Recent clashes between Israel and Iran have rattled international markets, dragging Bitcoin and different digital property decrease over the previous 24 hours. This uptick in geopolitical danger highlights how shortly crypto can wobble when conventional secure havens, like gold, shine brighter.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t answerable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

For buyers weighing shelter in opposition to sudden shocks, understanding crypto’s evolving function has by no means been extra essential. In a panorama the place headlines can spark sharp sell-offs, timing is every part. That’s why framing the perfect crypto to purchase now calls for each technique and nerve.

Gold Worth Rises as Crypto Dips in Center East Storm

The current Center East tensions have despatched cryptocurrency markets decrease, highlighting how international instability can shake investor confidence. Bitcoin and different digital property declined over the previous day, with the entire crypto market worth dropping greater than 3%, in line with CoinGecko information. The set off was escalating battle between Israel and Iran.

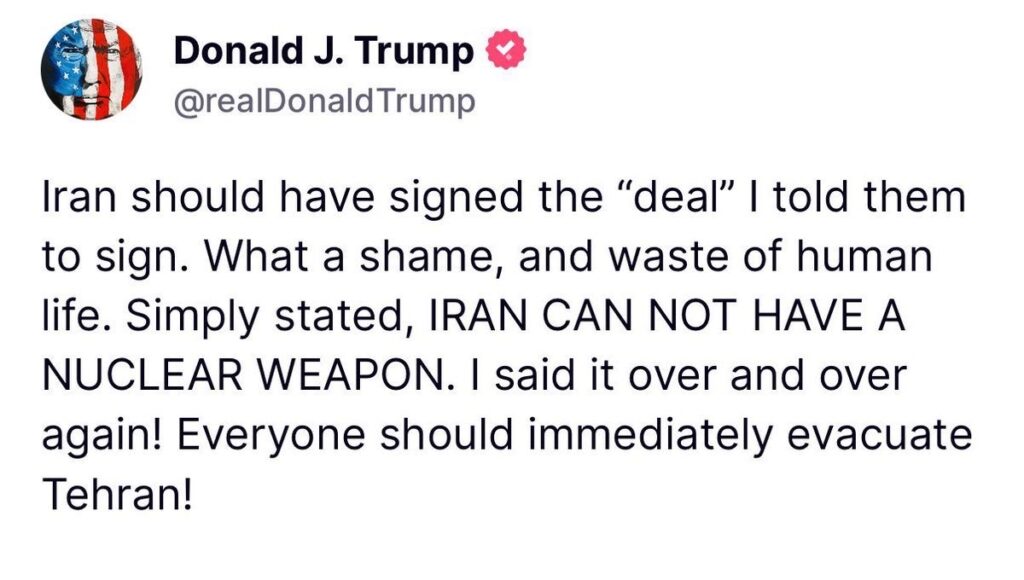

Including to market nerves, former US President Donald Trump lower quick his journey to the G7 summit in Canada. He cited the Center East state of affairs as his cause for leaving early. Trump later posted on his Fact Social platform, advising individuals in Tehran to evacuate instantly. Experiences famous he additionally requested for the White Home State of affairs Room to be readied.

This mixture of occasions sparked renewed concern amongst merchants. Traders searching for safer choices are taking a look at two principal property: conventional gold and Bitcoin, typically known as “digital gold.” Nonetheless, their current efficiency tells totally different tales.

Gold, the outdated favourite in troubled occasions, surged in worth. Beginning round Rs 96,700 on June twelfth, it climbed to a report excessive close to Rs 1,01,078 by June sixteenth. Whereas some buyers later took earnings, pulling the value again to roughly Rs 99,452 by June 18th, its general bounce clearly confirmed its enchantment throughout uncertainty.

Bitcoin, nonetheless, struggled. Because the Center East battle flared, Bitcoin fell from about $109,000 on June twelfth to $103,700 by June seventeenth, a close to 5% drop. This mirrored falls in riskier property like shares, contrasting sharply with gold’s good points.

