Bitcoin worth motion. The analyst believes that BTC has been compressing over the previous weeks. In that sense, loads of merchants expect a spike in volatility.

As seen on the picture under, the Bitcoin worth has been buying and selling inside a decent vary type by its month-to-month excessive sitting at $110,600 and a month-to-month low at round $100,000. Inside this vary, there are two key ranges to observe: the world between $109,000 and $103,000.

A breakout or breakdown from this vary may sign the return of volatility to the Bitcoin worth motion. Thus, the cryptocurrency may reclaim or return to both or the beforehand talked about ranges on greater timeframes.

The analyst acknowledged the next:

BTC Nonetheless hanging across the $105K space which is the center of the month-to-month vary and proper on the month-to-month open. Value has been compressing and it’s clear that the market is ready for a giant transfer to happen. The statistics nonetheless closely favor an additional displacement this week and particularly this month. So control these ranges and play accordingly.

Bitcoin worth buying and selling inside a decent vary on the 4 hour chart. Supply: Daan Crypto by way of X

Bitcoin Seasonality Would possibly Shock Merchants

On a separate report, buying and selling desk QCP Capital claims that the Bitcoin worth could be affected by ‘summertime blues.’ In different phrases, the agency predicts a decline in volatility as establishments and merchants exit the market over July and August.

Associated Studying

QCP Capital claims that there are indicators of this sluggishness affecting the market, together with BTC’s implied volatility. This indicator is at the moment sitting under 40%. As well as with a hawkish Fed, the buying and selling desk predicts extra uninteresting worth motion over the approaching weeks and warning amongst operators:

(…) the Fed held rates of interest regular. However its stance stays hawkish. Inflation expectations are nonetheless elevated, with tariffs flagged as a key upside danger. The Fed prefers to “wait and see” till there’s extra readability on inflation’s path. Whereas some macro watchers count on softening labor and financial knowledge to finally push the Fed dovish, the present numbers say in any other case.

Cowl picture from ChatGPT, BTC/USD chart from Tradingview