Regardless of the continuing debate over Bitcoin’s function within the monetary system, famend economist Peter Schiff believes the cryptocurrency’s volatility undermines its credibility as a long-term retailer of worth, in contrast to gold, which has maintained this popularity for many years.

Tonight U.S. inventory futures and the greenback are each promoting off. However as soon as once more gold and Bitcoin are moving into reverse instructions. Gold is appearing like a secure haven and rising about 1%. Bitcoin is buying and selling like a danger asset, falling by about 2%. Clearly Bitcoin shouldn’t be digital gold.

— Peter Schiff (@PeterSchiff) Might 5, 2025

So, can Bitcoin actually compete with gold as a disaster hedge? The current occasions have reignited this debate.

Some market watchers see Bitcoin growing a longer-term function. “Bitcoin is beginning to construct a popularity as a possible secure haven,” famous one analyst, pointing to its rising maturity. Bitget’s Vugar Usi Zade added that Bitcoin presents liquidity and a few safety from authorities actions throughout crises, although he acknowledged its volatility stays a lot greater than gold’s.

For now, gold’s regular efficiency reinforces its long-held standing as a dependable secure harbor throughout market shocks. Bitcoin exhibits promise however stays delicate to shifting investor moods and broader market swings. The competition between the tangible metallic and the digital asset continues.

Bitcoin Worth Evaluation

Bitcoin’s current value motion exhibits a transparent shift from a powerful uptrend right into a interval of consolidation between roughly $103 000 and $107 000. After climbing from round $104 000 in late Might to a peak slightly below $110 000 in early June on notably excessive quantity, the market retraced to check the demand zone close to $103 000 the place patrons defended the extent twice, most just lately on June 16.

Each effort to interrupt above $107,000 has been met with rising promoting stress, forming a ceiling that has restricted upward motion. Quantity patterns recommend that the declines have been a pure results of profit-taking somewhat than indicators of panic. A clear break above $107,000 on excessive quantity is predicted to revive the uptrend towards $110,000.

Then again, a protracted decline under $103,000 may set the stage for a extra substantial correction to $100,000. Merchants might think about shopping for on the decrease finish of this vary with stops positioned under $102,000 and targets just under $107,000, or they might await a confirmed breakout above $107,000 with a cease round $104,000. Shorting round $107,000 with a detailed cease above $108,000 may additionally present a great risk-reward ratio if the resistance space holds.

In response to The Crypto Categorical, an evaluation of Bitcoin (BTC) exhibits that Bitcoin is at an important level. It’s bouncing off a assist line however faces resistance from the “Ichimoku Cloud.” If it breaks above the cloud and a particular provide zone, it’s bullish. If it breaks under the assist, count on a downward transfer.

#BTC/USDT ANALYSIS

Bitcoin is rebounding from the assist trendline of the ascending triangle sample, whereas the Ichimoku Cloud is appearing as a resistance barrier above the value.

A breakout above the cloud and the sample’s provide zone would sign a bullish development, whereas a… pic.twitter.com/Yn24yIAe79

— The Crypto Categorical (@TheCryptoExpres) June 18, 2025

Greatest Crypto to Purchase Now

As geopolitical tremors expose crypto’s danger profile, savvy buyers are eyeing tokens that mix resilience and upside. With capital shifting away from equities and gold’s good points topping headlines, sure digital property stand poised to seize the comeback narrative. One of the best crypto to purchase now presents a steadiness of stability and progress potential.

Solaxy

As headlines highlight secure havens, Solaxy’s scalable DeFi toolkit reminds buyers that innovation usually thrives amid uncertainty, hinting at progress when others retreat.

Solaxy, a rising Layer 2 venture constructed on Solana, has accomplished one of many 12 months’s largest presales, drawing consideration from a variety of crypto buyers, analysts, and merchants.

What’s driving the thrill? Solaxy presents an answer to a long-standing subject on the Solana community: congestion. As an alternative of counting on conventional bridges, which are sometimes sluggish and complicated, Solaxy is growing a brand new type of Layer 2 bridge utilizing Hyperlane’s modular, permissionless structure. This tech is designed to permit quick, reasonably priced, and seamless token motion between Solana, Ethereum, and the Solaxy blockchain.

The venture just lately launched its Layer 2 testnet, which has already processed over 1 million transactions at a mean of 16 transactions per second. Builders say that is simply the beginning, with the community being prepped for a broader rollout quickly.

Well-liked crypto YouTuber 99Bitcoins says there are only some days left to purchase Solaxy, the extremely anticipated meme token, which guarantees sturdy returns.

With its testnet performing nicely and a brand new cross-chain infrastructure in place, Solaxy’s momentum is barely rising. As $SOLX prepares to hit exchanges, many within the business are watching to see whether or not this formidable Layer 2 can stay as much as the hype.

Bitcoin Hyper

When market jitters trigger blue-chip Bitcoin to dip, Bitcoin Hyper amplifies the chance by offering leveraged publicity to Bitcoin’s actions whereas sustaining its enchantment as digital gold.

Constructed to deal with Bitcoin’s long-standing scalability points, Bitcoin Hyper processes transactions off the principle chain, serving to to scale back charges and delays. The venture makes use of the Solana Digital Machine (SVM) to speed up transaction speeds whereas preserving property safe and preserving token worth.

Bitcoin’s base community, restricted to round seven transactions per second, struggles underneath excessive demand. This usually results in sluggish confirmations and elevated prices. Bitcoin Hyper goals to repair that with its Canonical Bridge, a system that bundles transactions, processes them off-chain in seconds, after which sends a report again to the Bitcoin blockchain.

Past its technical options, Bitcoin Hyper is drawing consideration for its rising neighborhood and meme coin enchantment. The venture’s presale has gained traction as buyers search for options that might carry out nicely in the course of the subsequent Bitcoin bull cycle.

As Bitcoin continues to face stress from newer, quicker networks, Bitcoin Hyper presents a well timed various. Its rising recognition suggests it may turn out to be a breakout identify within the coming weeks.

SUBBD

SUBBD is gaining consideration for its give attention to on-chain staking, interesting to yield-seekers whereas positioning itself as a possible hedge in occasions of disaster, providing an alternative choice to conventional property like gold.

SUBBD is being launched as the primary subscription service constructed round AI to empower content material creators. Its core function is an AI assistant that tackles repetitive admin work, liberating creators to focus purely on making content material. This contemporary method goals to essentially change how creators earn from their efforts.

Getting into the crypto world, SUBBD lets customers launch their very own private AI fashions. This cuts out conventional middlemen like YouTube or Patreon, giving creators extra management and a direct line to their followers. Central to this technique is the $SUBBD token.

Followers use $SUBBD tokens to unlock unique content material, vote on creator concepts, and entry particular communities. For buyers, this implies tapping right into a devoted and increasing viewers, immediately sharing within the success of in style creators.

SUBBD is designed for stability and regular progress, specializing in actual utility somewhat than hype. As creators more and more look past outdated platforms, SUBBD positions itself as a brand new mannequin for fan-funded assist. Crucially, each creators and followers holding $SUBBD tokens get an actual say within the platform’s course by way of voting on main choices.

Many see the shift to Web3, the subsequent evolution of the web, as unavoidable. Creators and customers alike need greater than what present platforms supply. For these betting on this shift within the creator financial system, getting concerned with SUBBD now presents an opportunity to be on the forefront. It represents a chance to personal a bit of the longer term infrastructure for content material creators.

Conclusion

Center East flare-ups have as soon as once more underscored how geopolitical tremors ripple by way of the crypto sphere, testing each market maturity and safe-haven credentials. Whereas gold’s sparkle held agency, Bitcoin’s dip rekindled the controversy over digital options.

But, as blockchain protocols diversify and on-chain yield methods strengthen, a brand new class of tokens is rising that may navigate shocks and seize upside. For these plotting their subsequent transfer, cautious asset choice issues greater than ever. By balancing stability with progress potential, buyers can establish the perfect crypto to purchase now.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t answerable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, immediately or not directly, for any injury or loss brought about or alleged to be brought on by or in reference to use of or reliance on any content material, items or companies talked about.